Kodak 2006 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

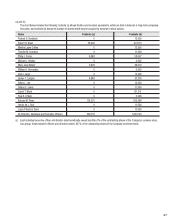

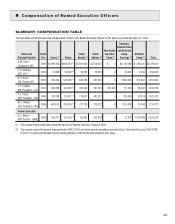

Long-Term Variable Equity Incentive Compensation

The purposes behind our long-term equity incentive compensation program are to align executive compensation with shareholder interests, create

signifi cant incentives for executive retention, encourage long-term performance by our executive offi cers and promote stock ownership. In 2006, the

Committee granted our Named Executive Offi cers long-term variable equity incentive compensation consisting of stock options and performance stock

units, known as Leadership Stock. The Committee also granted our Named Executive Offi cers performance stock units under the 2006 Executive Per-

formance Share Plan. In addition to these equity award programs, the Company granted individual equity awards to certain Named Executive Offi cers

in connection with signifi cant promotions, retention, new hires and outstanding individual achievements that promoted Kodak’s strategic business

plan.

Our long-term variable equity incentive programs balance a focus on stock price appreciation and the achievement of strategic business goals. Stock

options are designed to compensate our most senior executives for stock appreciation and provide a strong link to shareholder value creation. We

believe options are an effective incentive compensation vehicle for those who are most responsible for infl uencing shareholder value. Leadership Stock

is designed to encourage executives to achieve key metrics (e.g., digital earnings from operations) that promote the Company’s digital transformation.

When determining the aggregate annual long-term variable equity awards to each of our Named Executive Offi cers, the Committee establishes the

aggregate value of stock option awards at the same time that it determines the aggregate value of Leadership Stock targets that are to be granted in

the next year. The Committee generally makes annual option grants in December of each year at its regularly scheduled meeting. Leadership Stock

allocations are also determined at this time for the next performance cycle. The timing of our option awards was selected because it enables the

Committee to consider current year performance and expectations for the succeeding year. The Company recently conducted a review of its past stock

option granting practices and did not identify any practices that raised concerns. In order to formalize its procedures relating to grants of stock options

and other equity awards, the Board of Directors adopted a policy that sets forth procedures for the setting of grant dates, which is discussed on page

41 of this Proxy Statement.

The Committee has no set policy for determining the mix of the form of long-term variable equity incentives granted to our Named Executive Of-

fi cers. At its regular meeting in December 2006, the Committee determined to grant one-half of the value of our Named Executive Offi cers’ long-term

variable equity incentives in the form of non-qualifi ed stock options and one-half of the value in the form of a target allocation under the Leadership

Stock Program for the 2007 performance cycle. Generally, the Committee does not consider prior awards in granting annual long-term variable equity

incentive awards.

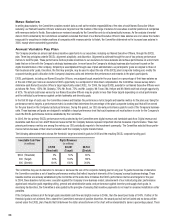

Long-Term Incentive Gap Closure

In response to the Committee’s fi ndings upon its annual review of our Named Executive Offi cers’ compensation in 2006, the Committee increased

the size of the award of annual stock option grants and Leadership Stock for the 2007 performance cycle to our Named Executive Offi cers relative to

prior years. The Committee determined that this increase was warranted because market data indicated that our executives’ long-term variable equity

incentive compensation opportunity was less than the median opportunity for executives in similar positions with similar responsibilities as identifi ed

based on the average of two national surveys using companies with gross revenues similar to Kodak.

The Committee assessed the aggregate cost of this increase and determined that the costs and long-term incentive budget as a result of the gap clo-

sure were reasonable. In making this determination, the Committee reviewed the long-term equity incentive practices of the following 15 peer group

companies based on review with its consultant:

• Agilent Technologies • H.J. Heinz Company • Motorola Inc.

• Caterpillar, Inc. • Hewlett-Packard Company • Sun Microsystems, Inc.

• The Clorox Company • Honeywell International Inc. • Texas Instrument Incorporated

• E.I. du Pont de Nemours and Company • Lexmark International Inc. • Xerox Corporation

• Emerson Electric Co. • Lucent Technologies • 3M Company

The peer group was selected based on the following criteria: 1) market capitalization; 2) revenue; 3) consumer/commercial/high-tech mix; 4) mix of

high growth and steady companies; 5) industry similarity; and 6) data availability. In comparing Kodak’s programs to the peer group, the Committee

reviewed the value of the Leadership Stock awards granted in January 2006, the 2005 stock option grants and the annualized value of other non-an-

nual equity grants (such as new hire or retention awards) as a percentage of Kodak’s market capitalization. This analysis indicated that the Company’s

current practices fell below the median range of our peer group. The Committee determined that increasing the 2006 stock option grants and 2007

Leadership Stock awards granted to our Named Executive Offi cers to bring their total direct compensation to the level the Committee considers

competitive would be reasonable.