Konica Minolta 2015 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

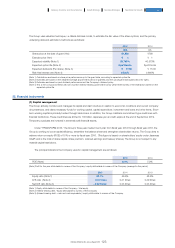

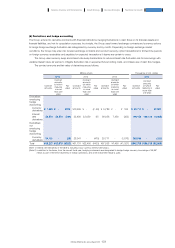

3) Details of the cancellation of treasury shares

(a) Type of shares to be acquired: ············································································· Ordinary shares

(b) Number of shares to be acquired: ······································································· Limited to 10 million

(2.0% of the total number of outstanding shares (excluding treasury shares))

(c) Total value of shares to be acquired: ·································································· Limited to ¥10 billion

(d) Acquisition period: ··································································································· May 14, 2015 to August 31, 2015

(e) Method of acquisition: ···························································································· Discretionary trading by a securities company

(a) Type of shares to be canceled: ············································································· Ordinary shares

(b) Number of shares to be canceled: ······································································ 9 million

(1.8% of the total number of issued shares prior to cancellation (including

treasury shares))

(c) Number of issued shares after cancellation: ···················································· 502, 664, 337 shares

(d) Planned date of cancellation: ··············································································· June 30, 2015

Note: Treasury shares as of March 31, 2015

Total number of issued shares: 511,664,337 shares

Total number of treasury shares: 9,801,071 shares

Total number of outstanding shares (excluding treasury shares): 501,863,266 shares

(1) Acquisition of own shares and cancellation of treasury stocks

At the Board of Directors meeting held on May 13, 2015, the Company approved the item related to the acquisition of its own

shares based on Article 156 of the Company Act, which is applicable in accordance with Article 165, Paragraph 3 of the same law

as well as the cancellation of treasury shares based on Article 178 of the same act. Details are as follows.

1) Reason for acquisition of own shares and cancellation of treasury shares

The Company decided to acquire its own shares and cancel its treasury shares with the aim of shareholders’ benefit, improving

capital efficiency and ensuring a flexible capital policy.

2) Details of the acquisition of own shares

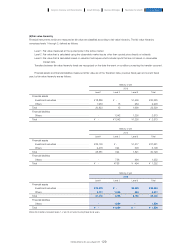

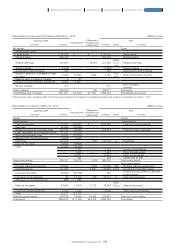

(2) Business Combinations

On August 3, 2015, the Group acquired, in cash, 100% of the shares in Radiant Vision Systems, LLC (“Radiant”), a US-based,

leading provider of testing and measurement systems for flat panel displays. Radiant develops and offers fully integrated testing and

measurement systems precisely engineered to meet customer requirements in the global display testing and measurement industry.

Through the acquisition of Radiant, the Group will solidify the foundation of its business of optical systems for industrial use

within the Industrial Business by integrating Radiant’s products and solutions with the existing business of light-source color

measurement.

Furthermore, to pursue its future growth, the Group will gain the technological strength necessary to enter the field of

manufacturing inspection systems, including visual surface inspections, where automation and integration will improve productivity.

Fair value of the consideration for acquisition includes the base amount of US$230 million and adjusted based on the

statement of financial position of Radiant as of the acquisition date.

Detailed information relating to the accounting for this business combination is not specified because the initial accounting for

acquisition of shares of Radiant has not been completed as of the date the Group’s consolidated financial statements for the fiscal

year ended March 31, 2015 were authorized to issue.

36. Events after the reporting period

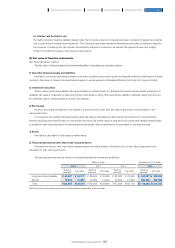

The Group guarantees borrowings and lease obligations, etc., to financial institutions for companies outside the Group. As of the

end of the current fiscal year, guarantee obligations totaled to ¥277 million (previous fiscal year: ¥427 million, Transition Date: ¥456

million). As the likelihood of performance of these guarantee obligations is low, they are not recognized as financial liabilities.

35. Contingencies

The amount of contractual commitments to acquire assets is negligible.

34. Commitments

133

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report