Konica Minolta 2015 Annual Report Download - page 140

Download and view the complete annual report

Please find page 140 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

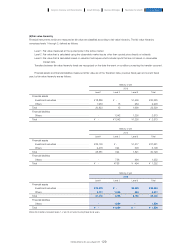

Notes related to adjustments to equity and total comprehensive income from Japanese GAAP to IFRS

A. Methods of depreciation property, plant and equipment

Under Japanese GAAP, the Company and its domestic subsidiaries mainly use the declining- balance method to calculate depreciation expenses. Under IFRS,

however, the straight-line method is used.

B. Leases

Under Japanese GAAP, finance lease transactions less than a certain fixed amount are accounted for in the same manner as operating leases. Under IFRS, they

are accounted for as finance leases.

C. Goodwill

Under Japanese GAAP, goodwill is amortized evenly over a rational time period within 20 years. However, the amortization of goodwill has been suspended as of

the Transition Date to IFRS, with impairment tests conducted annually.

D. Changes in interest in a subsidiary without loss of control

Additional purchase of shares in subsidiaries resulting in the acquisition of control and the partial sale of shares in subsidiaries without loss of control are handled

as income or expense transactions under Japanese GAAP. Under IFRS, these are handled as equity transactions.

E. Contingent consideration

Contingent consideration in business combinations is recognized under Japanese GAAP at the point when delivery or transfer is certain. Under IFRS, these are

recognized at fair value at the time of business combinations.

F. Financial instruments

Investments in equity financial instruments with no market value are measured at historical cost under Japanese GAAP. Under IFRS, these are measured at fair

value.

Financial assets whose fair value is measured through other comprehensive income are reclassified to income/loss under Japanese GAAP. Under IFRS, these are

not reclassified.

Under Japanese GAAP, designated accounting applies to currency swaps that fulfill specified requirements, and specified accounting is used for interest-rate

swaps that fulfill specified requirements. Under IFRS, these are measured at fair value and recognized as assets or liabilities respectively.

G. Retirement benefit liabilities

Under Japanese GAAP, actuarial gains and losses are amortized as incurred for each fiscal year using the straight-line method over certain periods within the

average remaining years of service of the employees at the time the service costs is generated. Under IFRS, after recognizing these entire amounts as incurred as

components of equity through other comprehensive income, they are immediately reclassified to retained earnings.

Under Japanese GAAP, prior service cost is recognized as income or expense as incurred using the straight-line method over certain periods within the average

remaining years of service of the employees. Under IFRS, the entire amount is recognized as income or expense as incurred.

H. Income taxes

Under Japanese GAAP, the deferral approach is used for tax effects related to the extinguishment of unrealized gains and losses. Under IFRS, the asset and liability

approach is used.

In addition, the recoverability for deferred tax assets are measured based on IFRS and the carrying amount deferred tax assets increases as a result.

I. Provisions

A portion of the provision for restructuring under Japanese GAAP does not fulfill the condition for provisions under IFRS, and is therefore not recognized as such.

J. Unused paid vacation entitlement

Under Japanese GAAP, the unused paid vacation entitlement is not recognized as a liability. Under IFRS, this is recognized as a liability.

K. Exchange differences on translation of foreign operations

As an exemption selected under the provisions of IFRS 1, the entire amount of cumulative exchange differences on foreign operations as of the Transition Date to

IFRS is reclassified to retained earnings.

L. Revenue

A portion of rebates is presented as selling, general and administrative expenses under Japanese GAAP. Under IFRS, these are deducted from total revenue.

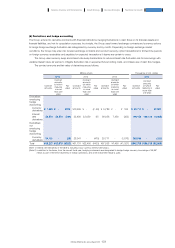

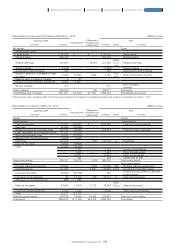

M. Reclassification in the consolidated statement of financial position

Principal reclassification based on IFRS provisions for presentation are as follows:

•Net deferred tax position are reclassified as non-current assets.

•Financial assets and liabilities are presented separately.

•Investments accounted for using the equity method are presented separately.

•Non-current assets or disposal groups held for sale are presented separately.

N. Changes in presentation in the consolidated statements of profit or loss

With regard to items presented as non-operating income, non-operating expenses, extraordinary income and extraordinary loss under Japanese GAAP, based on

IFRS presentation provisions, finance-related items are presented as finance income or finance costs. Other items are, according to their nature, presented as

other income and expenses, share of profit of entities accounted for using the equity method, selling, general and administrative expenses, etc.

Principal adjustments to the consolidated statements of cash flow for the fiscal year ended March 31, 2014

No significant differences exist between the consolidated statements of cash flow presented under Japanese GAAP and those presented under IFRS for fiscal year ended

March 31, 2014.

139

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report