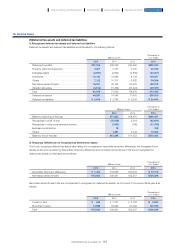

Konica Minolta 2015 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

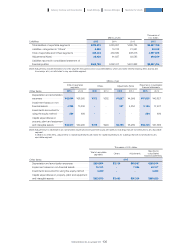

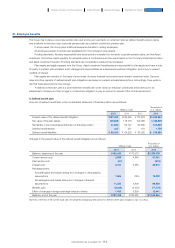

(1) Impairment losses

For fiscal year ended March 31, 2014, impairment losses were recognized on manufacturing equipment of glass substrates for

HDDs as a result of the resolution to withdraw from this business and on manufacturing equipments of medical-use X-ray films as

no further use was expected due to the cessation of manufacturing.

Manufacturing equipments of glass substrates for HDDs (“machinery and vehicles,” “buildings and structures,” etc.) was

written down to the recoverable amounts of ¥3,852 million for these assets, and impairment losses of ¥11,910 million were

recognized for the Industrial Business segment. The recoverable amounts were calculated using a valuation technique (market

approach) which included unobservable inputs. They are therefore classified within level 3 of fair value hierarchy.

As manufacturing equipments for medical-use X-ray films (“buildings and structures”) are specialty assets that cannot be easily

converted or sold, the recoverable amounts of these assets were estimated at zero, and impairment losses of ¥3,516 million were

recorded. These impairment losses were generated on assets not attributed to reportable segments.

For fiscal year ended March 31, 2015, impairment losses were recognized on goodwill at sales sites in Europe due to ongoing

losses stemming from worsening of market environment, on manufacturing equipments of optical products and film manufacturing

equipments located in Japan in the Industrial Business segment due to reduced utilization rates, and on company-wide idle assets,

etc., due to reduced utilization rates and review of asset values.

With regard to sales sites in Europe, the recoverable amount of goodwill and intangible assets associated with the acquisition

of sales subsidiaries was estimated at zero, and impairment losses of ¥2,733 million were recognized in the Business Technologies

business.

With regard to manufacturing equipments of optical products (“machinery and vehicles” and “tools and equipment,” etc.), the

recoverable amounts of these assets was written down to ¥188 million, and impairment losses of ¥473 million were recognized for

the Industrial Business segment. The recoverable amounts is the fair value less costs of disposal, calculated using the valuation

technique (market approach) which included unobservable inputs.It is therefore classified within level 3 of fair value hierarchy.

With regard to film manufacturing equipment located in Japan (“machinery and vehicles” and “tools and equipment”), as these

are specialty assets that cannot be easily converted or sold, the recoverable amounts of these assets was estimated at zero, and

impairment losses of ¥553 million were recorded in the Industrial Business segment.

With regard to idle assets, etc. (“buildings and structures,” “machinery and vehicles” and “land,” etc.), the recoverable amount

for land was written down to ¥50 million, the recoverable amount of assets other than land was estimated at zero, and company-

wide impairment losses of ¥957 million were recognized. The recoverable amount of land is fair value less costs of disposal,

calculated using the valuation technique (market approach) which included unobservable inputs. It is therefore classified within level

3 of fair value hierarchy. These impairment losses were generated on assets not attributable to reportable segments.

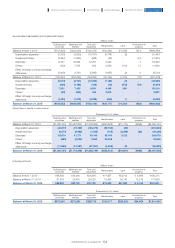

(2) Goodwill impairment tests

Goodwill of ¥46,208 million was generated during management integration with Minolta Co., Ltd. At the Transition Date and for each

fiscal year, ¥41,613 million is allocated to Business Technologies and ¥4,595 million to the Industrial Business segment. No

impairment losses were recognized at the Transition Date or in any fiscal year. Calculation of the recoverable amount for each

cash-generating unit is based on value in use. Value in use is calculated as future cash flows discounted to the present value, based

on the most recent business plans approved by the Board of Directors. Estimated future cash flows for periods subsequent to

approved business plans are calculated by using a fixed growth rate based on the long-term average rate of growth for markets to

which the cash-generating unit belongs. The pre-tax discount rate used during the fiscal year under review was 7.52% (previous

fiscal year: 7.89%, Transition Date: 7.62%). In the event of changes in principal assumptions used in the impairment tests within the

scope of rational forecasting possibility, management judges that the likelihood that significant impairment losses will be generated

for these cash-generating units is low.

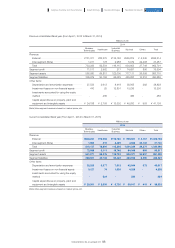

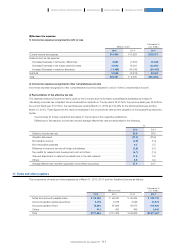

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Property, plant and equipment ············································································································································ ¥2,444 ¥17,401 $20,338

Goodwill ······················································································································································································································ 2,551 - 21,228

Intangible assets ·························································································································································································· 188 85 1,564

Total ··································································································································································································································· ¥5,185 ¥17,487 $43,147

The Group recognizes impairment losses when the recoverable amount of assets falls below their carrying amount. Impairment

losses are included in other expenses in the consolidated statements of profit or loss.

Impairment losses on property, plant and equipment and goodwill and intangible assets are as follows:

13. Impairment losses on non-financial assets

107

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report