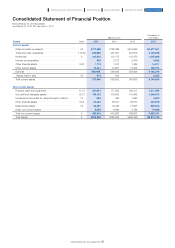

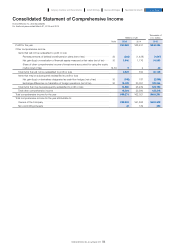

Konica Minolta 2015 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

• Business Technologies Business

In the office services field, sales of mainstay A3 color MFPs

remained firm, with all regions reporting unit sales growth

compared to the previous fiscal year. A4 color MFP unit sales also

grew, partially due to the strengthening of our global sales and

support framework targeted at major accounts and to a steady

increase in business deals and sales involving OPS, which

optimizes customers’ output environments. Concerning initiatives

targeting small- and medium-sized companies, we have launched

MCS, which is an advanced form of our hybrid-type sales rolled

out primarily in Europe and the U.S. that provides customers with

IT services and equipment. MCS optimizes our customers’ content

management by putting ourselves inside their business processes.

We already have a strong MCS track record centered in North

America. Going forward, these services will drive user base

expansion and print volume growth.

In the commercial and industrial printing field, models such as

the bizhub PRESS C1100 and bizhub PRESS C1085 showed

robust sales throughout the year and resulting in unit sales for color

models as a whole that beat the previous year. Regarding MPM

services, which help companies’ marketing departments improve

their business processes and optimize their printed material costs,

we established a subsidiary of Charterhouse (headquartered in the

U.K.) in the U.S. and a subsidiary of Ergo (headquartered in

Australia) in Japan. Through these efforts, we have completed a

global system for providing services that cover Europe, Asia

Pacific, the U.S., and Japan. In the industrial inkjet business,

healthy sales of both components and textiles resulted in a sales

boost over the previous year.

As a result, external revenue in this business rose 10.5% year

on year to ¥808.2 billion. Operating profit increased 1.6% year on

year to ¥72.6 billion, which, although partially offset by business

structure improvement expenses at sales companies in Europe, is

attributed to an increase in gross profit resulting from increased

sales of color units combined with our services, as well as

increased sales of digital printing systems and increased sales and

income arising from exchange-rate gains owing to a weak yen.

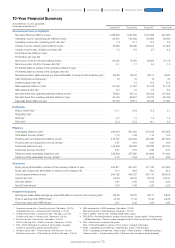

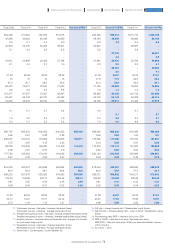

Operating Results by Segment

Profit attributable to owners of the company

Fiscal 2014 changes in revenue and operating profit

(Billions of yen)

48

36

24

12

0

(Billions of yen)

8.0

6.0

4.0

2.0

0

ROE*

(%)

28.3

40.9

8.7

20132012 2014

(FY)

J-GAAP IFRS

6.1

4.6

3.4

21.8

15.1

(FY)(FY)

Revenue Operating profit

20142013 2013 2014

9.0%

Operating

profit ratio

731.3 9.8%

808.2

(10.5%)

71.5 72.6

( ) indicates

comparison

to previous

fiscal year

• Healthcare Business

Although sales were strong in North America, China, India, and

other overseas markets, conditions remained poor in Japan, with

sales of local procurements declining as a result of a cooling market.

Compared with last year, worldwide sales of core Konica

Minolta products increased. Unit sales saw an uptick for AeroDR, a

mainstay cassette-type digital X-ray imaging system. We also

released the SONIMAGE HS1, a new product developed by

Konica Minolta for the diagnostic ultrasound system business that

we are working to develop as a new field. The product has been

well received for its product capabilities, and we have seen sales

expand towards the end of the period. Film products sold well in

emerging countries, and unit sales was roughly on par with the

previous year. Sales of local procurements slid due to a domestic

market downturn.

As a result, external revenue in this business dropped 4.6%

year on year to ¥78.5 billion. Operating profit fell 28.7% year on

year to ¥2.1 billion, attributable to a drop in gross profit resulting

from decreased sales of local procurements in Japan, and to

anticipatory expenses associated with the launch of the diagnostic

ultrasound system business.

Fiscal 2014 changes in revenue and operating profit

(Billions of yen)

2.7%

Operating

profit ratio

3.6%

78.5

(-4.6%)

2.9

2.1

82.3

Revenue Operating profit

( ) indicates

comparison

to previous

fiscal year

(FY)(FY)

20142013 2013 2014

* ROE (J-GAAP) = Net income / Average shareholders’ equity

ROE (IFRS) = Profit attributable to owners of the company / (Share capital +

Share premium + Retained earnings + Treasury shares (average at

start of fiscal year and end of fiscal year))

76

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report