Konica Minolta 2015 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

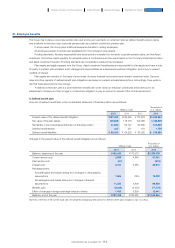

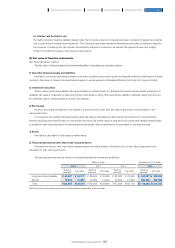

(2)Categories of financial instruments

1) The Group classifies financial instruments as follows:

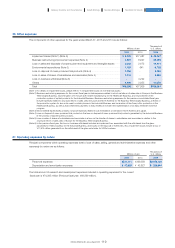

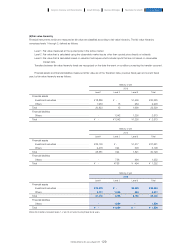

2) Financial assets designated as FVTOCI

Shares and other equity financial instruments are held primarily for the purpose of participating in the management of the investees,

encouraging an alliance of enterprises or reinforcing sales foundations. These are financial assets designated as FVTOCI.

The names and fair value of principal equity financial instruments are as follows:

To increase the efficiency of held assets, the fair value of equity financial instruments is periodically reviewed. The financial condition

of the issuers determined and the ongoing holding status of these instruments are reviewed.

The fair value at the time of sale of shares during the year, cumulative gains or losses recognized in other components of equity

(net of tax effects), and total dividends received are as follows:

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

Financial assets

Cash and cash equivalents ························································································ ¥177,496 ¥188,489 ¥214,556 $1,477,041

Financial assets measured at amortized cost

Trade and other receivables (net) ···························································· 252,962 247,067 214,616 2,105,035

Other financial assets ·································································································· 7,690 8,960 8,374 63,993

Financial assets measured at FVTOCI

Other financial assets ·································································································· 30,428 27,514 20,237 253,208

Financial assets measured at FVTPL

Other financial assets ·································································································· 5,017 3,213 2,291 41,749

Total ···································································································································································· 473,594 475,245 460,076 3,941,034

Financial liabilities

Financial liabilities measured at amortized cost

Trade and other payables ···················································································· 177,564 171,309 146,605 1,477,607

Bonds and borrowings ····························································································· 165,586 202,439 230,435 1,377,931

Financial liabilities measured at FVTPL

Other financial liabilities ···························································································· 1,559 1,252 2,573 12,973

Total ···································································································································································· ¥344,710 ¥375,001 ¥379,614 $2,868,520

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

OMRON Corporation ············································································································ ¥2,900 ¥2,248 ¥1,291 $24,132

Marubeni Corporation ········································································································· 2,593 2,527 2,588 21,578

MGI Digital Graphic Technology S.A. ························································ 1,829 2,884 - 15,220

ROHM Co., Ltd. ···························································································································· 1,813 1,068 - 15,087

Mitsubishi Logistics Corporation ······································································ ¥1,642 ¥1,200 ¥1,486 $13,664

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Fair value at time of sale ································································································································································· ¥3,266 ¥397 $27,178

Cumulative gains (net of tax effects) ·························································································································· 1,065 75 8,862

Dividends received ··················································································································································································· ¥ 112 ¥ 2 $ 932

124

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report