Konica Minolta 2015 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

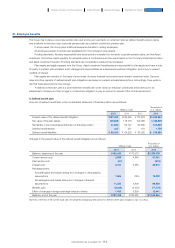

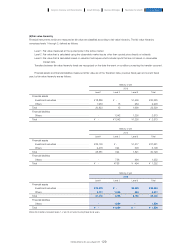

The Group’s share-based payments arise from the share options to the Company’s directors (excluding outside directors) and

executive officers.

No vesting conditions are attached, but in the event that an executive officer retires prior to the completion of his target service

period, he may retain a number of subscription rights to shares corresponding to that number granted multiplied by the number of

months in appointment (from the month prior to the month in which the target service period started until the month in which the

executive retired) and divided by 12. The remaining subscription rights to shares are to be returned free of charge.

The exercise period is defined in an allocation agreement, and the options are forfeited if not exercised during that period.

Options are also forfeited if the executive retires between the grant date and the date of rights allotment.

Rights exercise conditions stipulate that the rights exercise period as one year from the date when the executive steps down

from his position.The Group accounts for share-based payments as equity-settled share-based payments. Expenses related to

equity-settled share-based payment transactions are recognized as selling, general and administrative expenses in the consolidated

statements of profit or loss. This amount for the current fiscal year is ¥159 million (previous fiscal year: ¥165 million)

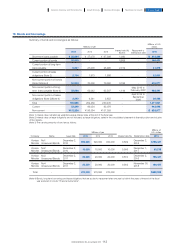

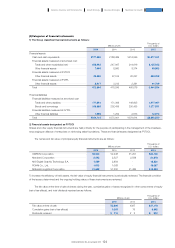

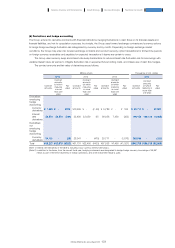

31. Share-based payments

Number of share

options granted Grant date Exercise Period Exercise price (Yen) Fair value at the

grant date (Yen)

1st ·············································· 194,500 August 23, 2005 June 30, 2025 ¥1 ¥1,071

2nd ··········································· 105,500 September 1, 2006 June 30, 2026 1 1,454

3rd ············································· 113,000 August 22, 2007 June 30, 2027 1 1,635

4th ············································· 128,000 August 18, 2008 June 30, 2028 1 1,419

5th ············································· 199,500 August 19, 2009 June 30, 2029 1 776

6th ············································· 188,000 August 27, 2010 June 30, 2030 1 664

7th ············································· 239,500 August 23, 2011 June 30, 2031 1 428

8th ············································· 285,500 August 22, 2012 June 30, 2032 1 518

9th ············································· 257,500 August 22, 2013 June 30, 2043 1 678

10th ········································· 159,600 September 11, 2014 June 30, 2044 ¥1 ¥1,068

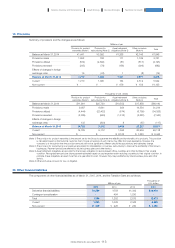

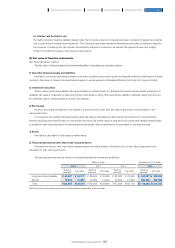

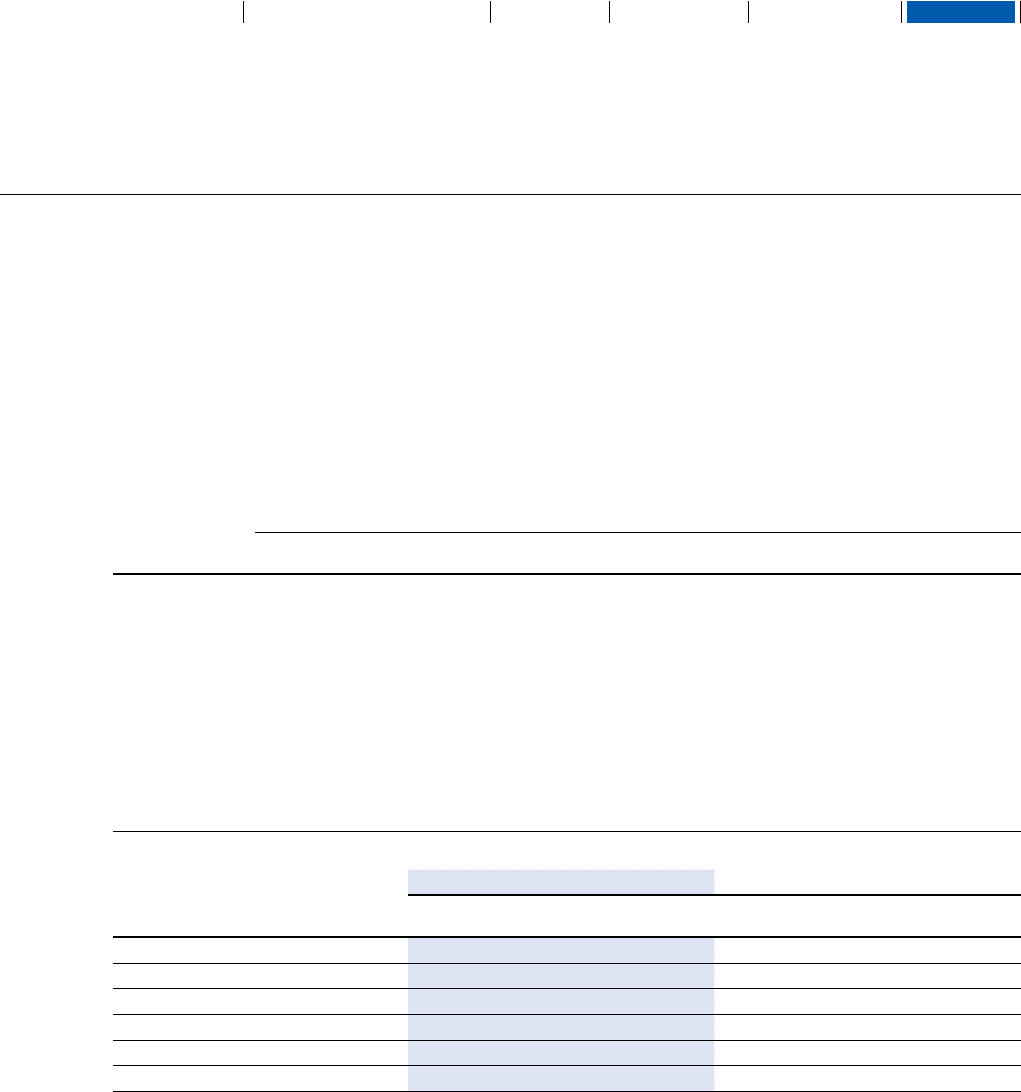

2015 2014

Number of shares Weighted average

exercise price (Yen) Number of shares Weighted average

exercise price (Yen)

Outstanding at April 1, 2014 ············································ 1,373,000 ¥1 1,148,000 ¥1

Granted ················································································································· 159,600 1 257,500 1

Exercised ············································································································ 63,000 1 27,500 1

Forfeited ··············································································································· 9,500 1 5,000 1

Outstanding at March 31, 2015 ································· 1,460,100 1 1,373,000 1

Exercisable at March 31, 2015 ····································· 1,460,100 ¥1 1,373,000 ¥1

(Note 1) The number of share options outstanding for each fiscal year is converted to the number of shares.

(Note 2) The weighted average share price for share options exercised during the year was ¥1,013 (Previous consolidated fiscal year: ¥833).

(Note 3) The weighted average remaining number of years for unexercised share options in the current fiscal year was 18 years (previous fiscal year: 18

years).

122

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report