Kodak 2006 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

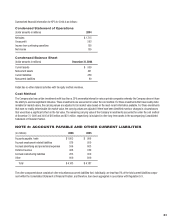

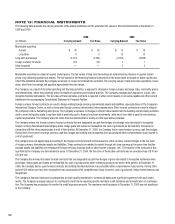

NOTE 13: FINANCIAL INSTRUMENTS

The following table presents the carrying amounts of the assets (liabilities) and the estimated fair values of financial instruments at December 31,

2006 and 2005:

2006 2005

(in millions) Carrying Amount Fair Value Carrying Amount Fair Value

Marketable securities:

Current $ 18 $ 18 $ 15 $ 16

Long-term 4 4 13 13

Long-term borrowings (2,714) (2,740) (2,764) (2,688)

Foreign currency forwards (10) (10) 1 1

Silver forwards — — 2 2

Marketable securities are valued at quoted market prices. The fair values of long-term borrowings are determined by reference to quoted market

prices or by obtaining quotes from dealers. The fair values for the remaining financial instruments in the above table are based on dealer quotes and

reflect the estimated amounts the Company would pay or receive to terminate the contracts. The carrying values of cash and cash equivalents, receiv-

ables, short-term borrowings and payables approximate their fair values.

The Company, as a result of its global operating and financing activities, is exposed to changes in foreign currency exchange rates, commodity prices

and interest rates, which may adversely affect its results of operations and financial position. The Company manages such exposures, in part, with

derivative financial instruments. The fair value of these derivative contracts is reported in other current assets or accounts payable and other current

liabilities in the accompanying Consolidated Statement of Financial Position.

Foreign currency forward contracts are used to hedge existing foreign currency denominated assets and liabilities, especially those of the Company’s

International Treasury Center, as well as forecasted foreign currency denominated intercompany sales. Silver forward contracts are used to mitigate

the Company’s risk to fluctuating silver prices. The Company’s exposure to changes in interest rates results from its investing and borrowing activities

used to meet its liquidity needs. Long-term debt is generally used to finance long-term investments, while short-term debt is used to meet working

capital requirements. The Company does not utilize financial instruments for trading or other speculative purposes.

The Company enters into foreign currency forward contracts that are designated as cash flow hedges of exchange rate risk related to forecasted

foreign currency denominated intercompany sales. Hedge gains and losses are reclassified into cost of goods sold as the inventory transferred in

connection with the intercompany sales is sold to third parties. At December 31, 2006, the Company had no open foreign currency cash flow hedges.

During 2006, there were no foreign currency cash flow hedges and nothing was reclassified from accumulated other comprehensive (loss) income to

cost of goods sold.

The Company does not apply hedge accounting to the foreign currency forward contracts used to offset currency-related changes in the fair value

of foreign currency denominated assets and liabilities. These contracts are marked to market through net (loss) earnings at the same time that the

exposed assets and liabilities are remeasured through net (loss) earnings (both in other income (charges), net). The majority of the contracts of this

type held by the Company are denominated in euros. At December 31, 2006, the fair value of these open contracts was an unrealized loss of $10 mil-

lion (pre-tax).

The Company has entered into silver forward contracts that are designated as cash flow hedges of price risk related to forecasted worldwide silver

purchases. Hedge gains and losses are reclassified into cost of goods sold as silver-containing products are sold to third parties. At December 31,

2006, the Company had no open forward contracts and nothing has been deferred in accumulated other comprehensive (loss) income. During 2006,

gains of $12 million (pre-tax) were reclassified from accumulated other comprehensive (loss) income to cost of goods sold. Hedge ineffectiveness was

insignificant.

The Company’s financial instrument counterparties are high-quality investment or commercial banks with significant experience with such instru-

ments. The Company manages exposure to counterparty credit risk by requiring specific minimum credit standards and diversification of counterpar-

ties. The Company has procedures to monitor the credit exposure amounts. The maximum credit exposure at December 31, 2006 was not significant

to the Company.