Konica Minolta 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

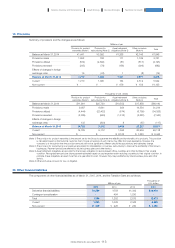

(Note 1) The provision for product warranties is the amount set by the Group to guarantee the reliability and functionality of its products. This provision

is calculated based on the historical customer claim. Future occurrence of such claims may differ from past experience. However, the

company is of the opinion that the provision amounts will not be significantly different should the assumptions and estimates change.

(Note 2) The provision for restructuring is an expense recognized for rationalization or business restructuring to improve the profitability of the Group’s

businesses. Payment periods are affected by future business plans and other factors.

(Note 3) Asset retirement obligations are provided for the Group’s obligation to restore leased offices, buildings and other facilities to their original

condition. Recognized amounts are future payment estimated based on past experience with restoring properties to their original condition. In

principle, these obligations are paid more than one year after incurred. However, they may be affected by future business plans and other

factors.

(Note 4) Others include a provision for loss on litigation.

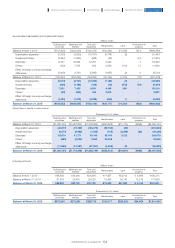

Millions of yen

Provision for product

warranties (Note 1)

Provision for

restructuring (Note 2)

Asset retirement

obligations (Note 3)

Other provisions

(Note 4) Total

Balance at March 31,2014 ··································· ¥1,441 ¥3,092 ¥1,268 ¥2,146 ¥7,948

Provisions made ······································································ 1,092 798 111 1,749 3,751

Provisions utilized ·································································· (534) (2,692) (81) (817) (4,125)

Provisions reversed ···························································· (245) (78) (158) (399) (882)

Effects of changes in foreign

exchange rates ·········································································· 16 (24) 1 (8) (14)

Balance at March 31,2015 ···························· 1,770 1,095 1,141 2,671 6,678

Current ····································································································· 1,770 1,095 164 2,512 5,542

Non-current ····················································································· ¥ - ¥ - ¥ 976 ¥ 159 ¥1,135

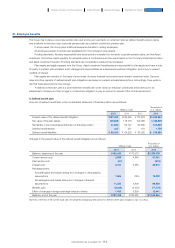

Thousands of U.S. dollars

Provision for product

warranties (Note 1)

Provision for

restructuring (Note 2)

Asset retirement

obligations (Note 3)

Other provisions

(Note 4) Total

Balance at March 31,2014 ··································· $11,991 $25,730 $10,552 $17,858 $66,140

Provisions made ······································································ 9,087 6,641 924 14,554 31,214

Provisions utilized ·································································· (4,444) (22,402) (674) (6,799) (34,326)

Provisions reversed ···························································· (2,039) (649) (1,315) (3,320) (7,340)

Effects of changes in foreign

exchange rates ·········································································· 133 (200) 8 (67) (117)

Balance at March 31,2015 ···························· 14,729 9,112 9,495 22,227 55,571

Current ····································································································· 14,729 9,112 1,365 20,904 46,118

Non-current ····················································································· $ - $ - $ 8,122 $ 1,323 $ 9,445

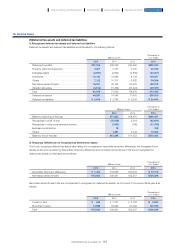

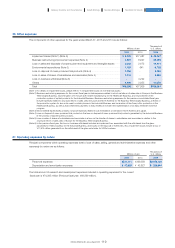

Millions of yen

Thousands of

U.S. dollars

2015 2014 2013 2015

Derivative financial liabilities ······················································································· ¥1,559 ¥758 ¥1,342 $12,973

Contingent consideration ······························································································ - 494 1,230 -

Total ···································································································································································· 1,559 1,252 2,573 12,973

Current ························································································································································· 1,020 1,026 2,342 8,488

Non-current ··········································································································································· ¥ 539 ¥ 226 ¥ 230 $ 4,485

The components of other financial liabilities as of March 31, 2015, 2014, and the Transition Date are as follows:

20. Other financial liabilities

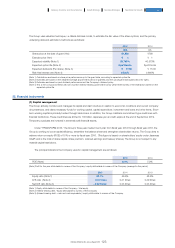

Summary of provisions and the changes are as follows:

19. Provisions

113

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report