Konica Minolta 2015 Annual Report Download - page 85

Download and view the complete annual report

Please find page 85 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

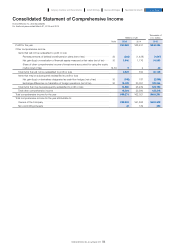

Consolidated Statement of Comprehensive Income

Konica Minolta, Inc. and Subsidiaries

For the fiscal years ended March 31, 2015 and 2014

Millions of yen

Thousands of

U.S. dollars

Note 2015 2014 2015

Profit for the year ·································································································································································································································································· ¥40,969 ¥28,431 $340,925

Other comprehensive income

Items that will not be reclassified to profit or loss

Remeasurements of defined benefit pension plans (net of tax) ·················································································· 30 (222) (1,428) (1,847)

Net gain (loss) on revaluation of financial assets measured at fair value (net of tax) ··············· 30 3,840 1,776 31,955

Share of other comprehensive income of investments accounted for using the equity

method (net of tax) ··································································································································································································································· 14,30 5 2 42

Total items that will not be reclassified to profit or loss ····························································································································· 3,623 350 30,149

Items that may be subsequently reclassified to profit or loss

Net gain (loss) on derivatives designated as cash flow hedges (net of tax) ··········································· 30 (348) 187 (2,896)

Exchange differences on translation of foreign operations (net of tax) ··························································· 30 15,029 23,051 125,064

Total items that may be subsequently reclassified to profit or loss ······················································································ 14,680 23,239 122,160

Total other comprehensive income ····························································································································································································· 18,304 23,590 152,318

Total comprehensive income for the year ················································································································································································· ¥59,274 ¥52,021 $493,251

Total comprehensive income for the year attributable to:

Owners of the Company ······························································································································································································································· ¥59,232 ¥51,892 $492,902

Non-controlling interests ································································································································································································································ 42 129 350

84

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report