Konica Minolta 2015 Annual Report Download - page 138

Download and view the complete annual report

Please find page 138 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

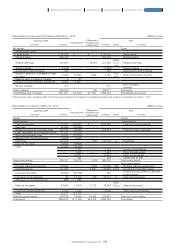

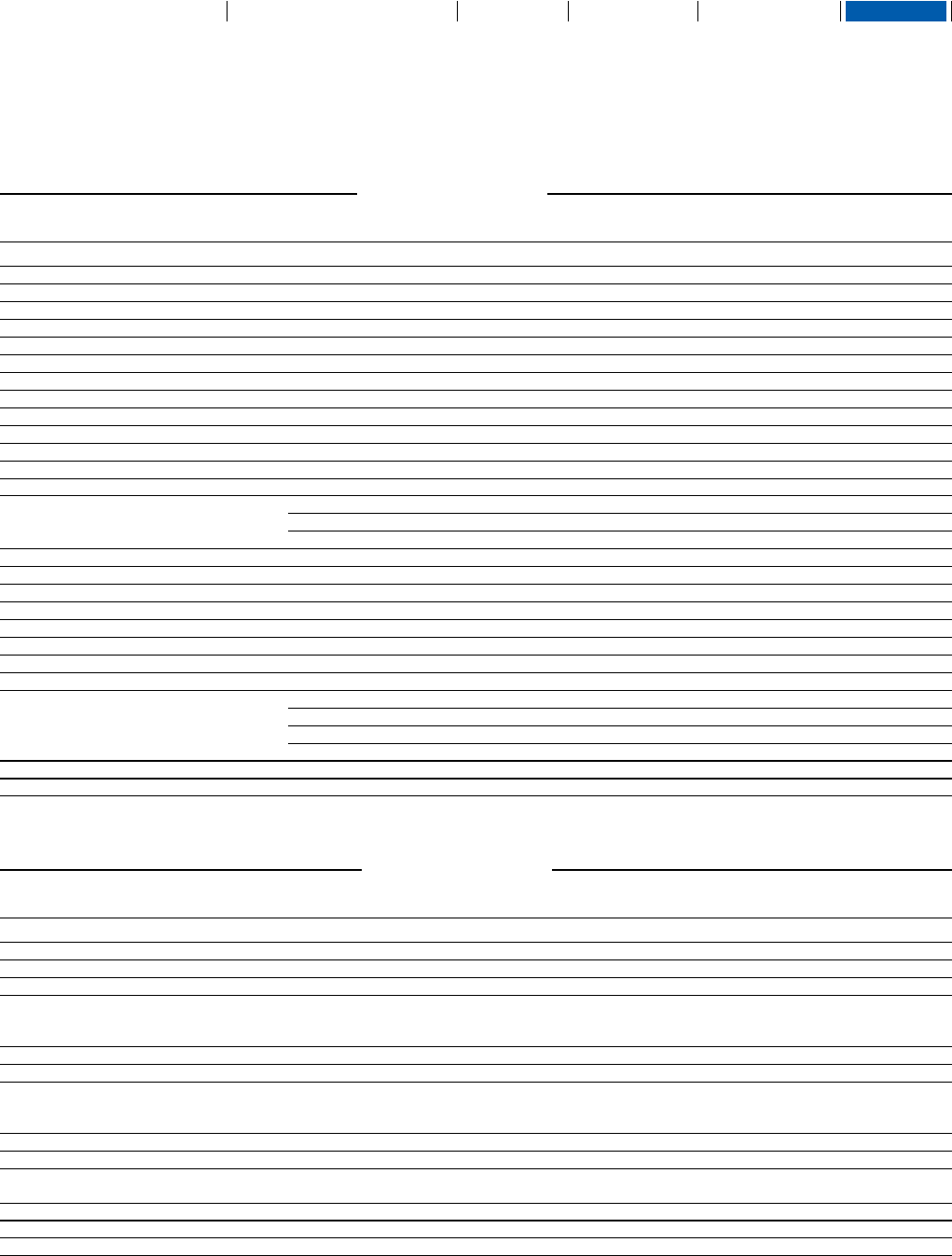

Reconciliation of equity as of March 31, 2014 (Millions of yen)

Reconciliation of equity as of March 31, 2014 (Millions of yen)

Japanese GAAP Reclassification

Differences in

recognition and

measurement

IFRS

Accounts Amounts Amounts Notes Accounts

Liabilities Liabilities

Current liabilities Current liabilities

Notes and accounts payable–trade ¥ 96,240 ¥75,069 ¥ - ¥171,309 Trade and other payables

Notes payable–facilities 1,185 (1,185) -

Accounts payable–other 39,824 (39,824) -

Accrued expenses 34,509 (34,509) -

Short-term loans payable 37,078 28,910 65 66,054 B Bonds and borrowings

Current portion of long-term loans payable 27,003 (27,003) -

Income taxes payable 5,652 585 - 6,238 Income tax payables

Provision for product warranties 1,441 5,489 (144) 6,787 I Provisions

Asset retirement obligations 256 (256) -

Provision for bonuses 13,007 (13,007) -

Provision for directors’ bonuses 244 (244) -

Provision for discontinued operations 195 (195) -

Other 28,580 (28,580) -

1,026 - 1,026 Other financial liabilities

32,001 177 32,178 J Other current liabilities

Total current liabilities 285,220 (1,723) 99 283,595 Total current liabilities

Non-current liabilities Non-current liabilities

Bonds payable 70,000 66,266 117 136,384 B Bonds and borrowings

Long-term loans payable 62,042 (62,042) -

Retirement benefit liabilities 53,563 251 11,113 64,928 G Retirement benefit liabilities

Deferred tax liabilities for land revaluation 3,269 (475) - 2,794 Deferred tax liabilities

Provision for directors’ retirement benefits 237 (237) -

Asset retirement obligations 1,012 (1,012) -

Other 10,658 (10,658) -

1,161 - 1,161 Provisions

- 226 226 F Other financial liabilities

3,327 - 3,327 Other non-current liabilities

Total non-current liabilities 200,785 (3,420) 11,457 208,821 Total non-current liabilities

Total liabilities ¥486,005 (¥ 5,144) ¥11,556 ¥492,417 Total liabilities

Japanese GAAP Reclassification

Differences in

recognition and

measurement

IFRS

Accounts Amounts Amounts Notes Accounts

Net assets Equity

Shareholders’ equity

Capital stock ¥ 37,519 ¥ - ¥ - ¥ 37,519 Share capital

Capital surplus 204,140 - (719) 203,421 D Share premium

Retained earnings 242,460 - (3,007) 239,453

A,B,C,

E,G,H,

I,J,K

Retained earnings

Treasury shares (17,322) - - (17,322) Treasury shares

Subscription rights to shares 910 - - 910 Subscription rights to shares

Valuation difference on available-for-sale

securities 5,086 6,520 16,492 28,100

C,D,E,

F,G,H,

I,K

Other components of equity

Deferred gains or losses on hedges (38) 38 -

Foreign currency translation adjustment 15,055 (15,055) -

Remeasurements of retirement benefit

plans (8,497) 8,497 -

Minority interests 740 - - 740 Non-controlling interests

Total net assets 480,055 - 12,766 492,822 Total equity

Total liabilities and net assets ¥966,060 (¥ 5,144) ¥24,322 ¥985,239 Total liabilities and equity

137

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report