Kodak 2006 Annual Report Download - page 102

Download and view the complete annual report

Please find page 102 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

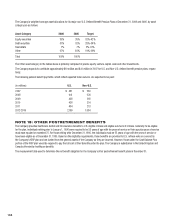

During 2005, the Company reached a settlement with the Internal Revenue Service covering tax years 1993-1998. As a result, the Company recog-

nized a tax benefit from continuing operations of $44 million, including interest. Net income from discontinued operations for 2005 was $150 million,

which was net of a $203 million tax benefit. The $203 million tax benefit for 2005 resulted from the Company’s audit settlement with the Internal

Revenue Service for tax years covering 1993 through 1998.

During 2004, the Company reached a settlement with the Internal Revenue Service covering tax years 1982-1992. As a result, the Company recog-

nized a tax benefit of $37 million in 2004, which consisted of benefits of $32 million related to a formal concession concerning the taxation of certain

intercompany royalties that could not legally be distributed to the parent entity and $9 million related to the income tax treatment of a patent infringe-

ment litigation settlement, and a $4 million charge related to other tax items. The Company also reached a favorable resolution of interest calculations

for these years, and recorded a benefit of $8 million. Finally, the Company recorded net charges of $13 million for adjustments for audit years 1993

and thereafter.

The Company and its subsidiaries’ income tax returns are routinely examined by various authorities. In management’s opinion, adequate provision

for income taxes has been made for all open years in accordance with SFAS No. 5, “Accounting for Contingencies.” A degree of judgment is required

in determining our effective tax rate and in evaluating our tax position. The Company establishes reserves when, despite significant support for the

Company’s filing position, a belief exists that these positions may be challenged by the respective tax jurisdiction. The reserves are adjusted upon the

occurrence of external, identifiable events, including the settlement of the related tax audit year with the Internal Revenue Service. A change in our tax

reserves could have a significant impact on our effective tax rate and our operating results.

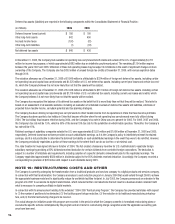

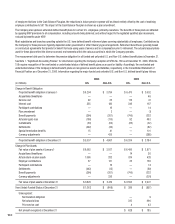

Deferred Tax Assets and Liabilities

The significant components of deferred tax assets and liabilities were as follows:

(in millions) 2006 2005

Deferred tax assets

Pension and postretirement obligations $ 935 $ 1,132

Restructuring programs 126 91

Foreign tax credit 353 447

Investment tax credits 147 156

Employee deferred compensation 143 106

Tax loss carryforwards 554 269

Other deferred revenue 214 —

Other 475 447

Total deferred tax assets 2,947 2,648

Deferred tax liabilities

Depreciation 177 519

Leasing 71 78

Inventories 74 116

Other 130 171

Total deferred tax liabilities 452 884

Valuation allowance 1,849 1,328

Net deferred tax assets $ 646 $ 436