Konica Minolta 2015 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

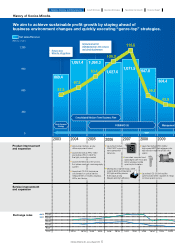

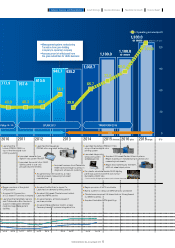

Financial and Non-Financial Highlights

(Billions of yen)

Revenue, Revenue growth

1,200

1,000

800

600

400

200

0

(%)

20

16

12

8

4

0

-4

2010 2011

813.0

2012 2013 2010 2011 2012 2013

2010 2011 2012 2013

(Billions of yen)

Operating profit, Operating profit ratio

80

60

40

20

0

40.0

5.1

40.3

5.3 5.0

(Billions of yen)

Profit attributable to owners of the company, ROE*

40

30

20

10

0

(%)

8.0

6.0

4.0

2.0

0

1.5

1.0

0.5

0

(%)

8.0

6.0

4.0

2.0

0

Total assets, Total assets turnover*

6.2

7.3

58.1

39.8

Operating profit

40.6

2010 2011 2012 2013

(%)

ROIC*

10.0

8.0

6.0

4.0

2.0

0

3.4

4.7

6.1

2014 (FY)

2014 (FY)

2014 (FY)

2014 (FY) 2014 (FY)

2014 (FY)

2014 (FY)

2014 (FY)

2010 2011 2012 2013

(Billions of yen) (times)

2010 2011 2012 20132010 2011 2012 2013

(Billions of yen)

Cash Flows

100

75

50

25

0

-25

-50

-75

-100

-42.7

72.3

67.9 66.4

-63.4

89.9

-55.7-54.1

(Billions of yen)

Interest-bearing debts, Cash and cash equivalents,

Net D/E ratio

300

250

200

150

100

50

0

(times)

0.08

0.06

0.04

0.02

0

-0.02

-0.04

224.9 213.9

227.9

Interest-bearing debts

Cash and cash equivalents

Cash flows from operating activities

Cash flows from investing activities

23.2 29.6

3.0

34.2 0.04

90.0

175.1

0.99

0.880.88

0.91

-3.3

-1.3

16.1

Profitability

Efficiency

Soundness

In the interest of balance sheet

management, we sold off idle

assets, reduced inventory, and

otherwise improved asset

efficiency, selling off ¥8.6 billion

in fixed assets and ¥3.2 billion

in securities held in fiscal 2014.

We strived to optimize

inventory, achieving along the

way an inventory turnover of

2.54 months.

Sales increased to ¥1 trillion on

gains in our mainstay Business

Technologies Business,

marking a return to a level last

seen seven fiscal periods ago.

Additionally, factors such as

improved profitability in the

commercial and industrial

printing field and structural

reform of our Industrial

Business brought significant

gains.

Towards our goal of achieving

an equity ratio attributable to

owners of the company of at

least 50% and net D/E ratio

close to zero, two targets for

achieving an A credit rating, in

fiscal 2014 we achieved an

equity ratio attributable to

owners of the company of

53.1% and net D/E ratio of

-0.02, maintaining a debt rating

of A by R&I and A+ by JCR.

5.1 5.2 5.2

2010 2011 2012 2013

(Billions of yen) (months)

Inventory, Inventory turnover*

150

100

50

0

3.0

2.0

1.0

0

100.2 105.0

2.67 2.60 2.52

2.81

943.7

5.9

Operating profit ratioRevenue Revenue growth

Inventory Inventory turnover*Total assets Total assets turnover*

Profit attributable to owners of the company ROE*

65.7

Net D/E ratioFree cash flow

101.9

-54.0

7.2

1,002.7

115.2

15.1

21.8

20.4

4.6

845.4

940.5

966.0 985.2 994.2

115.1 120.8

902.0

202.4 188.4

192.6 165.6 177.4

0.03

-0.01

1,000

800

600

0

28.4

40.9

25.8

196.1

188.4

231.9

J-GAAP IFRS

J-GAAP IFRS

J-GAAP IFRS

J-GAAP IFRS J-GAAP IFRS

J-GAAP IFRS

J-GAAP IFRS

J-GAAP IFRS

112.4

0.02

777.9 767.8

-44.7

6.1

8.7

5.0

8.3

0.96 1.01

2.82

2.54

35.9 48.0

0.03

-0.02

4.3

6.6

935.2

* ROE (J-GAAP) = Net income / Average shareholders’ equity

ROE (IFRS) = Profit attributable to owners of the company / (Share

capital + Share premium + Retained earnings + Treasury shares

(average at start of fiscal year and end of fiscal year))

* Total assets turnover = Revenue / Average total assets * Inventory turnover = Inventory balance at fiscal year end / Average

cost of sales for most recent three months

* ROIC = Operating profit after tax/(Share capital + Share premium +

Retained earnings + Treasury shares + Interest-bearing debt - Cash

and cash equivalents (yearly average))

7

KONICA MINOLTA, INC. Annual Report 2015 7

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report