Konica Minolta 2015 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business Results

Business Technologies Business

Office Services

IT solution services

• Our hybrid-type sales model, which combines IT services with our MFP

products, experienced strong growth in both Europe and North America.

Office products

• Sales remain strong for A3 color MFPs, introduced as strategic products into

countries where markets are growing.

• In the U.S., the now large MIF (machines in the field) with regard to color

MFPs resulted in steady color print volume.

• We entered into a new global business deal with French conglomerate in the

defense, aviation, and communications fields.

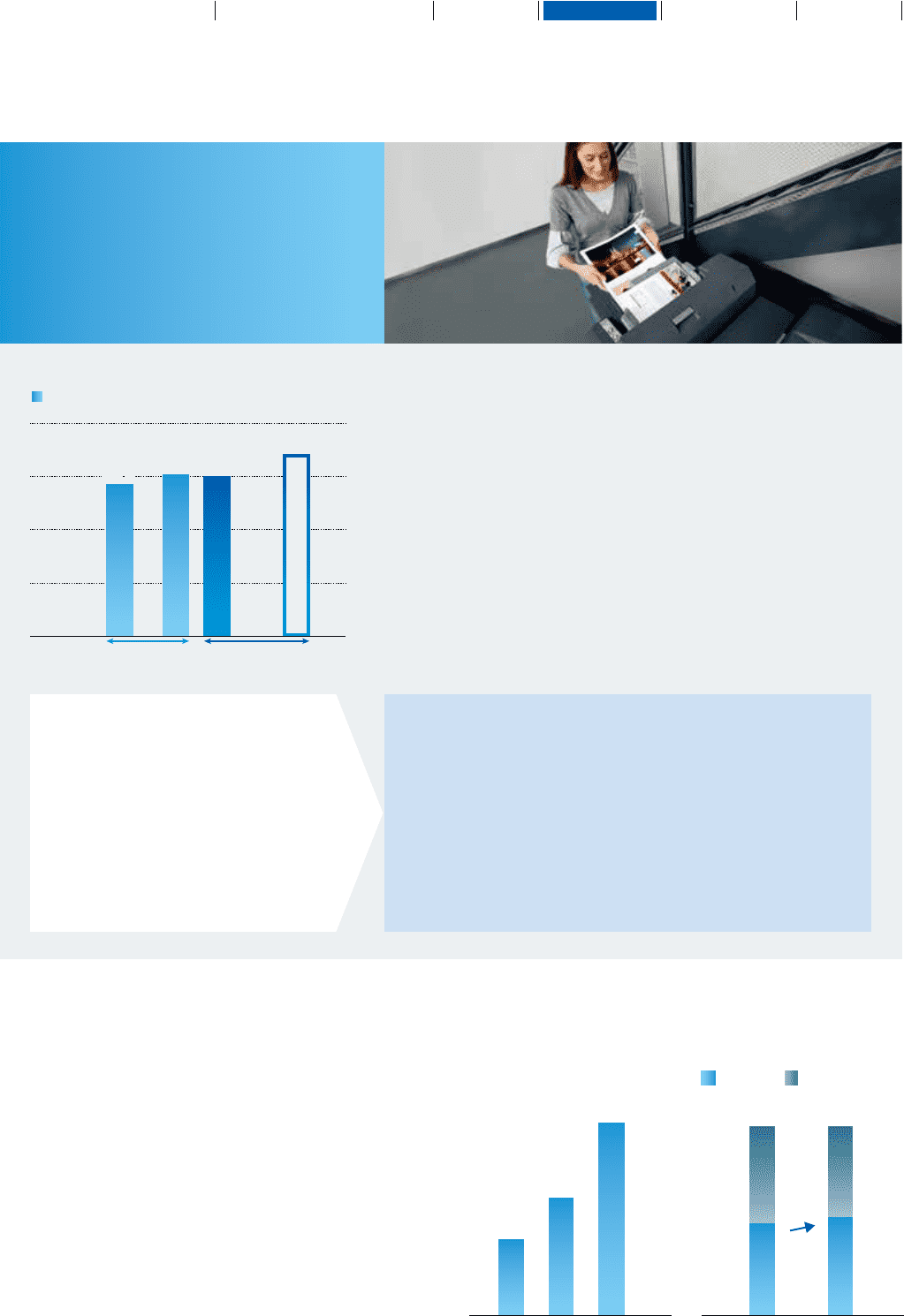

• Fiscal 2014 business results and fiscal 2015 forecast

One basic strategy for this segment involves improving the

proportion of sales of high-profitability A3 color MFPs and medium-

and high-speed MFPs, which carry the greatest potential for high

print volume. Another involves strengthening our competitiveness

in the market and ensuring stable earnings by way of hybrid-type

sales that integrate IT services with MFPs.

Regarding fiscal 2014 business results, sales of IT service

solutions were up 15% year on year and sales of mainstay A3 color

MFPs remained solid, with sales units expanding in all regions.

The number of contracts and sales steadily increased for OPS

(Optimized Print Services) as well, which optimize a customer’s

output environment, following efforts to strengthen the sales and

support system for major customers globally. Sales units of A4

color MFPs also increased as a result of these conditions.

For small- and medium-sized customers, the Group further

evolved its hybrid-type sales that combine IT services with MFPs,

an initiative being developed primarily in the European and U.S.

markets, and started MCS (Managed Content Services), which

Revenue Main Achievements in Fiscal 2014

OPS sales A3 MFP unit sales growth

* Base index: FY2013=100* Base index: FY2012=100

* Figures published in May, 2014

Market environment

(opportunities and challenges)

• At small- and medium-sized companies, the

bulk of our customer base, there is often a

shortage of IT specialists, and latent demand

for IT services is high.

• The market for MFPs has reached maturity in

developed countries, and we need to find a

way to further enhance the value we provide

to customers while avoiding price

competition as these products become

increasingly commoditized.

Strengths and strategies

• We focused on high-profitability A3 color MFPs and high-speed models.

• We improved hybrid-type sales that integrate IT services with MFP

products.

• We enhanced Konica Minolta solutions aimed at putting MFPs at the

center of offices’ IT networks. As a result, we expanded sales to

medium enterprises and larger organizations by removing ourselves

from price competition.

• We transitioned to an industry-specific and business type-specific

system of sales structure from a region-specific system in order to

conduct strategic sales directed at companies that handle high print

volume. We are achieving good success in North America.

(Billions of yen)

(FY)

800

600

400

200

0

2013

597.0

2014

604.2

680.0

567.1

2016

(plan*)

Revenue

J-GAAP IFRS

(FY)

100

155

20132012

254

2014 (FY)

100

2013

102

2014

52 48

48 52

+11.2%

Color B/W

39

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report