Konica Minolta 2015 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As of the end of June 2015, the Konica Minolta Group has

138 consolidated subsidiaries in approximately 50 countries

around the world. The ratio of sales overseas is approximately

80% and foreign investors own about 45% of the outstanding

shares. One of the biggest reasons for the voluntary adoption

of IFRS beginning from this term is to strengthen our ability to

disseminate information to investors in and outside of Japan

as a global company, and further increase the reliability of the

Group. By adopting IFRS, the only accounting standards

utilized uniformly worldwide, we are now able to disseminate

financial information in a way that is easy for foreign investors

to understand and have simplified the method utilized by

Japanese investors to make international comparisons.

Another reason for utilizing IFRS is to strengthen

governance. Until now, after our 138 global subsidiaries

settled their accounts using the accounting standards of their

respective countries, figures were consolidated by converting

items to be consistent with Japanese standards. From this

The IFRS require that an impairment test be conducted

annually—regardless of any indications of impairment—for the

purpose of reevaluating goodwill. In other words, any risk that

cannot be eliminated through regular amortization can

suddenly amount to a large impairment risk if the performance

of the company or business targeted deteriorates.

The Konica Minolta Group began strengthening the risk

management of investment projects such as M&As from an

early stage, doing so with the plan to significantly reduce

impairment risk by adopting IFRS. More specifically, in addition

to executing the functions of normal management, several

committees have been established. These include the

Investment Assessment Committee, Business Assessment

Committee and Risk Management Committee, which review

individual projects based on a multifaceted approach.

Basically, the Group assesses investment projects using

the net present value (NPV) index, which calculates the

current investment target value from the cash flow during the

investment period. We endeavor to prevent impairment from

occurring after M&As by further improving NPV through

synergies of the Konica Minolta Group.

Return on equity (ROE) is one of the indicators overseas

investors place the most importance on when choosing a

stock. For this very reason, we believe it is vital to boost our

ROE into the double digits at the earliest possible time;

especially considering that 45% of Konica Minolta Group

Message from the CFO

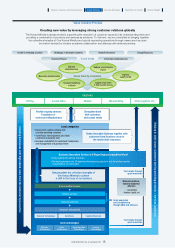

Pursuing efficient business management as a global

company to meet the expectations of our investors.

Ken Osuga, Director and Senior Executive Officer

Q 1.

What does Konica Minolta aim to achieve by

applying International Financial Reporting

Standards (IFRS) beginning from this term?

A1.

We are aiming to strengthen our ability to

disseminate information to investors and improve

governance transparency and fairness.

Q2. Konica Minolta is proactively involved in M&As, but

how do you intend to deal with impairment risk?

A2.

We will strengthen risk management for investment

projects and improve value by fully leveraging

Group synergies.

Q3.

A ROE of 10% has been established as one of the

targets of the Medium Term Business Plan. Please

explain the policies and strategies implemented to

achieve this?

A3.

Our focus is on increasing profit for the year, raising

employee awareness and moving forward with the

formulation of a code of conduct.

time onward, by utilizing a common accounting standard

throughout the Group including overseas subsidiaries, it is

believed we can improve the transparency and fairness of the

Group’s governance, making more appropriate, more efficient

capital allocation possible.

23

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report