Konica Minolta 2015 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

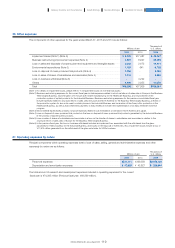

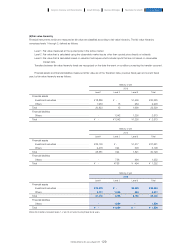

(b) Allowance for doubtful accounts

The Group uses an allowance for doubtful accounts to record impairment losses on individually significant financial assets for

their non-recoverable amounts and on financial assets that are not individually significant for the non-recoverable amounts

estimated based on such factors as past performance of such financial assets.

The allowance for doubtful accounts for these financial assets is included in “trade and other receivables” and “other

financial assets” in the consolidated statement of financial position. Changes in allowances for doubtful accounts for trade

receivables and other financial assets in the respective fiscal years are as follows:

Taking into account such factors as customers’ financial conditions and past-due status, impairment losses recognized on

trade and other receivables were ¥6,000 million, ¥6,218 million and ¥10,002 million at the Transition Date, end of the previous

fiscal year and end of the current fiscal year, respectively. Allowances for doubtful accounts on these receivables were ¥685

million, ¥785 million and ¥1,407 million, respectively.

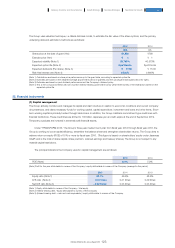

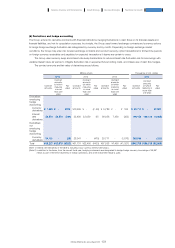

2) Liquidity risk (Risk of not being able to pay on the payment due date)

The Group raises funds through borrowings and other means. With these liabilities, the Group assumes liquidity risk arising from the

possibility that it may become unable to meet its payment obligations on their due date, owing to deterioration in the fund-raising

environment.

To control liquidity risk, the Company’s finance department creates and updates cash plans as necessary, based on

information obtained from its consolidated subsidiaries and various departments. At the same time, the Company constantly

monitors the operating environment to maintain and ensure appropriate on-hand liquidity in response to changing conditions.

Balances of long-term financial liabilities by due date are shown below. Contractual cash flows are undiscounted cash flows

that do not include interest payment amounts.

As of April 1, 2013

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Balance, beginning of the year ··········································································································································· ¥6,527 ¥5,934 $54,315

Provisions made ·················································································································································································· 2,210 1,267 18,391

Provisions utilized ·············································································································································································· (1,061) (1,192) (8,829)

Provisions reversed ········································································································································································ (768) (410) (6,391)

Effects of changes in foreign exchange rates ·················································································· 3 928 25

Balance, end of the year ································································································································································ ¥6,911 ¥6,527 $57,510

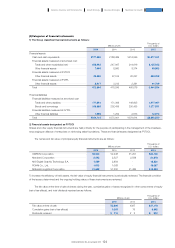

Millions of yen

Carrying

amounts

Contractual

cash flows

Less than

1 year

More than

1 year, less

than 2 years

More than

2 years, less

than 3 years

More than

3 years, less

than 4 years

More than

4 years, less

than 5 years

More than

5 years

Long-term loans payable ············· ¥ 87,498 ¥ 87,498 ¥23,990 ¥27,004 ¥ 5,000 ¥ 4,000 ¥ 9,000 ¥18,501

Bonds ············································································ 70,000 70,000 - - 20,000 20,000 10,000 20,000

Lease obligations ······································· 5,538 5,538 1,686 1,445 1,543 520 192 149

Others ··········································································· 2,573 2,573 2,342 230 - - - -

Total ·················································································· ¥165,610 ¥165,610 ¥28,020 ¥28,680 ¥26,544 ¥24,520 ¥19,193 ¥38,650

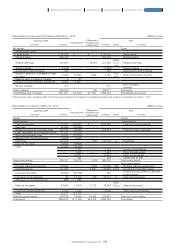

As of March 31, 2014

Millions of yen

Carrying

amounts

Contractual

cash flows

Less than

1 year

More than

1 year, less

than 2 years

More than

2 years, less

than 3 years

More than

3 years, less

than 4 years

More than

4 years, less

than 5 years

More than

5 years

Long-term loans payable ············· ¥ 89,045 ¥ 89,045 ¥27,003 ¥ 5,001 ¥ 4,001 ¥ 9,001 ¥ 3,000 ¥41,038

Bonds ············································································ 70,000 70,000 - 20,000 20,000 10,000 20,000 -

Lease obligations ······································· 6,315 6,315 1,973 2,333 1,123 575 186 122

Others ··········································································· 1,252 1,252 1,026 - - - - 226

Total ·················································································· ¥166,613 ¥166,613 ¥30,003 ¥27,335 ¥25,124 ¥19,576 ¥23,186 ¥41,387

126

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report