Konica Minolta 2015 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

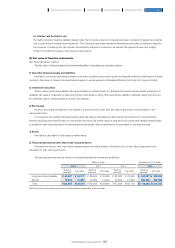

3) Market risks (foreign exchange, share price and interest rate fluctuation risks)

(a) Foreign exchange fluctuation risk

As part of developing its global business, the Group has foreign currency receivables and payables, which are subject to foreign

exchange fluctuation risk. To manage this risk, the Group determines its foreign exchange fluctuation risk in each currency every

month and, in principle, hedges this risk by using forward exchange transactions and currency option transactions. Depending

on foreign exchange market conditions, the Group may also enter into forward exchange contracts and currency option

transactions on foreign currency receivables and payables for expected transactions it deems certain to occur.

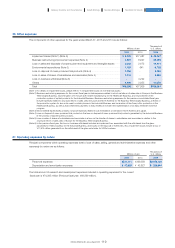

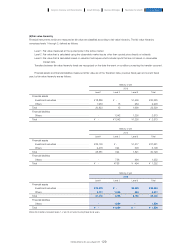

Foreign exchange sensitivity analysis

The table below shows the impact on profit before tax in the consolidated statement of profit or loss of a 1% change in value of

the U.S.dollar, the euro and the pound sterling against the yen due to its holdings of foreign currency receivables and payables

at the end of each fiscal year. In making these calculations, the Group has assumed no changes in currencies other than those

used.

As of March 31, 2015

As of March 31, 2015

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

U.S. dollar ················································································································································································································ ¥246 ¥127 $2,047

Euro ···································································································································································································································· (9) (17) (75)

Pound sterling ·································································································································································································· ¥ 17 ¥ 67 $ 141

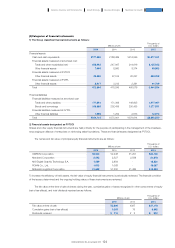

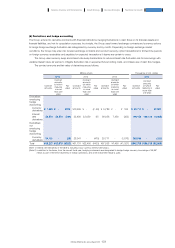

Millions of yen

Carrying

amounts

Contractual

cash flows

Less than

1 year

More than

1 year, less

than 2 years

More than

2 years, less

than 3 years

More than

3 years, less

than 4 years

More than

4 years, less

than 5 years

More than

5 years

Long-term loans payable ············· ¥ 63,697 ¥ 63,697 ¥ 5,001 ¥ 4,001 ¥ 9,000 ¥ 3,000 ¥5,500 ¥37,193

Bonds ············································································ 70,000 70,000 20,000 20,000 10,000 20,000 - -

Lease obligations ······································· 6,244 6,244 2,704 1,818 1,012 487 109 111

Others ··········································································· 1,559 1,559 1,020 - - - - 539

Total ·················································································· ¥141,501 ¥141,501 ¥28,725 ¥25,820 ¥20,013 ¥23,488 ¥5,610 ¥37,844

Thousands of U.S. dollars

Carrying

amounts

Contractual

cash flows

Less than

1 year

More than

1 year, less

than 2 years

More than

2 years, less

than 3 years

More than

3 years, less

than 4 years

More than

4 years, less

than 5 years

More than

5 years

Long-term loans payable ············· $ 530,057 $ 530,057 $ 41,616 $ 33,294 $ 74,894 $ 24,965 $45,768 $309,503

Bonds ············································································ 582,508 582,508 166,431 166,431 83,215 166,431 - -

Lease obligations ······································· 51,960 51,960 22,501 15,129 8,421 4,053 907 924

Others ··········································································· 12,973 12,973 8,488 - - - - 4,485

Total ·················································································· $1,177,507 $1,177,507 $239,036 $214,862 $166,539 $195,456 $46,684 $314,921

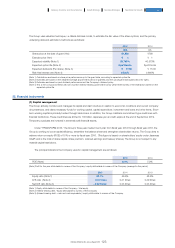

(b) Share price fluctuation risk

The Group holds shares in other listed companies in the interest of cultivating business relationships, and these equity financial

instruments are subject to share price fluctuation risk. Equity financial instruments are held to ensure the smooth operation of

business strategies by participating in the management of the investees, encouraging an alliance of enterprises or reinforcing

sales foundations, and not for earning investment returns through sales. With regard to equity financial instruments, the Group

regularly monitors share prices and checks the issuing entity’s financial condition.

Share price fluctuation sensitivity analysis

In the sensitivity analysis below, the Group calculates sensitivity based on the price risk on equity financial instruments at the

end of the fiscal year. A 1% increase or decrease in share prices had a ¥261 million impact on cumulative other comprehensive

income (net of taxes) as of the end of the previous fiscal year. As of the end of the current fiscal year, the sensitivity was a 283

million.

127

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report