Konica Minolta 2015 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

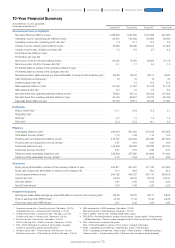

• Cash flows from financing activities

Cash flows from financing activities amounted to an outflow of

¥62.1 billion, compared with ¥63.6 billion in the previous fiscal year,

primarily due to a ¥41.9 billion net decrease in corporate bonds

and debts payable, ¥13.5 billion in expenditures for the purchase

of treasury stocks, and 8.9 billion in expenditures for the payment

of dividends.

• Cash flows from investing activities

Cash of ¥39.0 billion was used in the acquisition of property, plant

and equipment, primarily for the construction of a new R&D

building, capital investment in the Business Technologies Business,

and new business investments in the Industrial Business. Other

cash outflows included ¥11.0 billion in payments for transfer of

business in the Business Technologies Business and for the

acquisition of subsidiary shares and ¥8.6 billion in payments for the

acquisition of intangible assets. This resulted in an outflow of ¥54.0

billion in cash flows used in investing activities, compared with

¥54.1 billion in the previous period. As a result, free cash flow,

calculated as the sum of cash flows from operating and investing

activities, rose to an inflow of ¥47.9 billion, up from ¥35.9 billion in

the previous fiscal year.

• Cash flows from operating activities

Net cash provided by operating activities increased to ¥101.9

billion, up from ¥90.0 billion in the previous period. Cash inflows

included profit before tax of ¥65.4 billion, depreciation and

amortization of ¥47.9 billion, an impairment loss of ¥5.1 billion,

¥10.6 billion caused by a decrease in operating receivables and

other receivables, and ¥0.6 billion caused by a decrease in

inventory. Cash outflows included ¥11.7 billion for payment of

income taxes, and ¥5.5 billion owing to a decrease in operating

debt and other debt.

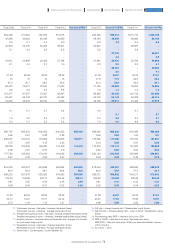

Cash Flows

120

80

40

0

-40

-80

(Billions of yen)

CF from operating activities

CF from investing activities

Free cash flow

89.9

34.1

-55.7

3.0

-63.4

90.0

35.9

-54.1

101.9

47.9

-54.0

20132012 2014 (FY)

J-GAAP IFRS

66.4

• Industrial Business

In the field of optical systems for industrial use, robust sales were

seen for mainstay products such as spectrophotometers for

measuring device displays and lenses for industrial and

professional use in the optics field. In the performance materials

field, sales were good for small, medium, and large panels. This

owed to steadfast demand for large-screen LCD televisions, a

growing trend towards larger screen sizes, and firm sales of

smartphones. Unit sales of thin-type TAC films increased over last

fiscal year, centered on VA-TAC films for increasing viewing angle,

an area in which Konica Minolta excels.

Despite an increase in sales over the previous fiscal year in the

performance materials field, overall sales for this business declined.

This is attributable to shrinking demand for lenses for compact

cameras in the field of optical systems for industrial use,

downsizing of the lens business for mobile phone cameras, and a

withdrawal from the glass substrates for HDDs business. However,

profit from this business increased as a result of sales increases for

the performance materials field and for measuring instruments,

along with the effects of business restructuring in the field of optical

systems for industrial use conducted in the previous fiscal year.

As a result, external revenue in this business dropped 2.9%

year on year to ¥112.7 billion, while operating profit rose to ¥19.7

billion, a ¥19.5 billion increase year on year.

Konica Minolta has established its new OLED lighting

business as a driver of future growth, and in the autumn of 2014

we began operations at the world’s first plant engaged in the mass

production of plastic substrate flexible OLED lighting panels. OLED

lighting panels designed by Konica Minolta were used for an

outdoor illumination at a well-known theme park in Japan, an

example of how these panels are bringing new value in being thin,

light, and flexible—characteristics not seen in conventional light

sources.

Fiscal 2014 changes in revenue and operating profit

(Billions of yen)

Cash flows

17.5%

Operating

profit ratio

116.1

0.2%

112.7

(-2.9%)

0.2

19.7

Revenue Operating

profit

( ) indicates

comparison

to previous

fiscal year

(FY)(FY)

20142013 2013 2014

77

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report