Konica Minolta 2015 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

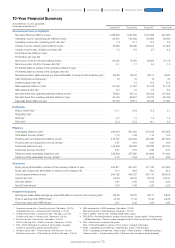

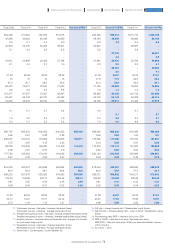

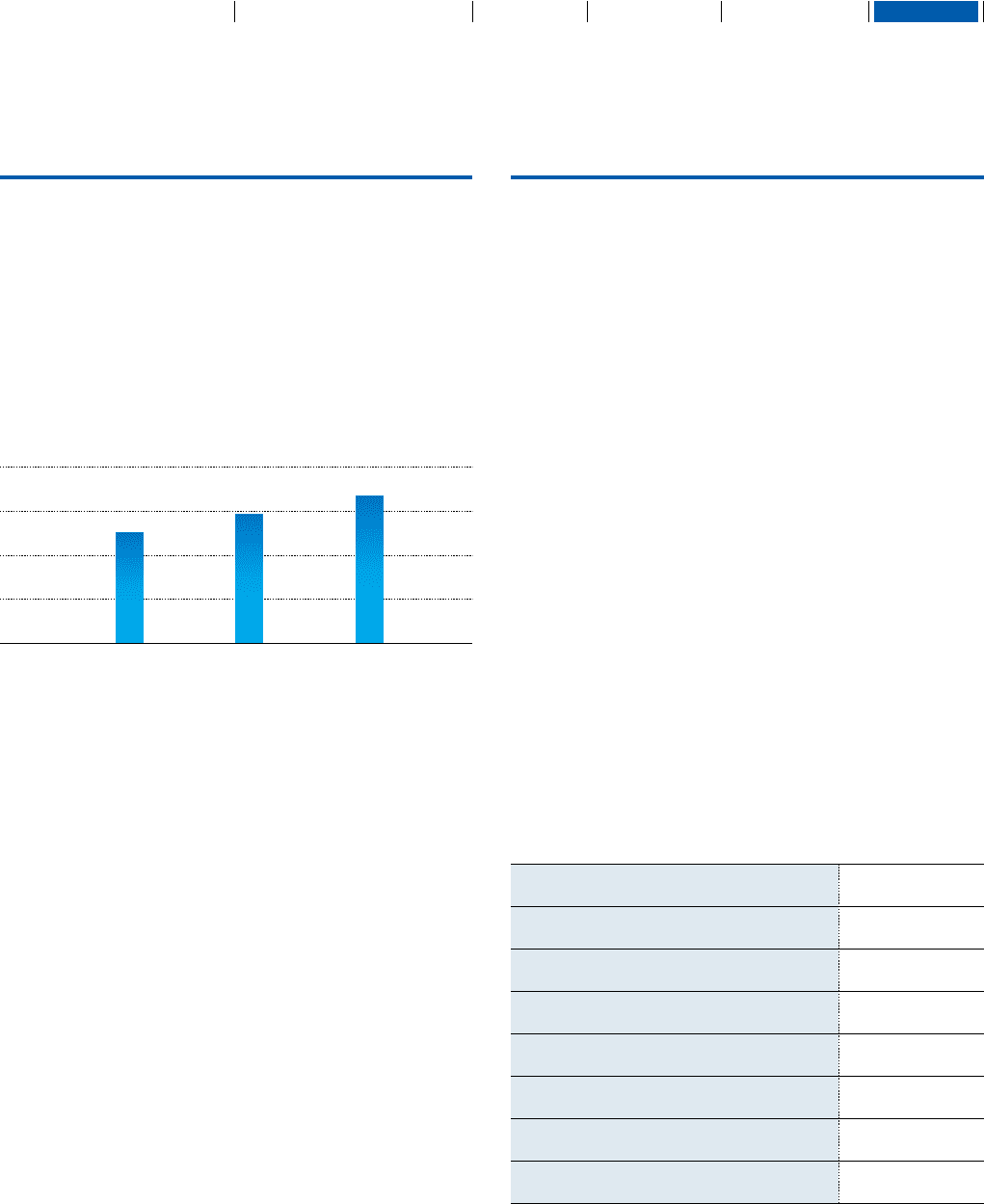

24

18

12

6

0

(Yen)

17.5

15.0

20.0

20132012 2014

(FY)

• Dividends for the fiscal year ended March 31, 2015 and

projected dividends for the fiscal year ending March 31,

2016

Dividends for the end of the fiscal year ended March 31, 2015

were paid at a rate of ¥10 per share, a ¥2.50 increase over the end

of the previous fiscal year. Combined with the dividend of ¥10 per

share already paid at the end of the second quarter, the total

annual dividend was ¥20 per share.

Regarding ordinary dividends for the fiscal year ending March

31, 2016, the Group plans to distribute a total annual dividend of

¥30 per share in order to strengthen shareholder returns, assuming

we achieve the results forecasts outlined on the right.

• Basic dividend policy

The Company’s basic policy regarding the payment of dividends is

to proactively distribute earnings to shareholders after

comprehensive consideration of factors including consolidated

business results and strategic investment in growth areas. The

Group strives to improve shareholder return by increasing the

per-share dividend and practicing flexible purchasing of treasury

stocks.

Outlook for the Fiscal Year Ending March 31,

2016

Dividend Policy

Looking at the global economic conditions surrounding the Group,

the U.S. economy is expected to make a gradual recovery despite

a slowdown in various economic indicators at the start of the year

2015. Major economies in Europe—including Germany, France and

the United Kingdom—are expected to make a strong showing due

in part to quantitative easing, despite the risk of the Greek financial

crisis reigniting. We also forecast a continued slowdown in

economic growth in China and stagnant growth in emerging

countries, including those in Asia and Latin America. Meanwhile, in

the Japanese economy, personal consumption is projected to

recover moderately reflecting solid corporate results.

As for the outlook for demand in the Group’s related markets,

in the Business Technologies Business, we expect demand for A3

color MFPs for the office to continue expanding in overseas

markets. In the commercial and industrial printing field, we project

expanding sales of color units and a resulting increase in print

volume. For the Healthcare Business, we expect continued high

growth in cassette-type digital X-ray systems and diagnostic

ultrasound systems in each region.

In the Industrial Business, we expect growth of smartphones

to continue and the trend for increasing screen size to persist in the

TV market in line with continued enhancement of image quality. In

digital cameras, we expect the markets for compact models and

models with interchangeable lenses to continue contracting.

Published May 13, 2015

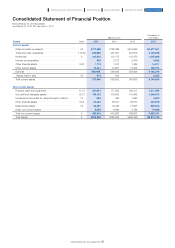

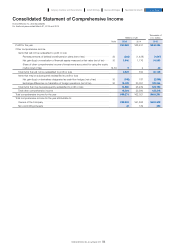

(Billions of yen)

Revenue 1,100

Operating profit 77

Operating profit ratio 7.0 %

Profit attributable to owners of the company 50

Capital investment 55

Depreciation 55

Free cash flow 15

Investment and financing 35

Forecast for the fiscal year ending March 31, 2016

Dividend per share

* Assumed exchange rates: 1 U.S. dollar = ¥120; 1 euro = ¥130

80

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report