Konica Minolta 2015 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Expected growth of new functional film business

(Billions of yen)

these panels are being recognized for the new value they provide

in being thin, light, and bendable—characteristics not seen in

conventional light sources.

As a result, fiscal 2014 revenue for the segment increased 5%

year on year to ¥60.9 billion (¥60.9 billion based on IFRS).

In fiscal 2015, along with continuing to satisfy market demand

with TAC films, we will further solidify our business base through

expanded efforts involving peripheral industries. At the same time,

we will look at bringing new products to market−including window

films and barrier films−in order to make the fiscal year a

springboard from which to develop businesses that will become

cornerstones of the Company, following TAC films. The above

factors contribute to a fiscal 2015 segment sales forecast of ¥62.0

billion (based on IFRS), a 2% year-on-year increase.

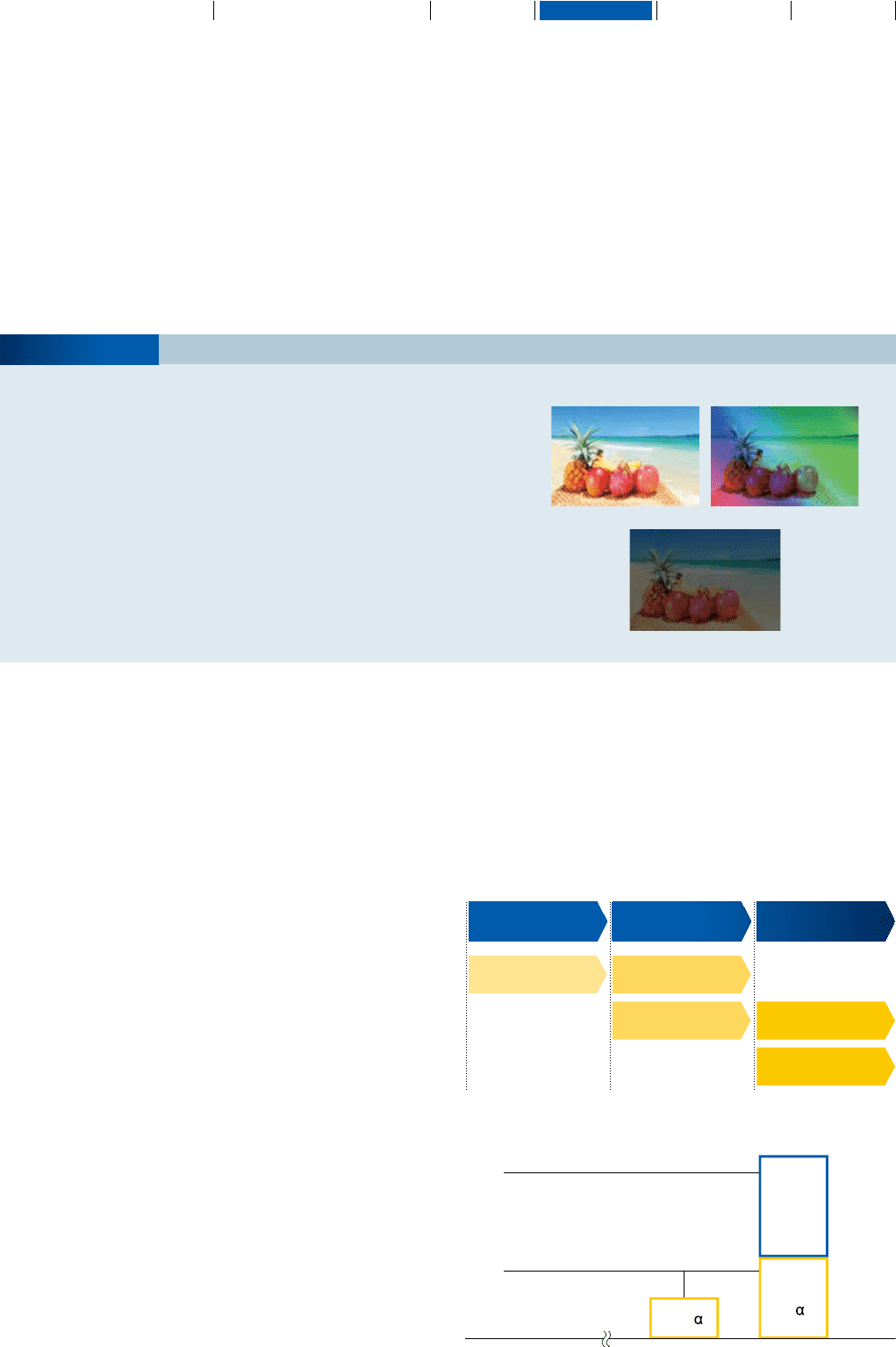

QWP film: emulating unpolarized light to show

device screen colors as they normally appear

As people increasingly use their smartphones and tablets outdoors, people

are beginning to see a problem in how images on these screens can appear

darker or discolored when viewed through polarized sunglasses. Konica

Minolta has developed QWP film in response. Used on displays, this film

emulates unpolarized light, allowing people to see the colors of images on

device screens as normal even when wearing polarized sunglasses. The

roll-to-roll manufacturing method can be used to produce the polarizing

plates, dramatically improving polarizing plate manufacturer productivity. A

mass production system will be built in the spring of 2016, with further

expansion to follow.

• Growth strategies

High-quality TAC film born from long-cultivated technologies for

manufacturing photographic base film is the engine driving growth

in this field. It is used to protect polarizing plates, a constituent

material of LCD screens used in everything from LCD TVs to

computers to smartphones, and there has been a steady demand

for these products.

Phase 0 will focus on achieving substantial TAC film sales

growth. Developments that include the emergence of 4K

televisions are expected to prompt a continued increase in TV

sizes. Total manufactured display area should continue to increase

with growth remaining strong in the market for small- to medium-

sized displays. This should result in more film being used. Although

we predict there will be greater competition with respect to things

such as pricing, we will focus on providing greater added value in

order to satisfy our customers’ expectations concerning quality

and survive the competition.

In Phase 1, efforts will focus on new areas of business that

are cropping up as displays find use in more and more

applications. This will involve expanding the range of TAC film

application by leveraging the many connections we have

developed with our customers to provide new value. One example

of this is investing technologies, expertise, and resources into

automobile window films that provide heat insulation and high

polarization performance, as well as QWP films used for device

screens, which are easier on the eyes and allow people wearing

polarized sunglasses to see screen colors as they normally appear

by emulating unpolarized light (see expected growth in the figure on

the right).

In Phase 2, we will begin full-scale efforts to market solutions

involving OLED lighting, which use organic materials that emit light

when voltage is applied. We will focus on a wide range of

applications including construction materials, automobiles, and

mobile devices, making the most of their strengths: being

lightweight, thin, and flexible; emitting light across the entire

surface; and consuming very little power.

By refining material technologies unique to Konica Minolta, we

will focus on creating new key business areas in the performance

materials field.

Roadmap for growth

Phase 0

TAC film New functional film

for displays

New functional film

and materials business

Window film

OLED lighting

Phase 2Phase 1

(FY)

20162014 2018

5.0+

10.0

+

12.5

Phase 2

New functional films

Phase 1

•QWP film (for polarized

sunglasses)

•Expanded range of

application

Focused Topic

With QWP film

How images appear

With PET film

With no film

50

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report