Konica Minolta 2015 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

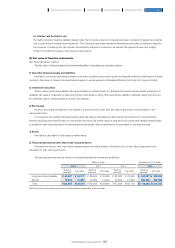

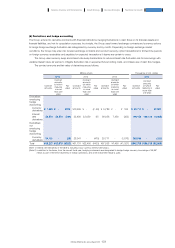

(Note 1) Interest rate derivatives in the table is including cross-currency interest rate swaps.

(Note 2) In addition to the items, from the current fiscal year, hedging instruments are designated to hedge foreign-currency borrowings of ¥5,587

million as part of the net investments in foreign operations, and a net investment hedge is used.

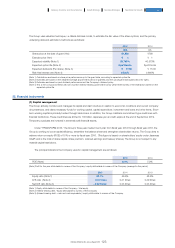

(6) Derivatives and hedge accounting

The Group enters into derivative contracts with financial institutions, hedging fluctuations in cash flows on its financial assets and

financial liabilities, and not for speculation purposes. In principle, the Group uses forward exchange contracts and currency options

to hedge foreign exchange fluctuation risk categorized by currency and by month. Depending on foreign exchange market

conditions, the Group may enter into forward exchange contracts and conduct currency option transactions for limited time periods

on foreign currency receivables and payables for expected transactions it deems are certain to occur.

The Group uses currency swap and interest-rate swap transactions to reduce interest rate fluctuation risk for borrowings with

variable interest rates, as well as to mitigate fluctuation risk on expected future funding costs, and makes use of cash flow hedges.

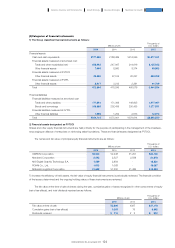

The contact amounts and fair value of derivatives are as follows:

Millions of yen Thousands of U.S. dollars

2015 2014 2013 2015

Contract

amounts

Contract

amounts

(of which

maturing

in more

than one

year)

Fair

value

Contract

amounts

Contract

amounts

(of which

maturing

in more

than one

year)

Fair

value

Contract

amounts

Contract

amounts

(of which

maturing

in more

than one

year)

Fair

value

Contract

amounts

Contract

amounts

(of which

maturing in

more than

one year)

Fair

value

Derivatives

employing

hedge

accounting

Currency

derivatives ¥ 7,536 ¥ - ¥238 ¥10,939 ¥ - (¥ 59) ¥ 5,789 ¥ - ¥ 103 $ 62,711 $ - $1,981

Interest

rate

derivatives

23,570 23,570 (539) 22,450 22,450 95 36,058 7,450 (353) 196,139 196,139 (4,485)

Derivatives

not

employing

hedge

accounting

Currency

derivatives 34,121 - (23) 28,341 - (470) 25,711 - (1,076) 283,939 - (191)

Total ¥65,227 ¥23,570 (¥323) ¥61,731 ¥22,450 (¥433) ¥67,558 ¥7,450 (¥1,327) $542,789 $196,139 ($2,688)

131

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report