Konica Minolta 2015 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

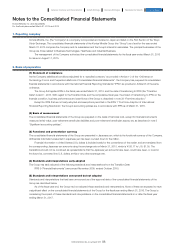

Additional acquisitions of non-controlling interests subsequent to the initial acquisition are treated as capital transactions, and no

goodwill is recognized on these transactions.

Intermediary fees, attorneys’ fees, due diligence fees and other specialist remuneration, consulting fees and any similar costs

are expensed as incurred.

If a business combination is not completed by the end of the fiscal year, uncompleted items are recognized at their provisional

amounts. If information pertaining to the reality and conditions likely to affect the measurement of amounts recognized on the

acquisition date and information on the determined period (the “measurement period”) exist and are known on the acquisition date,

that information is reflected and the provisionally recognized amounts are retroactively adjusted on the acquisition date. This

additional information may be recognized as additional assets and liabilities. The maximum measurement period is one year.

(3) Foreign currency translation

1) Functional currency and presentation currency

The consolidated financial statements of the Group are presented in Japanese yen, which is the functional currency of the Company.

The foreign operations (subsidiaries, associates and branches) of the Group principally use local currencies as their functional

currencies. However, if the currency of the primary economic environment in which an entity operates is other than its local currency,

the functional currency other than the local currency is used.

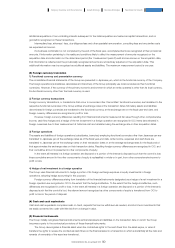

2) Foreign currency transactions

Foreign currency transactions, or transactions that occur in currencies other than entities’ functional currencies, are translated to the

respective functional currencies of the Group entities at exchange rates at the transaction dates. Monetary assets and liabilities

denominated in foreign currencies are translated to the functional currency at the exchange rate on the fiscal year-end date, and

foreign currency differences are recognized in profit or loss.

However, foreign currency differences resulting from financial instruments measured at fair value through other comprehensive

income, cash flow hedges and a hedge of the net investment in a foreign operation are recognized in OCI. Items denominated in

foreign currencies due to their measurement at historical cost are translated using the exchange rate on their acquisition dates.

3) Foreign operations

The assets and liabilities of foreign operations (subsidiaries, branches) employing functional currencies other than Japanese yen are

translated to Japanese yen at the exchange rates as of the fiscal year-end date, while income, expenses and cash flows are

translated to Japanese yen at the exchange rates on their transaction dates or at the average exchange rates for the fiscal period

that approximates the exchange rates on their transaction dates. Resulting foreign currency differences are recognized in OCI, and

their cumulative amount is presented in other components of equity.

In the event all interests in a foreign operation are disposed or a portion of the interest is disposed such that the control is lost,

these cumulative amount in the other components of equity is reclassified in whole or in part, from other comprehensive income to

profit or loss.

4) Hedge of net investment in a foreign operation

The Group uses financial instruments to hedge a portion of its foreign exchange exposure in equity investments in foreign

operations, adopting hedge accounting for this purpose.

Foreign currency differences arising from translation of the financial instruments designated as a hedge of a net investment in a

foreign operation are recognized in OCI to the extent that the hedge is effective. To the extent that the hedge is ineffective, such

differences are recognized in profit or loss. In the event all interests in a foreign operation are disposed or a portion of the interest is

disposed such that the control is lost, the relevant amount recognized as other components of equity is transferred from OCI to

profit or loss in the period of disposal.

(4) Cash and cash equivalents

Cash and cash equivalents comprises cash on hand, deposits that can be withdrawn as needed, and short-term investments that

are easily converted into cash with little risk from a change in value.

(5) Financial instruments

The Group initially recognizes financial instruments as financial assets and liabilities on the transaction date on which the Group

becomes a party to the contractual provisions of these financial instruments.

The Group derecognizes a financial asset when the contractual rights to the cash flows from the asset expire, or when it

transfers the rights to receive the contractual cash flows on the financial asset in a transaction in which substantially all the risks and

rewards of ownership of the asset are transferred.

90

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report