Konica Minolta 2015 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

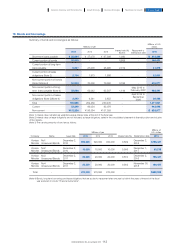

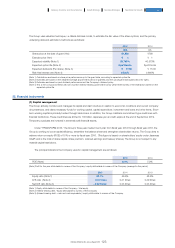

The Group has in place a corporate pension plan and a lump-sum payments on retirement plan as defined benefit pension plans,

and a defined contribution-type corporate pension plan as a defined contribution pension plan.

In some cases, the Group pays additional severance benefits to retiring employees.

An employee pension trust has been established for the Company’s plan assets.

Funding standards, fiduciary responsibility and disclosure are consistent for domestic corporate pension plans, and the Asset

Investment Committee meets regularly. An actuarial review is conducted every five years based on the Company’s financial condition

and asset investment forecast. If funding standards are not satisfied, premiums are increased.

Plan assets are legally separate from the Group. Asset investment beneficiaries are responsible for plan assets and have a duty

of loyalty to pension plan enrollees, such management responsibilities as a dispersed investment obligation, and a duty to prevent

conflicts of interest.

Plan assets are invested on the basis of soundness. However financial instruments have inherent investment risks. Discount

rates and other aspects of defined benefit plan obligations are based on pension actuarial assumptions. Accordingly, there exists a

risk that these assumptions may change.

A defined contribution plan is a post-retirement benefit plan under which an employer contributes a fixed amount to an

independent company and has no legal or constructive obligation to pay an amount in excess of the contributed amount.

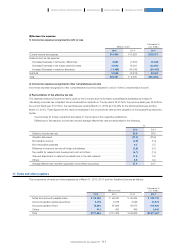

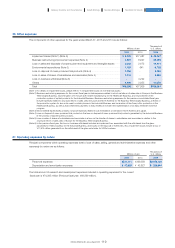

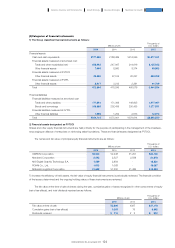

1) Defined benefit plan

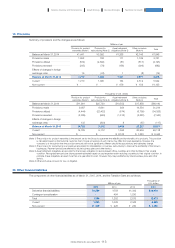

Amounts of defined benefit plan in the consolidated statement of financial position are as follows:

21. Employee benefits

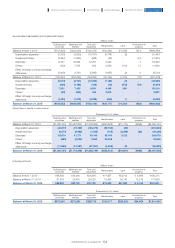

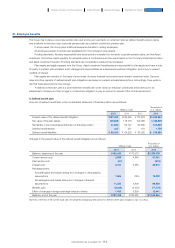

Changes in the present value of the defined benefit obligation are as follows:

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Balance, beginning of the year ··················································································································································· ¥183,425 ¥173,976 $1,526,379

Current service cost ······················································································································································································· 5,689 4,849 47,341

Past service cost ································································································································································································· (81) - (674)

Interest cost ················································································································································································································· 3,121 3,583 25,972

Remeasurement:

Actuarial gains and losses arising from changes in demographic

assumptions ······································································································································································································ 1,566 (145) 13,032

Actuarial gains and losses arising from changes in financial

assumptions ······································································································································································································· 11,565 4,806 96,239

Benefits paid ··············································································································································································································· (9,298) (9,453) (77,374)

Effect of changes in foreign exchange rates and others ································································ 1,495 5,809 12,441

Balance, end of the year ········································································································································································ ¥197,483 ¥183,425 $1,643,364

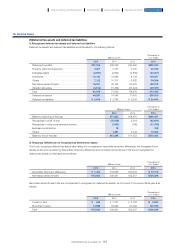

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

Present value of the defined benefit obligation ···························································································· ¥197,483 ¥183,425 ¥173,976 $1,643,364

Fair value of the plan assets ························································································································································· 135,649 118,718 109,085 1,128,809

Net liability in the consolidated statement of financial position ········································ 61,833 64,707 64,890 514,546

Defined benefit assets ············································································································································································ 205 221 191 1,706

Defined benefit liabilities ······································································································································································· ¥ 62,039 ¥ 64,928 ¥ 65,082 $ 516,260

(Note) As of the end of the current fiscal year, the weighted average payment period for defined benefit plan obligations was 12.2 years.

114

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report