Konica Minolta 2015 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

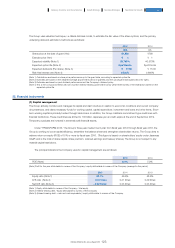

(3)Financial risk management

1) Credit risk (risk that counterparties will fail to fulfill their contractual obligations)

Customer credit risk is an inherent part of trade and other receivables. For that reason, with regard to its trade receivables the Group

regularly monitors the condition of its key business partners to determine potential unrecoverability due to worsening financial

conditions at an early stage and to reduce this risk. The Group also has a policy of managing receivables for each of its transaction

partners by date and balance. For new customers, the Group employs third-party credit ratings, bank references and other available

information to analyze individual credit conditions. The Group’s policy is to set credit limits for each customer and monitor these on

an ongoing basis.

The Group uses derivative transactions to hedge foreign exchange fluctuation risk and interest rate fluctuation risk. The

financial institutions that are counterparties to such transactions present credit risks. However, the Group believes its credit risk

related to counterparties failing to fulfill their obligations is low, as the Group only conducts such transactions with financial

institutions of high credit ratings. Any major exposure to credit risk in financial assets is stated in the carrying amounts presented in

the consolidated statement of financial position.

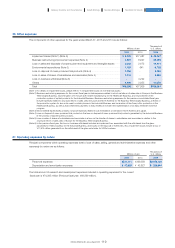

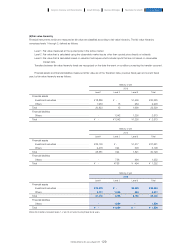

(a) Past-due receivables

The allowance for doubtful accounts on past-due trade and other receivables is as follows:

As of March 31, 2014

As of April 1, 2013

As of March 31, 2015

As of March 31, 2015

Millions of yen

Amount past due

Less than 3 months More than 3 months,

less than 6 months

More than 6 months,

less than 12 months More than 12 months

Trade and other receivables (Gross) ······················ ¥20,113 ¥3,483 ¥1,892 ¥3,681

Allowance for doubtful accounts ································· (462) (690) (702) (1,798)

Trade and other receivables (Net) ······························ ¥19,650 ¥2,793 ¥1,190 ¥1,883

Millions of yen

Amount past due

Less than 3 months More than 3 months,

less than 6 months

More than 6 months,

less than 12 months More than 12 months

Trade and other receivables (Gross) ······················ ¥25,617 ¥3,797 ¥2,988 ¥4,633

Allowance for doubtful accounts ································· (816) (604) (929) (2,265)

Trade and other receivables (Net) ······························ ¥24,800 ¥3,193 ¥2,059 ¥2,367

Millions of yen

Amount past due

Less than 3 months More than 3 months,

less than 6 months

More than 6 months,

less than 12 months More than 12 months

Trade and other receivables (Gross) ······················ ¥26,958 ¥3,938 ¥3,022 ¥4,406

Allowance for doubtful accounts ································· (458) (453) (1,401) (2,758)

Trade and other receivables (Net) ······························ ¥26,500 ¥3,484 ¥1,621 ¥1,647

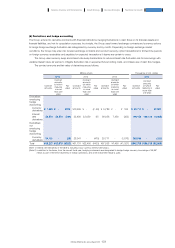

Thousands of U.S. dollars

Amount past due

Less than 3 months More than 3 months,

less than 6 months

More than 6 months,

less than 12 months More than 12 months

Trade and other receivables (Gross) ······················ $224,332 $32,770 $25,148 $36,665

Allowance for doubtful accounts ································· (3,811) (3,770) (11,658) (22,951)

Trade and other receivables (Net) ······························ $220,521 $28,992 $13,489 $13,706

125

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report