Konica Minolta 2015 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2015 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

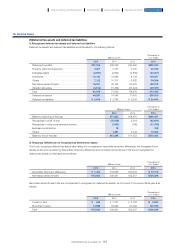

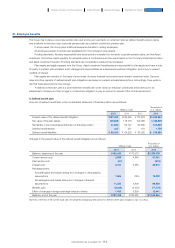

Changes in the fair value of the plan assets are as follows:

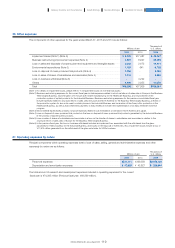

Summary of the fair value of the plan assets is as follows:

Millions of yen

Thousands of

U.S. dollars

2015 2014 2015

Balance, beginning of the year ··········································································································································· ¥118,718 ¥109,085 $ 987,917

Interest income ······························································································································································································· 2,407 2,593 20,030

Remeasurement:

Return on plan assets (net) ·············································································································································· 13,109 2,929 109,087

Contributions by the employer ············································································································································ 7,246 7,104 60,298

Benefits paid ······································································································································································································· (7,328) (7,881) (60,980)

Effect of changes in foreign exchange rates and others ························································ 1,496 4,886 12,449

Balance, end of the year ································································································································································ ¥135,649 ¥118,718 $1,128,809

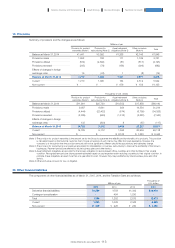

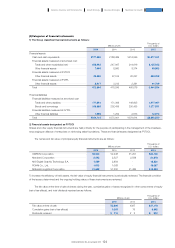

(Note 1) Plan assets are invested in securities, shares and derivatives.

(Note 2) I n accordance with the requirements of defined-benefit pension plans, a regular contribution must be made at least annually. To ensure a

financial balance between forecasted benefit requirement and expected investment income, this amount is calculated based on the

assumptions of interest rates, rates of mortality, withdrawal rates and forecast amounts for other required benefit expenses. Furthermore, this

contribution amount is subject to actuarial review every five years. If the reserve amount is below that provided by minimum funding

standards, a fixed amount must be contributed. The calculation method used for the Company’s defined benefit plans takes into

consideration deductible amounts under tax law, the status of plan assets reserves and various actuarial calculations.

(Note 3) Expected contributions to plan assets in the next fiscal year are ¥7,211 million.

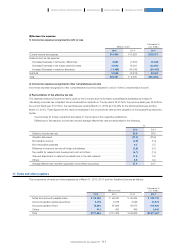

Millions of yen

2015 2014 2013

Quoted market price in an active market Quoted market price in an active market Quoted market price in an active market

Yes No Total Yes No Total Yes No Total

Debt securities (Foreign) ¥27,010 ¥ - ¥ 27,010 23,208 ¥ - ¥ 23,208 22,038 ¥ - ¥ 22,038

Debt securities (Domestic) 3,870 - 3,870 11,030 - 11,030 15,968 - 15,968

Equity securities (Foreign) 7,151 - 7,151 10,417 - 10,417 8,294 - 8,294

Equity securities

(Domestic) 19,552 - 19,552 17,994 - 17,994 11,063 - 11,063

Employee pension trust

(Foreign equity securities) 18,931 - 18,931 11,773 - 11,773 10,354 - 10,354

Employee pension trust

(Domestic equity securities) 10,801 - 10,801 11,824 - 11,824 9,949 - 9,949

Life insurance company

general accounts - 11,920 11,920 - 11,824 11,824 - 17,544 17,544

Others 28,317 8,091 36,409 18,624 2,021 20,645 12,277 1,594 13,872

Total ¥135,649 ¥118,718 ¥109,085

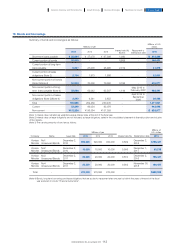

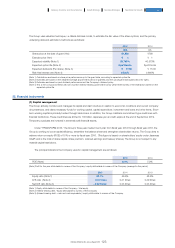

Thousands of U.S. dollars

2015

Quoted market price in an active market

Yes No Total

Debt securities (Foreign) $224,765 $ - $ 224,765

Debt securities (Domestic) 32,204 - 32,204

Equity securities (Foreign) 59,507 - 59,507

Equity securities (Domestic) 162,703 - 162,703

Employee pension trust (Foreign equity securities) 157,535 - 157,535

Employee pension trust (Domestic equity securities) 89,881 - 89,881

Life insurance company general accounts - 99,193 99,193

Others 235,641 67,330 302,979

Total $1,128,809

115

KONICA MINOLTA, INC. Annual Report 2015

Foundation for GrowthBusiness StrategiesGrowth StrategyCompany Overview and Characteristics Financial Report