Konica Minolta 2015 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

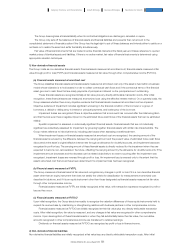

Consolidated Statement of Cash Flows

Konica Minolta, Inc. and Subsidiaries

For the fiscal years ended March 31, 2015 and 2014

Millions of yen

Thousands of

U.S. dollars

Note 2015 2014 2015

Cash flows from operating activities

Profit before tax ······························································································································································································································································ ¥ 65,491 ¥ 37,736 $ 544,986

Depreciation and amortization expenses ··········································································································································································· 47,905 43,827 398,644

Impairment losses ······················································································································································································································································ 5,185 17,487 43,147

Share of profit or loss in investments accounted for using the equity method ················································· (35) 1,163 (291)

Interest and dividend income ················································································································································································································· (2,533) (2,122) (21,078)

Interest expenses ························································································································································································································································ 2,398 2,852 19,955

(Gain) loss on sales and disposals of property, plant and equipment and intangible

assets ······························································································································································································································································································ (1,152) 2,048 (9,586)

Loss (gain) on sales of investments in subsidiaries ·········································································································································· 949 - 7,897

(Increase) decrease in trade and other receivables ·········································································································································· 10,622 (1,710) 88,391

(Increase) decrease in inventories ··································································································································································································· 685 9,198 5,700

Increase (decrease) in trade and other payables ·················································································································································· (5,586) (617) (46,484)

Decrease on transfer of lease assets ························································································································································································ (6,785) (5,837) (56,462)

Increase (decrease) in retirement benefit liabilities ·············································································································································· (2,960) (1,412) (24,632)

Others ····························································································································································································································································································· (595) 2,073 (4,951)

Subtotal ··············································································································································································································································································· 113,588 104,687 945,228

Dividends received ···················································································································································································································································· 853 493 7,098

Interest received ···························································································································································································································································· 1,682 1,598 13,997

Interest paid ·········································································································································································································································································· (2,386) (2,927) (19,855)

Income taxes paid ····················································································································································································································································· (11,748) (13,793) (97,762)

Net cash flows from operating activities ·············································································································································································· 101,989 90,058 848,706

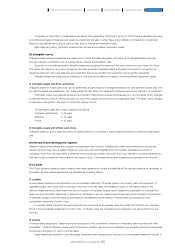

Cash flows from investing activities

Purchase of property, plant and equipment ·································································································································································· (39,063) (36,487) (325,064)

Proceeds from sales of property, plant and equipment ···························································································································· 8,630 2,355 71,815

Purchase of intangible assets ················································································································································································································ (8,676) (8,654) (72,198)

Purchase of investments in subsidiaries ·············································································································································································· (4,360) (2,393) (36,282)

Purchase of investment securities ································································································································································································· (729) (4,910) (6,066)

Proceeds from sales of investment securities ··························································································································································· 3,266 397 27,178

Payment for loans receivable ·················································································································································································································· (97) (306) (807)

Collection of loans receivable ················································································································································································································· 83 159 691

Payments for transfer of business ································································································································································································· (6,709) (2,102) (55,829)

Others ····························································································································································································································································································· (6,358) (2,199) (52,908)

Net cash flows from investing activities ················································································································································································ (54,014) (54,143) (449,480)

Cash flows from financing activities

Increase (decrease) in short-term loans payable ·················································································································································· (11,411) (35,013) (94,957)

Proceeds from bonds issuance and long-term loans payable ····································································································· - 25,598 -

Redemption of bonds and repayments of long-term loans payable ·················································································· (30,493) (26,805) (253,749)

Purchase of treasury shares ····················································································································································································································· (13,509) (15,806) (112,416)

Cash dividends paid ·············································································································································································································································· 23 (8,908) (9,284) (74,128)

Payments for acquisition of interests in subsidiaries from non-controlling interests ································ (293) (1,633) (2,438)

Others ····························································································································································································································································································· 2,486 (727) 20,687

Net cash flows from financing activities ················································································································································································ (62,128) (63,672) (517,001)

Effect of exchange rate changes on cash and cash equivalents ······································································································ 3,160 1,690 26,296

Net increase (decrease) in cash and cash equivalents ········································································································································ (10,993) (26,067) (91,479)

Cash and cash equivalents at the beginning of the year ································································································································· 188,489 214,556 1,568,520

Cash and cash equivalents at the end of the year ····················································································································································· ¥177,496 ¥188,489 $1,477,041

87

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report