Konica Minolta 2015 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Regarding Group balance sheet management, essentially we

are pursuing streamlining and greater efficiency while

maintaining a number of important points. One point is

securing liquidity, or cash on hand. However, in the case of

the Konica Minolta Group, having everything in cash is not

required. We have therefore shifted towards an off-balance-

sheet approach, which involves counting credit lines from

financial institutions as cash on hand and decreasing the

assets balance on the balance sheet by that amount.

The second point is managing current assets and current

liabilities. Konica Minolta has five business segments and each

of these have significantly different accounts receivables-

trade, inventory scales, collection periods and so forth.

Therefore, the Group works to ensure optimal balance sheet

management for each business area utilizing various

measures such as checking the cash conversion cycle of

each business.

Furthermore, regarding investment and loan activities, we

have a policy of proactively using upfront investment

necessary for growth. However, we also streamline by

excluding items like equipment from balance sheets as much

as possible. Finally, in order to suppress financial leveraging,

taking management stability into consideration, our policy is

appropriate operations that hold it to approximately two-fold

from the aspect of intensifying growth investment.

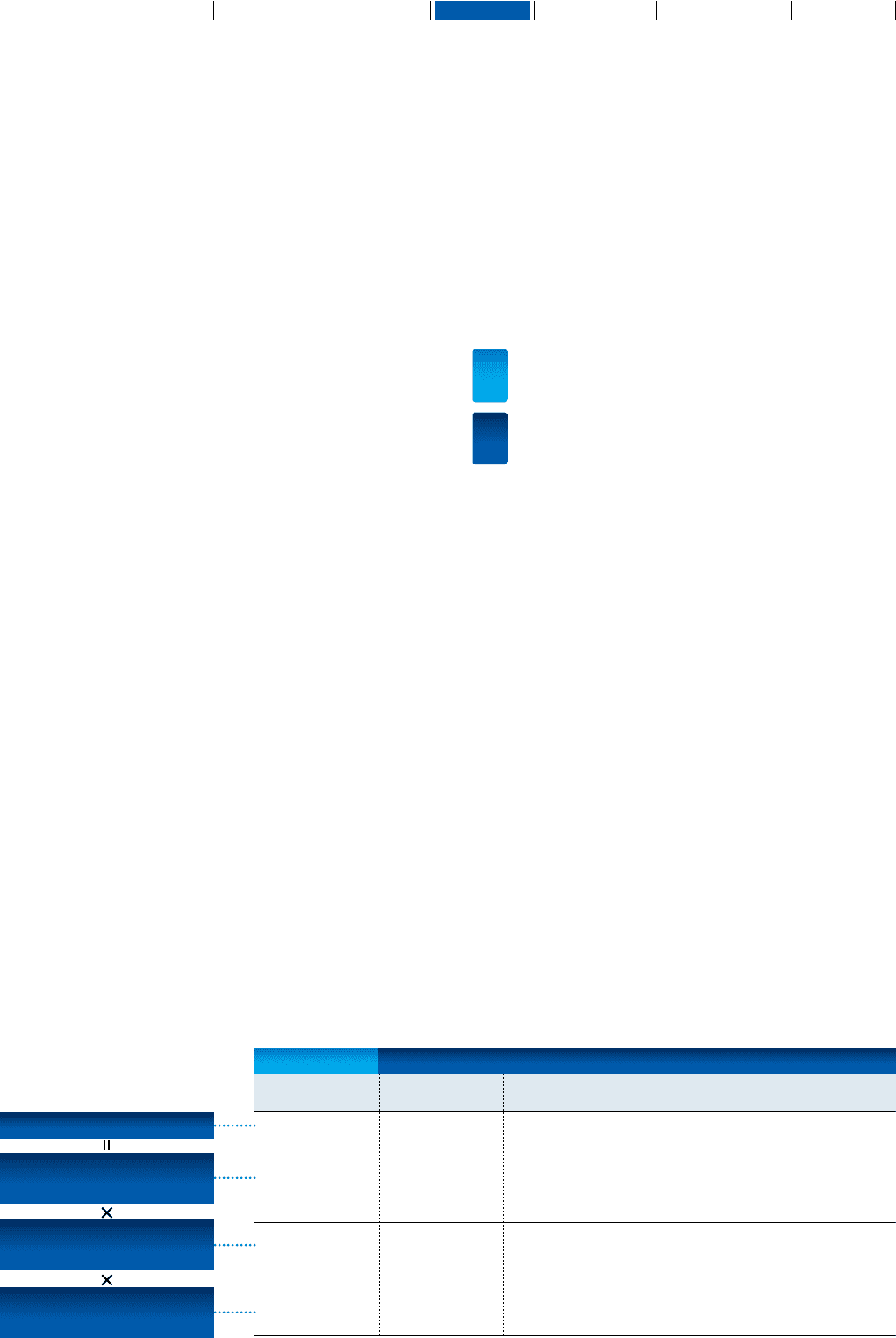

Progress towards the Medium Term Business Plan of 10% ROE or higher (IFRS base)

* ROE = Profit attributable to owners of the company / (Share capital + Share premium + Retained earnings + Treasury shares

(average at start of fiscal year and end of fiscal year))

Q4.

Please explain the balance sheet management

policies such as assets turnover and financial

leverage.

A4. We implement detailed balance sheet management

to suit the characteristics of each business.

shares are currently owned by foreign investors. Adopting

IFRS, the ROE for fiscal 2014 was 8.7%, and our target for

the Medium Term Business Plan is to achieve a ROE of 10%

or more by fiscal 2016. However, we are now striving to

achieve this a year earlier, in fiscal 2015.

The calculation for ROE is as follows: ROE = profit ratio x

assets turnover x financial leverage. There are a number of

ways to increase ROE; however, the Konica Minolta Group is

placing greatest emphasis on increasing the profit ratio for the

year.

We have implemented various initiatives such as raising

employee awareness and revising assessment systems in

order to increase profit for the year. As one of the employee

key performance indicators (KPIs) or key goal indicators

(KGIs), the Konica Minolta Group places special importance

on contributing to operating profit. However, now that we

have adopted IFRS, profit such as non-operating profit and

extraordinary income and loss other than finance income and

loss are also incorporated. This has made it difficult to assess

performance and achievement of targets using operating

profit alone. Meanwhile, profit for the year is an important

indicator that has a direct impact on ROE. Accordingly, we

must raise employee awareness of corporate goals and

steadily increase profit for the year from now on. However, it is

difficult for employees in the field to determine what is required

in order to increase profit for the year. This is why we believe it

is necessary to establish KPIs and KGIs, which break things

down in more detail and provide all employees with a concrete

code of conduct.

TargetResult

8.7%

4.1%

1.01

2.09

10% or higher

5% or higher

1.0 or higher

2.0

Fiscal 2016Fiscal 2014

Themes/Measures

A shift in the focus of our business + Profitability

• Operating profit ratio – 8% or higher

• Non-operating income/Special loss improvement

Balance sheet management

• Sale of idle assets • Inventory reduction • Proactive shareholder return

Secure financial soundness

• Net debt/equity ratio: 0 • Credit ranking: Maintain A rating

ROE

Profitability

Profit ratio

Efficiency

Assets turnover

Soundness

Financial leverage

24

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report