Konica Minolta 2015 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

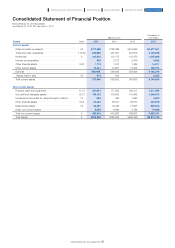

• Equity

Compared to the end of the previous fiscal year, total equity

increased ¥36.6 billion, or 7.4%, to ¥529.5 billion. Retained

earnings rose ¥11.8 billion to ¥251.3 billion. Major factors included

net profit of ¥40.9 billion, an ¥8.9 billion decrease owing to

dividends of surplus, and a ¥20.7 billion decrease attributable to

cancelation of treasury shares.

Furthermore, treasury shares decreased ¥6.5 billion due to

such factors as a ¥14.2 billion increase due to purchase of shares

and a ¥20.7 billion decrease owing to cancellation of shares. Other

components of equity increased ¥17.8 billion to ¥45.9 billion,

reflecting a ¥15.0 billion foreign currency translation adjustment

increase and a ¥3.1 billion marketable securities valuation

difference increase, among other factors.

As a result, compared to the end of the previous fiscal year,

the total equity attributable to owners of the company increased

¥36.3 billion, or 7.4%, to ¥528.4 billion, earnings per share

attributable to owners of the company stood at ¥1,052.94, and the

ratio of equity attributable to owners of the company increased 3.2

points to 53.1%.

• Liabilities

Compared with the end of the previous fiscal year, liabilities

dropped ¥27.6 billion, or 5.6%, to ¥464.7 billion (46.7% of total

assets). Current liabilities fell ¥1.7 billion, or 0.6%, to ¥281.8 billion

and non-current liabilities dropped ¥25.9 billion, or 12.4%, to

¥182.8 billion.

Regarding current liabilities, trade and other payables

increased ¥6.2 billion to ¥177.5 billion while income tax payables

rose ¥1.2 billion to ¥7.5 billion. Bonds and borrowings decreased

¥12.7 billion to ¥53.3 billion and provisions dropped ¥1.2 billion to

¥5.5 billion. Other current liabilities amounted to ¥36.8 billion,

reflecting an accrued tax increase of ¥2.2 billion and increase in the

provision for paid vacation of ¥1.9 billion.

Regarding non-current liabilities, bonds and borrowings

decreased ¥24.1 billion to ¥112.2 billion and net defined benefit

liabilities dropped ¥2.8 billion to ¥62.0 billion.

• Assets

Assets at fiscal year end increased ¥9.0 billion, or 0.9%, over last

fiscal year end to ¥994.2 billion. Current assets rose ¥1.0 billion, or

0.2%, to ¥570.6 billion (57.4% of total assets), and non-current

assets climbed ¥7.9 billion, or 1.9%, to ¥423.6 billion (42.6% of

total assets).

For current assets, cash and cash equivalents decreased by

¥10.9 billion to ¥177.4 billion. Operating receivables and other

receivables stood at ¥252.9 billion, a ¥5.8 billion increase.

Additionally, inventories rose ¥5.6 billion to ¥120.8 billion.

Although there was overall progress in the amortization of

property, plant, and equipment, non-current assets increased ¥4.5

billion to ¥181.6 billion partially as a result of the construction of a

new R&D center, as well as capital investment in the Business

Technologies Business and investments into new businesses in the

Industrial Business. Goodwill and intangible assets climbed ¥6.5

billion to ¥126.1 billion. Other financial assets grew to ¥41.4 billion

due in part to a ¥2.9 billion increase in investment in securities

caused by a rising stock market, while deferred tax assets fell

¥10.0 billion compared to previous fiscal year end to ¥64.2 billion

partially as a result of taxation rate changes prompted by taxation

system amendments. Other non-current assets amounted to ¥9.6

billion due to factors including a ¥1.4 billion increase in long-term

prepaid expenses.

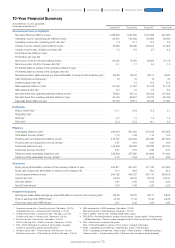

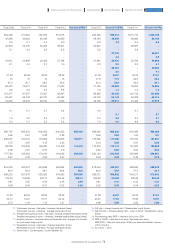

Financial Position and Liquidity

Equity

Total assets

Interest-bearing debt, Cash reserves, Net D/E ratio

600

450

300

150

0

(Billions of yen)

492.8

466.4 466.5

529.5

20132012 2014

(FY)

J-GAAP IFRS

300

240

180

120

60

0

0.3

0.2

0.1

0

-0.1

-0.2

(Billions of yen) (times)

Interest-bearing Debt Cash reserves Net D/E Ratio

0.02%

224.9 213.9 214.5 202.4

165.6 177.4

0.03%

-0.02%

0.03%

20132012 2014

(FY)

J-GAAP IFRS

230.4

188.4

1,200

900

600

300

0

(Billions of yen)

985.2

940.5 958.4 994.2

20132012 2014

(FY)

J-GAAP IFRS

79

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report