Kodak 2006 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The EROA assumption is based on a combination of formal asset and liability studies, historical results of the portfolio, and management’s expectation

as to future returns that are expected to be realized over the estimated remaining life of the plan liabilities that will be funded with the plan assets. The

salary growth assumptions are determined based on the Company’s long-term actual experience and future and near-term outlook. The healthcare

cost trend rate assumptions are based on historical cost and payment data, the near-term outlook and an assessment of the likely long-term trends.

The Company reviews its EROA assumption annually for the Kodak Retirement Income Plan (KRIP). To facilitate this review, every three years, or

when market conditions change materially, the Company undertakes a new asset and liability study to reaffirm the current asset allocation and the

related EROA assumption. In March 2005, a new asset and liability modeling study was completed and the KRIP EROA assumption for 2005 and 2006

was 9.0%. The KRIP EROA assumption is expected to remain at 9.0% for 2007 as well. Given the increase in the discount rate of 50 basis points

from 5.50% for 2006 to 6.00% for 2007, changes in demographic assumptions resulting from the completion of assumption studies in 2005, and

a decrease in amortization expense relating to unrecognized actuarial losses in accordance with SFAS No. 87, total pension income from continuing

operations before special termination benefits, curtailments and settlements for the major funded and unfunded defined benefit plans in the U.S. is ex-

pected to increase from $99 million in 2006 to $133 million in 2007. Pension expense from continuing operations before special benefits, curtailments

and settlements in the Company’s major funded and unfunded non-U.S. defined benefit plans is projected to decrease from $85 million in 2006 to

$54 million in 2007, which is primarily attributable to decreased service cost and amortization expense relating to the unrecognized prior service cost

from the Company’s restructuring actions. Additionally, due in part to the increase in the discount rate from 5.50% for 2006 to 5.75% for 2007 and an

increase in amortization expense relating to the unrecognized actuarial losses, the Company expects the cost, before curtailment and settlement gains

and losses, of its most significant postretirement benefit plan, the U.S. plan, to approximate $184 million in 2007, as compared with $175 million for

2006.

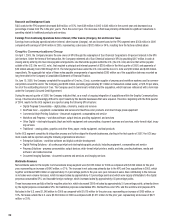

The following table illustrates the sensitivity to a change to certain key assumptions used in the calculation of expense for the year ending December

31, 2007 and the projected benefit obligation (PBO) at December 31, 2006 for the Company’s major U.S. and non-U.S. defined benefit pension plans:

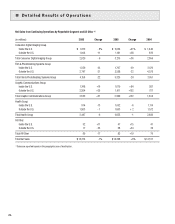

Impact on 2007 Impact on PBO

Pre-Tax Pension Expense December 31, 2006

Increase (Decrease) Increase (Decrease)

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Change in assumption:

25 basis point decrease in discount rate $ (2) $ 12 $ 150 $ 140

25 basis point increase in discount rate 2 (12) (142) (132)

25 basis point decrease in EROA 15 8

25 basis point increase in EROA (15) (8)

Environmental Commitments

Environmental liabilities are accrued based on estimates of known environmental remediation exposures. The liabilities include accruals for sites

owned by Kodak, sites formerly owned by Kodak, and other third party sites where Kodak was designated as a potentially responsible party (PRP). The

amounts accrued for such sites are based on these estimates, which are determined using the ASTM Standard E 2137-01, “Standard Guide for Esti-

mating Monetary Costs and Liabilities for Environmental Matters.” The overall method includes the use of a probabilistic model that forecasts a range

of cost estimates for the remediation required at individual sites. The Company’s estimate includes equipment and operating costs for remediation

and long-term monitoring of the sites. Such estimates may be affected by changing determinations of what constitutes an environmental liability or an

acceptable level of remediation. Kodak’s estimate of its environmental liabilities may also change if the proposals to regulatory agencies for desired

methods and outcomes of remediation are viewed as not acceptable, or additional exposures are identified. The Company has an ongoing monitoring

and identification process to assess how activities, with respect to the known exposures, are progressing against the accrued cost estimates, as well

as to identify other potential remediation issues that are presently unknown.

Stock-Based Compensation

The Company accounts for its stock options and other forms of stock-based compensation in accordance with SFAS No. 123R, “Share-Based Pay-

ment,” as interpreted by Financial Accounting Standards Board (FASB) Staff Positions No. 123R-1, 123R-2, 123R-3, 123R-4, 123R-5, and 123R-6,

using the fair value recognition provisions of SFAS No. 123, “Accounting for Stock-Based Compensation,” effective January 1, 2005.

The fair value of each option award is estimated on the date of grant using the Black-Scholes option valuation model that uses the following assump-

tions. Expected volatilities are based on historical volatility of the Company’s stock, management’s estimate of implied volatility of the Company’s

stock, and other factors. The expected term of options granted is derived from the vesting period of the award, as well as historical exercise behavior,

and represents the period of time that options granted are expected to be outstanding. The risk-free rate is calculated using the U.S. Treasury yield

curve, and is based on the expected term of the option. The Company uses historical data to estimate forfeitures.