Kodak 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The decline was also impacted by $44 million of charges, including a $19 million impairment of the investment in Lucky Film as a result of an other-

than-temporary decline in the market value of Lucky’s stock and a $25 million asset impairment. Additionally, equity income from joint ventures

declined by $18 million due to the acquisitions of KPG and NexPress, which were formerly accounted for under the equity method, and have been

consolidated in the Company’s Statement of Operations and included in the Graphic Communications Group segment since the date of acquisition.

These items were partially offset by a net year-over-year increase of $59 million from gains on the sale of properties and capital assets.

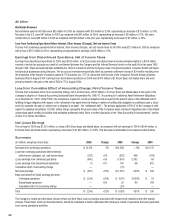

Loss From Continuing Operations Before Income Taxes

The loss from continuing operations before income taxes for 2005 was $799 million as compared with a loss of $113 million for 2004, representing an

increase in the loss of $686 million. This change was attributable to the reasons described above.

Income Tax (Benefit) Provision

The Company’s annual effective tax rate from continuing operations decreased from a benefit rate of 161% for 2004 to a provision rate of 69% for

2005. The change is primarily attributable to the inability to recognize a benefit from losses in the U.S. as a result of the requirement to record a valua-

tion allowance against U.S. net deferred tax assets where it is not more likely than not that these benefits will be realized.

During the year ended December 31, 2005, the Company recorded a tax provision of $555 million representing an income tax rate on losses from

continuing operations of 69%. The income tax rate of 69% for the year ended December 31, 2005 differs from the Company’s statutory tax rate

of 35% primarily due to the inability to benefit losses in the U.S., which resulted in the recording of the valuation allowance charge against net U.S.

deferred tax assets in the amount of $955 million. Some of the other significant items that caused the difference from the statutory tax rate include:

(1) non-U.S. tax benefits of $106 million associated with total worldwide restructuring costs of $1,143 million; (2) a benefit of $101 million associ-

ated with rate differentials on operations outside the U.S.; (3) a benefit of $28 million associated with export sales and manufacturing credits; (4) a

tax charge of $29 million associated with the remittance of earnings from subsidiary companies outside of the U.S. in connection with the American

Jobs Creation Act of 2004; and (5) a tax benefit of $44 million resulting from the Company’s audit settlement with the Internal Revenue Service for tax

years covering 1993 through 1998.

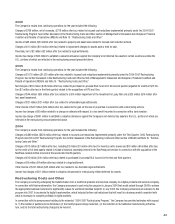

Valuation Allowance - U.S.

During the third quarter of 2005, based on the Company’s assessment of positive and negative evidence regarding the realization of the net deferred

tax assets, the Company recorded a valuation allowance of approximately $778 million against its U.S. net deferred tax assets. In accordance with

SFAS No. 109, the Company’s assessment included the evaluation of scheduled reversals of deferred tax assets and liabilities, estimates of projected

future taxable income, carryback potential and tax planning strategies.

Prior to the Company’s third quarter 2005 assessment of realizability, it was believed, based on available evidence including tax planning strategies,

that the Company would more likely than not realize its net U.S. deferred tax assets. The third quarter 2005 assessment considered the following

significant matters based upon some recent changes that occurred in the quarter:

• In July 2005, management announced plans to significantly accelerate its restructuring efforts and to significantly reduce the assets support-

ing its traditional business by the end of 2007. This global plan includes accelerating the reduction of traditional film assets from $2.9 billion

in January 2004 to approximately $1 billion by 2007 and terminating approximately 10,000 employees. These actions will have a negative

impact on Kodak’s ability to generate taxable income in the U.S.

• On October 18, 2005, the Company entered into a new secured credit facility pursuant to which the borrowings in the U.S. are collateralized

by certain U.S. assets, including the Company’s intellectual property assets. Thus, management determined that the previous tax planning

strategy to sell the U.S. intellectual property to a foreign subsidiary to generate taxable income in the U.S. was no longer prudent nor feasible

and should not be relied upon as part of the third quarter assessment of realizability of the Company’s U.S. deferred tax assets.

Based upon the Company’s above-mentioned September 30, 2005 assessment of realizability, the Company concluded that it was no longer more

likely than not that the U.S. net deferred tax assets would be realized and, as such, recorded a valuation allowance of approximately $778 million.

In the fourth quarter of 2005, the Company updated its assessment of the realizability of its net deferred tax assets. As a result of the Company’s

assessment of positive and negative evidence regarding the realization of the net deferred tax assets, which included the evaluation of scheduled

reversals of deferred tax assets and liabilities, estimates of projected future taxable income, carryback potential and tax planning strategies, the

Company maintained that it was still no longer more likely than not that the U.S. net deferred tax assets would be realized and, as such, increased the

valuation allowance by approximately $183 million relating to deferred tax benefits generated in the fourth quarter. In addition, the Company expects

to record a valuation allowance on all U.S. tax benefits generated in the future until an appropriate level of profitability in the U.S. is sustained or until

the Company is able to generate enough taxable income through other tax planning strategies and transactions. Both the net deferred tax asset bal-

ances and the offsetting valuation allowance included estimates attributable to the acquisitions of KPG and Creo. Deferred tax amounts attributable to

these businesses were finalized during 2006 with the completion of the Company’s purchase accounting for these acquired entities.

As of December 31, 2005, the Company had a valuation allowance of $1,116 million relating to its net deferred tax assets in the U.S. of $1,195 million.

The valuation allowance of $1,116 million is attributable to (i) the charges totaling $961 million that were recorded in the third and fourth quarters of

2005 and (ii) a valuation allowance of $155 million recorded in a prior year for certain state tax carryforward deferred tax assets relating to which the