Konica Minolta 2015 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

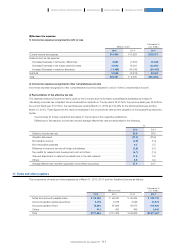

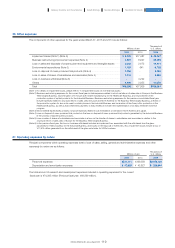

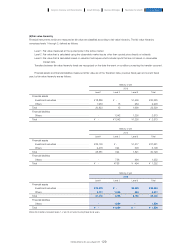

A calculation of basic and diluted earnings per share attributable to owners of the Company for fiscal years ended March 31, 2015

and 2014 is as follows:

29. Earnings per share

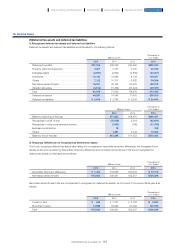

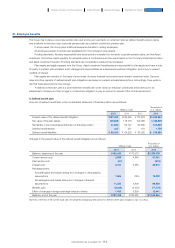

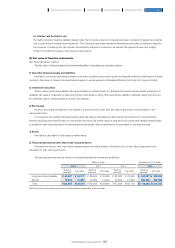

The components of finance income and costs, for fiscal years ended March 31, 2015 and 2014 are as follows:

28. Finance income and costs

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Finance income

Interest income (Note 1)

Financial assets measured at amortized cost ·················································································· ¥1,689 ¥1,641 $14,055

Dividends received

Financial assets measured at FVTOCI ·········································································································· 844 480 7,023

Gain on valuation of investment securities

Financial assets measured at FVTPL ·············································································································· 7 3 58

Total ··································································································································································································································· 2,541 2,125 21,145

Finance costs

Interest expense (Note 1)

Financial assets measured at amortized cost ·················································································· 2,276 2,642 18,940

Financial assets measured at FVTPL ·············································································································· 121 209 1,007

Foreign exchange loss (net) (Note 2) ························································································································ 449 232 3,736

Total ··································································································································································································································· ¥2,848 ¥3,084 $23,700

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Basis of calculating basic earnings per share

Profit for the year attributable to owners of the Company ·················································· ¥40,934 ¥28,354 $340,634

Profit for the year not attributable to owners of the Company ····································· ---

Profit for the year to calculate basic earnings per share ··············································· 40,934 28,354 340,634

Adjustments of profit for the year ·························································································································· ---

Profit for the year to calculate diluted earnings per share ········································· ¥40,934 ¥28,354 $340,634

Yen U.S. dollars

2015 2014 2015

Basic earnings per share attributable to owners of the Company ································· ¥81.01 ¥53.67 $0.67

Diluted earnings per share attributable to owners of Company ········································· ¥80.79 ¥53.54 $0.67

Thousands of shares

2015 2014

Weighted average number of ordinary shares outstanding during the period ··············································· 505,282 528,269

Increase in the number of ordinary shares under subscription rights to shares ··············································· 1,412 1,281

Weighted average number of diluted ordinary shares outstanding during the period ·············································· 506,695 529,550

(Note 1) Valuation gains or losses on interest rate derivatives are included in interest income or interest expense.

(Note 2) Valuation gains or losses on currency derivatives are included in foreign exchange differences.

120

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report