Konica Minolta 2015 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

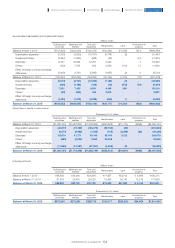

(2)Income tax expense

1) Income tax expense recognized in profit or loss

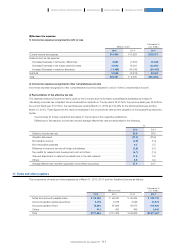

2) Income tax expense recognized in other comprehensive income

Income tax expense recognized in other comprehensive income is indicated in note 30 “Other Comprehensive Income”.

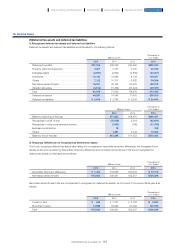

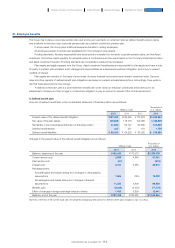

3) Reconciliation of the effective tax rate

The Japanese statutory income tax rate is used by the Company and its domestic consolidated subsidiaries as a basis for

calculating corporate tax, inhabitant tax and business tax deductions. The tax rate is 38.01% for the previous fiscal year, 35.64% for

the current fiscal year, 33.10% for the next fiscal year (ending March 31, 2016) and 32.34% for the following fiscal year (ending

March 31, 2017). These figures are the result of decreases in the corporate tax rate and the cessation of the Special Reconstruction

Surtax.

Income taxes for foreign operations are based on the tax laws of the respective jurisdictions.

Differences in the statutory income tax rate and average effective tax rate are attributable to the following.

%

2015 2014

Statutory income tax rate ··································································································································································································································· 35.6 38.0

Valuation allowance ······················································································································································································································································ (10.3) (25.0)

Non-taxable revenue ·················································································································································································································································· (2.6) (1.4)

Non-deductible expenses ································································································································································································································· 4.3 2.5

Difference in statutory tax rate of foreign subsidiaries ······································································································································ (2.9) (3.1)

Tax credits for research and development cost and others ···················································································································· (4.7) (1.3)

Year-end adjustment to deferred tax assets due to tax rate revisions ·················································································· 11.6 5.0

Others ·································································································································································································································································································· 6.5 9.9

Average effective tax rate after application of tax effect accounting ························································································ 37.4 24.7

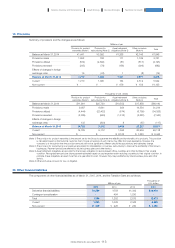

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Current income tax expense ···························································································································································· ¥14,465 ¥11,624 $120,371

Deferred income tax expense

(Increase) Decrease in temporary differences ··························································································· 5,834 (7,367) 48,548

(Increase) Decrease in net losses carried forward ············································································· 15,690 15,091 130,565

Increase (Decrease) in valuation allowance ··································································································· (11,469) (10,042) (95,440)

Subtotal ································································································································································································································ 10,056 (2,318) 83,681

Total ············································································································································································································································ ¥24,521 ¥ 9,305 $204,053

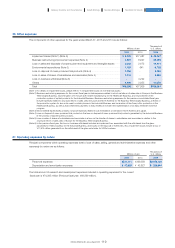

Millions of yen

Thousands of

U.S. dollars

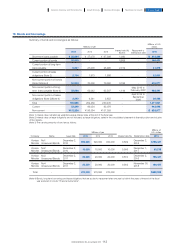

2015 2014 2013 2015

Notes and accounts payable-trade ····························································· ¥ 98,152 ¥ 96,240 ¥ 85,534 $ 816,776

Accounts payable-capital expenditure ··················································· 5,128 6,768 4,526 42,673

Accounts payable-others ······························································································ 73,868 67,898 56,075 614,696

Others ····························································································································································· 414 402 469 3,445

Total ···································································································································································· ¥177,564 ¥171,309 ¥146,605 $1,477,607

The components of trade and other payables as of March 31, 2015, 2014, and the Transition Date are as follows:

17. Trade and other payables

111

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report