Kodak 2006 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

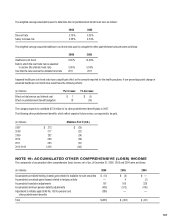

The table above excludes approximately 68 (in thousands) options granted by the Company in 2001 at an exercise price of $.05-$21.91 as part of an

acquisition. At December 31, 2006, approximately 4 (in thousands) stock options were outstanding in relation to this acquisition.

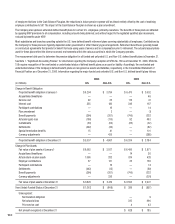

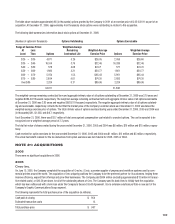

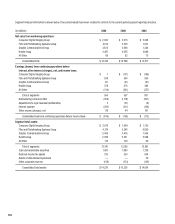

The following table summarizes information about stock options at December 31, 2006:

(Number of options in thousands) Options Outstanding Options Exercisable

Range of Exercise Prices Weighted-Average

At Less Remaining Weighted-Average Weighted-Average

Least Than Options Contractual Life Exercise Price Options Exercise Price

$20 – $30 4,871 5.26 $26.05 2,056 $26.60

$30 – $40 16,514 3.79 $32.46 16,286 $32.46

$40 – $50 578 4.08 $41.71 577 $41.70

$50 – $60 1,666 3.21 $54.77 1,661 $54.77

$60 – $70 5,974 1.53 $65.43 5,961 $65.44

$70 – $80 2,684 0.61 $74.20 2,683 $74.20

Over $80 2,324 0.17 $89.96 2,324 $89.96

34,611 31,548

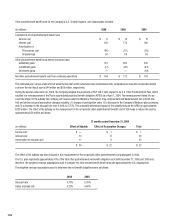

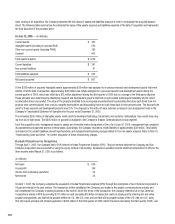

The weighted-average remaining contractual term and aggregate intrinsic value of all options outstanding at December 31, 2006 was 3.10 years and

negative $684,407 thousand, respectively. The weighted-average remaining contractual term and aggregate intrinsic value of all options exercisable

at December 31, 2006 was 2.85 years and negative $682,611 thousand, respectively. The negative aggregate intrinsic value of all options outstand-

ing and exercisable, respectively, reflects the fact that the market price of the Company’s common stock as of December 31, 2006 was below the

weighted-average exercise price of options. The total intrinsic value of options exercised during years ended December 31, 2006, 2005 and 2004 was

(in thousands) $61, $1,238, and $417, respectively.

As of December 31, 2006, there was $12.7 million of total unrecognized compensation cost related to unvested options. The cost is expected to be

recognized over a weighted-average period of 2.2 years.

The total fair value of shares vested during the years ended December 31, 2006, 2005 and 2004 was $8 million, $16 million and $15 million, respec-

tively.

Cash received for option exercises for the years ended December 31, 2006, 2005 and 2004 was $1 million, $12 million and $5 million, respectively.

The actual tax benefit realized for the tax deductions from option exercises was not material for 2006, 2005 or 2004.

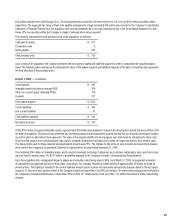

NOTE 21: ACQUISITIONS

2006

There were no significant acquisitions in 2006.

2005

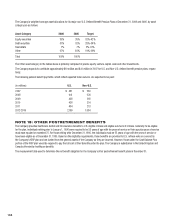

Creo Inc.

On June 15, 2005, the Company completed the acquisition of Creo Inc. (Creo), a premier supplier of prepress and workflow systems used by com-

mercial printers around the world. The acquisition of Creo uniquely positions the Company to be the preferred partner for its customers, helping them

improve efficiency, expand their offerings and grow their businesses. The Company paid $954 million (excluding approximately $13 million in transac-

tion related costs), or $16.50 per share, for all of the outstanding shares of Creo. The Company used its bank lines to initially fund the acquisition,

which has been refinanced with a term loan under the Company’s Secured Credit Agreement. Creo’s extensive solutions portfolio is now part of the

Company’s Graphic Communications Group segment.

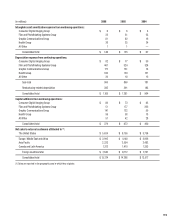

The following represents the total purchase price of the acquisition (in millions):

Cash paid at closing $ 954

Estimated transaction costs 13

Total purchase price $ 967