Konica Minolta 2015 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

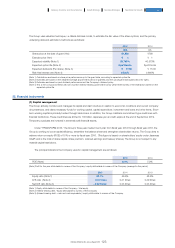

(c) Interest rate fluctuation risk

For debt instrument bearing variable interest rates, the Company enters into interest-rate swap contracts to hedge the potential

risk to cash flows of interest rate fluctuations. The Company uses these derivative transactions according to defined policies for

the purpose of reducing risk. No interest rate sensitivity analysis is conducted, as interest rate payments have only a slight

impact on profits and losses on the Group’s performance.

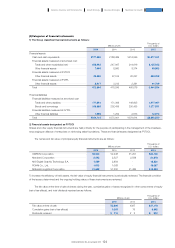

(4) Fair value of financial instruments

Fair value calculation method

The fair value of financial assets and financial liabilities is calculated as described below.

1) Derivative financial assets and liabilities

Fair value of currency derivatives is based on forward quotations and prices quoted by financial institutions that enter into these

contracts. Fair value of interest rate derivatives is based on prices quoted by financial institutions that enter into these contracts.

2) Investment securities

Where market prices are available, fair value is based on market prices. For financial instruments whose market prices are not

available, fair value is measured by discounting future cash flows or using other appropriate valuation methods, taking into account

the individual nature, characteristics and risks of the assets.

3) Borrowings

As short-term loans payable are to be settled in a short period of time, their fair value is assumed to be equivalent to the

carrying amounts.

For long-term borrowings with fixed interest rates, fair value is calculated by discounting the total amount of principal and

interest using assumed interest rate of a new similar borrowing. As the fair value of long-term borrowings with variable interest rates

is revised for each repricing period the carrying amounts,their fair value is assumed to be equivalent to carrying amounts.

4) Bonds

Fair value is calculated on the basis of market value.

5) Financial instruments other than those indicated above

Financial instruments other than those indicated above are mainly settled in the short term, so fair value is assumed to be

equivalent to their carrying amounts.

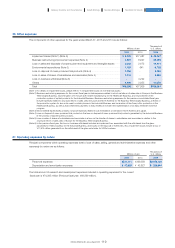

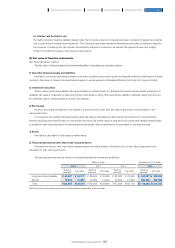

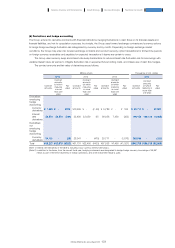

The carrying amounts and fair values of principal financial instruments are as follows:

Millions of yen Thousands of U.S. dollars

2015 2014 2013 2015

Carrying

amounts Fair value Carrying

amounts Fair value Carrying

amounts Fair value Carrying

amounts Fair value

Long-term loans payable ········· ¥ 63,697 ¥ 63,317 ¥ 89,045 ¥ 87,926 ¥ 87,498 ¥ 87,440 $ 530,057 $ 526,895

Bonds ······································································ 70,000 70,887 70,000 71,040 70,000 71,309 582,508 589,889

Total ············································································ ¥133,697 ¥134,204 ¥159,045 ¥158,966 ¥157,498 ¥158,749 $1,112,566 $1,116,785

(Note) Long-term borrowings and bonds include balances redeemable within one year.

128

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report