Konica Minolta 2015 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

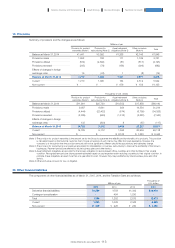

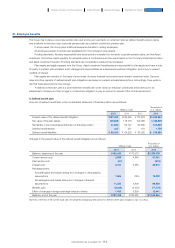

(2) Share premium

Under the Companies Act of Japan (“Companies Act”), at least 50% of the proceeds of certain issues of common shares shall be

credited to share capital. The remainder of the proceeds shall be credited to share premium. The Companies Act permits, upon

approval at the general meeting of shareholders, the transfer of amounts from additional paid-in capital to share capital.

(3)Retained earnings

The Companies Act provides that a 10% dividend of retained earnings shall be appropriated as additional paid-in capital or as a

legal reserve until the aggregate amount of the additional paid-in capital and the legal reserve equals 25% of share capital. The legal

reserve may be used to eliminate or reduce a deficit or be transferred to retained earnings upon approval at the general meeting of

shareholders.

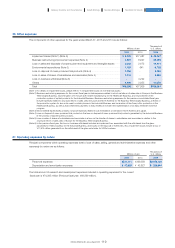

(4)Other Components of Equity

(Note 1) Remeasurements of defined benefit pension plans are differences in return on plan assets and interest income on plan assets due to

differences between actuarial assumptions at the start of the year and actual results.

(Note 2) Net gain (loss) on revaluation of financial assets measured at fair value through OCI is cumulative in nature.

(Note 3) Net gain (loss) on derivatives designated as cash flow is that the effective portion of the cumulative differences in fair value of derivative

transactions designated as cash flow hedges.

(Note 4) Exchange differences on translation of foreign operations are exchange differences resulting from the translation of financial statements of

foreign operations and exchange differences on the net investment hedge on foreign operations.

(Note 5) Share of other comprehensive income of associates accounted for using the equity method includes the cumulative net gain (loss) on

revaluation of financial assets measured at fair value held by associates.

Millions of yen

Remeasurements

of defined benefit

plans (Note 1)

Net gain (loss) on

revaluation of

financial assets

measured at fair

value through other

comprehensive

income (Note 2)

Net gain (loss) on

derivatives

designated as

cash flow hedges

(Note 3)

Exchange

differences on

translating foreign

operations (Note 4)

Share of other

comprehensive

income of

investments

accounted for

using the equity

method (Note 5)

Total

Balance at April 1,

2013 ¥ - ¥3,322 (¥163) ¥ - (¥7) ¥ 3,150

Increase (decrease) (1,428) 1,776 187 22,999 2 23,537

Transfer to retained

earnings 1,428 (16) - - - 1,411

Balance at March 31,

2014 - 5,081 23 22,999 (4) 28,100

Increase (decrease) (222) 3,840 (348) 15,022 5 18,297

Transfer to retained

earnings 222 (714) - - - (492)

Balance at March

31, 2015 ¥ - ¥8,207 (¥324) ¥38,022 ¥0 ¥45,905

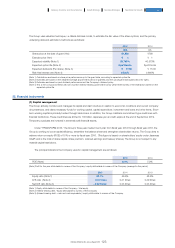

Thousands of U.S. dollars

Remeasurements

of defined benefit

plans

Net gain (loss) on

revaluation of

financial assets

measured at fair

value through other

comprehensive

income

Net gain (loss) on

derivatives

designated as

cash flow hedges

Exchange

differences on

translating foreign

operations

Share of other

comprehensive

income of

investments

accounted for

using the equity

method

Total

Balance at March 31,

2014 $ - $42,282 $ 191 $191,387 ($33) $233,835

Increase (decrease) (1,847) 31,955 (2,896) 125,006 42 152,259

Transfer to retained

earnings 1,847 (5,942) - - - (4,094)

Balance at March

31, 2015 $ - $68,295 ($2,696) $316,402 $ 0 $382,000

117

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report