Konica Minolta 2015 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

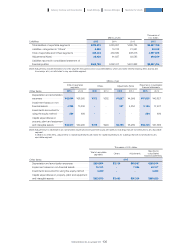

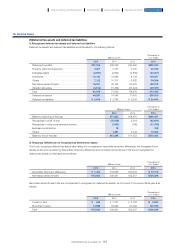

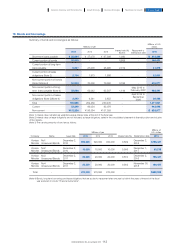

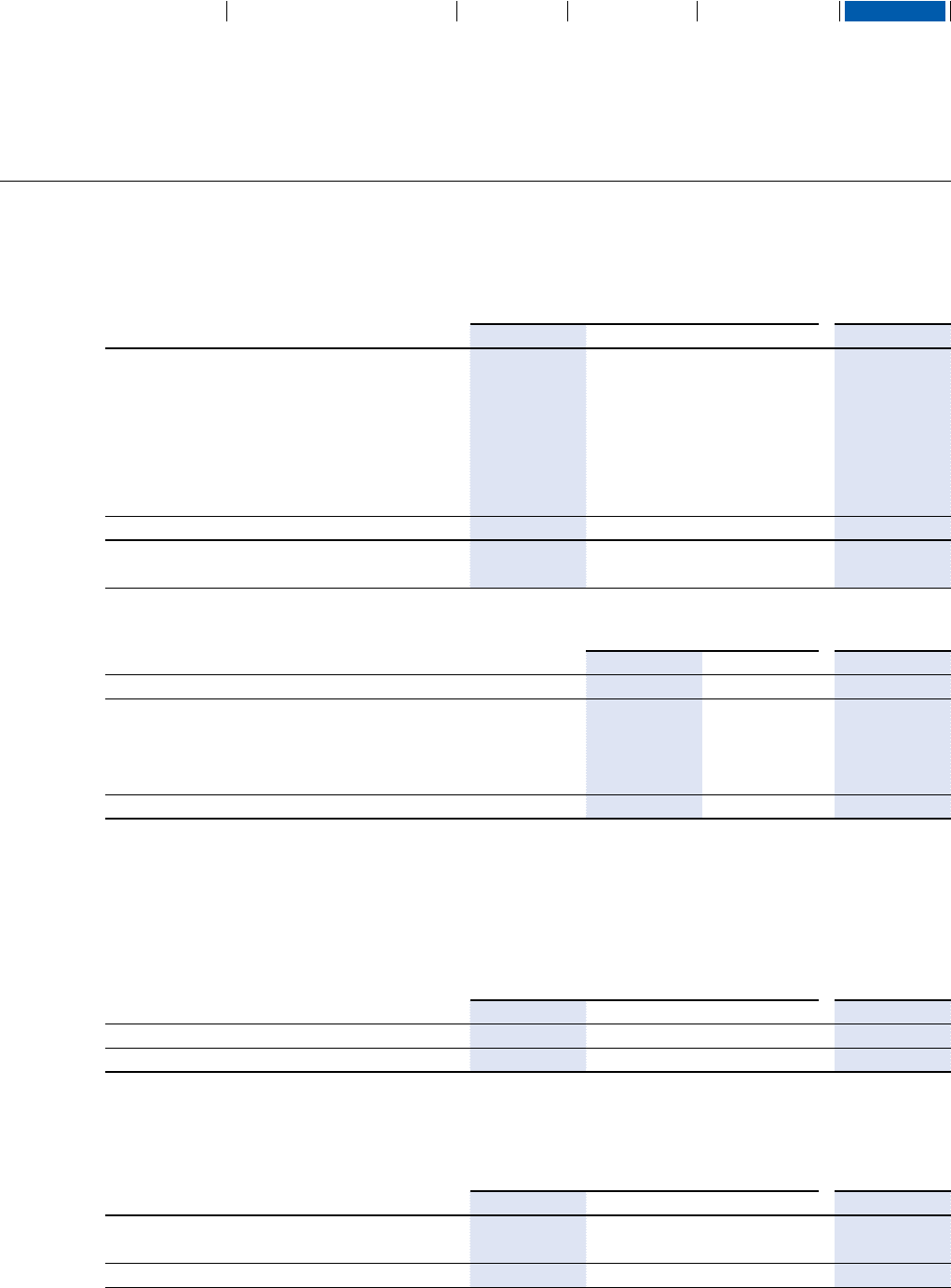

(1)Deferred tax assets and deferred tax liabilities

1) Recognized deferred tax assets and deferred tax liabilities

Deferred tax assets and deferred tax liabilities are attributable to the following factors:

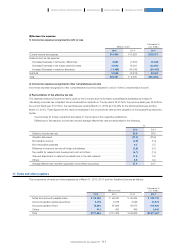

16. Income taxes

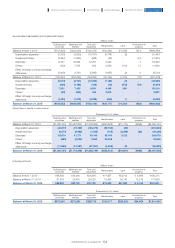

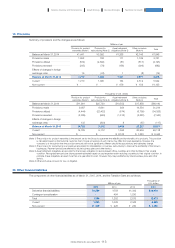

2) Temporary differences not recognized as deferred tax assets

The Group recognizes deferred tax assets after taking into consideration deductible temporary differences, the forecasted future

taxable profits and tax planning. Deductible temporary differences and net losses carried forward that are not recognized for

deferred tax assets on this basis are as follows:

Net losses carried forward that are not expected to recognized for deferred tax assets, as of the end of the current fiscal year is as

follows;

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Balance, beginning of the year ··········································································································································· ¥71,553 ¥68,970 $595,431

Recognized in profit or loss ······················································································································································ (10,056) 2,318 (83,681)

Recognized in other comprehensive income ····························································································· (1,651) (780) (13,739)

Business combinations ···································································································································································· 19 - 158

Others ···························································································································································································································· 1,481 1,044 12,324

Balance, end of the year ································································································································································ ¥61,346 ¥71,553 $510,493

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

Retirement benefits ·················································································································· ¥27,565 ¥30,626 ¥30,660 $229,383

Property, plant and equipment ············································································· 2,851 3,157 3,700 23,725

Intangible assets ··························································································································· (2,927) (2,834) (2,859) (24,357)

Inventories ··············································································································································· 13,145 12,086 8,728 109,387

Others ····························································································································································· 7,122 10,707 5,882 59,266

Net losses carried forward ·························································································· 19,501 35,192 50,283 162,278

Valuation allowance ················································································································· (5,912) (17,382) (27,424) (49,197)

Total ···································································································································································· 61,346 71,553 68,970 510,493

Deferred tax assets ·················································································································· 64,291 74,348 71,605 535,000

Deferred tax liabilities ············································································································ ¥ 2,944 ¥ 2,794 ¥ 2,634 $ 24,499

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

Deductible temporary differences ··································································· ¥ 1,463 ¥16,958 ¥20,094 $ 12,174

Net losses carried forward ·························································································· ¥15,625 ¥30,651 ¥52,207 $130,024

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

5 years or less ··································································································································· ¥ 636 ¥ 7,721 ¥ 5,122 $ 5,293

More than 5 years ······················································································································ 14,988 22,929 47,084 124,723

Total ···································································································································································· ¥15,625 ¥30,651 ¥52,207 $130,024

110

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report