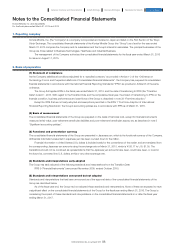

Konica Minolta 2015 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

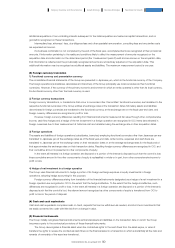

The Group derecognizes a financial liability when its contractual obligations are discharged, cancelled or expire.

The Group only sets off the balances of financial assets and financial liabilities and presents their net amount in the

consolidated statement of financial position if the Group has the legal right to set off these balances and intends either to settle on a

net basis or to realize the asset and settle the liability simultaneously.

Fair value of financial instruments that are traded in active financial markets at the fiscal year-end makes reference to quoted

market prices of identical assets and liabilities. If there is no active market, fair value of financial instruments is determined using

appropriate valuation techniques.

1) Non-derivative financial assets

The Group holds as non-derivative financial assets: financial assets measured at amortized cost, financial assets measured at fair

value through profit or loss (FVTPL) and financial assets measured at fair value through other comprehensive income (FVTOCI).

(a) Financial assets measured at amortized cost

The Group classifies financial assets as financial assets measured at amortized cost only if the asset is held within a business

model whose objective is to hold assets in order to collect contractual cash flows and if the contractual terms of the financial

asset give rise to cash flows that are solely payments of principal and interest on the principal amount outstanding.

These financial assets are recognized initially at fair value plus any directly attributable transaction costs. After initial

recognition, these financial assets are measured at amortized cost using the effective interest method. On a quarterly basis, the

Group assesses whether there is any objective evidence that financial assets measured at amortized cost are impaired.

Objective evidence of impairment includes significant worsening in the financial condition of the borrower or a group of

borrowers, a default or delinquency in interest or principal payments, and bankruptcy of the borrower.

Impairment losses are recognized if there is objective evidence that a loss event has occurred after the initial recognition

and that the loss event has a negative impact on the estimated future cash flows of the financial assets that can be estimated

reliably.

Specific impairment is assessed on individually significant financial assets. Financial assets that are not individually

significant are collectively assessed for impairment by grouping together financial assets with similar risk characteristics. The

Group makes reference to historical trends, including past losses when assessing overall impairment.

When impairment losses on financial assets measured at amortized cost are recognized, the carrying amount of the

financial asset is reduced by the difference between the carrying amount and the present value of estimated future cash flows

discounted at the asset’s original effective interest rate through an allowance for doubtful accounts, and impairment losses are

recognized in profit or loss. The carrying amount of these financial assets is directly reduced for the impairment when they are

expected to become non-recoverable in the future, offsetting the carrying amount by the allowance for doubtful accounts. If the

impairment amount decreases and the decrease can be related objectively to an event occurring after the impairment was

recognized, impairment losses are reversed through profit or loss. An impairment loss is reversed only to the extent that the

asset’s amortized cost that would have been determined if no impairment loss had been recognized.

(b) Financial assets measured at FVTPL

The Group measures a financial asset at fair value and recognizes any changes in profit or loss if it is a non-derivative financial

asset other than an equity instrument that does not satisfy the criteria for classification for measurement at amortized cost

described in (a) above, and if it is an equity instrument other than those designated as financial assets measured at fair value

through other comprehensive income.

Financial assets measured at FVTPL are initially recognized at fair value, with transaction expenses recognized in profit or

loss as they occur.

(c) Financial assets measured at FVTOCI

Upon initial recognition, the Group elects irrevocably to recognize the valuation differences of those equity instruments held to

expand its revenue base by maintaining or strengthening relations with business partners in other comprehensive income.

Financial assets measured at FVTOCI are initially recognized at their fair value plus any directly attributable transaction

costs. After initial recognition, fair value is measured, and any changes in fair value are recognized in other comprehensive

income. Upon derecognition of these financial assets or when they fall substantially below their fair value, the cumulative

amounts recognized in other comprehensive income are transferred to retained earnings.

Dividends on financial assets measured at FVTOCI are recognized as profit or loss in finance income.

2) Non-derivative financial liabilities

Non-derivative financial liabilities are initially recognized at fair value less any directly attributable transaction costs. After initial

91

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report