Konica Minolta 2015 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

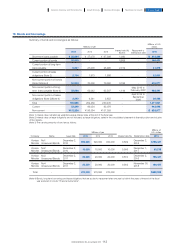

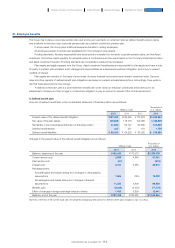

(1)Share capital and Treasury shares

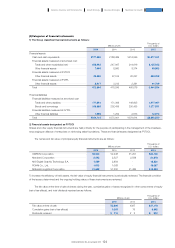

22. Equity and other equity items

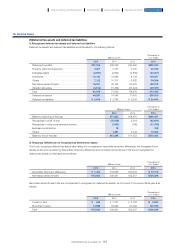

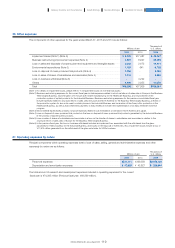

Principal actuarial assumptions used to measure defined benefit obligations are as follows:

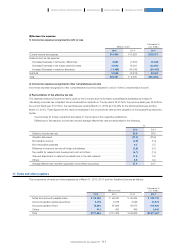

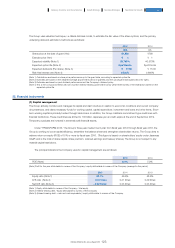

2) Defined contribution plan

The amount recorded as expenses in relation to defined contribution plans are the amounts contributed to these plans during the

year. This amount was ¥4,560 million for the current fiscal year (previous fiscal year: ¥4,102 million).

3) Other employee benefits

Certain U.S. subsidiaries employ a Supplemental Executive Retirement Plan (SERP). Obligations incurred under this plan amounted

to ¥2,362 million for the current fiscal year (previous fiscal year: ¥1,646 million, Transition Date: ¥1,197 million). These amounts are

recognized as other non-current liabilities.

The table below indicates the effect of a 0.5% increase or decrease in major actuarial assumptions, while other variables are kept

constant. In reality, individual assumptions may be simultaneous affected by fluctuations in economic indicators and conditions.

Accordingly, because fluctuations may occur independently or mutually, the actual impact of these fluctuations on defined benefit

plan obligations may differ from these assumptions.

%

2015 2014 2013

Discount rate ······································································································································································································ 0.71 1.00 1.42

Millions of yen Thousands of U.S. dollars

2015 2014 2015

Increase Decrease Increase Decrease Increase Decrease

Effect of change of discount rate ······························ (¥6,522) ¥6,698 (¥6,467) ¥6,897 ($54,273) $55,738

Number of

authorized shares

Number of issued shares

(Note 1) (Note 2)

Number of

treasury shares

At April 1, 2013 ·································································································································· 1,200,000,000 531,664,337 1,346,048

Increase (Note 3) ··························································································································· - - 15,402,953

Decrease ······················································································································································· - - 28,313

At March 31, 2014 ······················································································································· 1,200,000,000 531,664,337 16,720,688

Increase (Note 3) ··························································································································· - - 13,143,715

Decrease (Note 4) ······················································································································· - 20,000,000 20,063,332

At March 31, 2015 ··················································································································· 1,200,000,000 511,664,337 9,801,071

(Note 1) Shares issued by the Company are non-par value ordinary shares.

(Note 2) Issued shares are fully paid.

(Note 3) Based on a Board of Directors resolution on January 30, 2014, and a Board of Directors resolution on July 30, 2014, 15,365,000 treasury

shares were acquired in the previous fiscal year, and 13,135,900 treasury shares were acquired in the current fiscal year.

(Note 4) Based on a Board of Directors resolution on July 30, 2014, 20,000,000 treasury shares were cancelled on August 29, 2014.

116

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report