Konica Minolta 2015 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

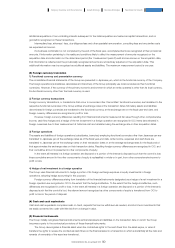

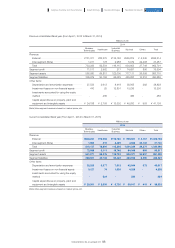

Standards and

interpretations Title

Mandatory adoption (From fiscal

years beginning on or after)

Fiscal year in which

Company will adopt standard Summary

IAS 19 Employee Benefits July 1, 2014 Fiscal year ending March

31, 2016

Revisions to accounting

related to contributions from

employees or third parties

IAS 16

IAS 38

Property, Plant and

Equipment

Intangible Assets

January 1, 2016 Fiscal year ending March

31, 2017

Clarification of permissible

depreciation and

amortization methods

IFRS 11 Joint Arrangements January 1, 2016 Fiscal year ending March

31, 2017

Accounting for the

acquisition of interest in joint

operations

IFRS 15 Revenue from Contracts

with Customers January 1, 2017 Fiscal year ending March

31, 2018

Revisions to accounting for

revenue recognition

IFRS 9 Financial Instruments January 1, 2018 Fiscal year ending March

31, 2019

Revisions to impairment and

hedge accounting

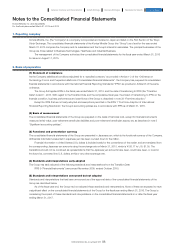

Significant accounting policies of the Group are described below. These policies have been applied consistently to all fiscal years

presented in the consolidated financial statements.

Exemptions that the Group applied retroactively under IFRS 1 in its transition from Japanese GAAP to IFRS are described in

note 38 “First-time adoption”.

(1) Basis of consolidation

The consolidated financial statements of the Group have been prepared based on the financial statements of the Company and its

subsidiaries and associates, which applied the accounting policies consistently. The financial statements of subsidiaries and

associates have been adjusted when necessary for them to align with the Group accounting policies.

1) Subsidiaries

Subsidiaries are entities controlled by the Group. The Group controls an entity when it is exposed to, or has rights to, variable

returns from its involvement with the entity and has the ability to affect those returns through its power over the entity.

The financial statements of subsidiaries are included in the consolidated financial statements of the Group from the date that

the control commences until the date that the control ceases. In the event that the control continues after the Company has

relinquished a portion of its interest in subsidiaries, this change is accounted for as a transaction with owners. Adjustments to

non-controlling interests and differences with the fair value of consideration are recognized directly in equity as equity attributable to

owners of the Company.

Balances and transactions within the Group, and any unrealized income and expenses arising from these transactions, are

eliminated in preparing the consolidated financial statements.

With regard to the comprehensive income of subsidiaries, even if the balance of non-controlling interests is negative, this

income is attributed to owners of the Company and non-controlling interests respectively based on their proportional ownership.

2) Associates

Associates are those entities in which the Group has significant influence, but not control, over the financial and operating policies of

these entities. Investments in associates are accounted for using the equity method.

Investments in associates are initially recognized at cost. Subsequent to initial recognition, The Group’s share in the profit or

loss and other comprehensive income of associates, is recognized as changes in the Group’s investment in associates from the day

that significant influence commences until the date that significant influence ceases.

(2) Business combinations

The Group accounts for business combinations using the acquisition method, recording as historical cost the total amount of the fair

value of the consideration transferred on the acquisition date and the recognized amount of any non-controlling interests (NCI) in the

acquiree. NCI are measured based on the proportional ownership of their fair value or the fair value of the recognized amount of the

identifiable assets acquired and liabilities assumed.

In the event the total amount of the fair value of consideration transferred, the recognized amount of NCI and the fair value of

the pre-existing interest in the acquiree exceeds the net recognized amount of the identifiable assets acquired and liabilities assumed,

this excess is recognized as goodwill. When the excess is negative, a bargain purchase gain is recognized immediately in profit or loss.

3. Significant accounting policies

89

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report