Kodak 2006 Annual Report Download - page 216

Download and view the complete annual report

Please find page 216 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

On February 28, 2007, Mr. Faraci’s letter agreement was amended to provide for lump-sum payment of his enhanced pension benefi ts. The amended

terms provide that if Mr. Faraci is terminated before June 1, 2007, he will receive his enhanced pension benefi t in a monthly annuity, with payments

beginning the fi rst month following the six-month anniversary of Mr. Faraci’s termination and continuing until the end of 2007, with the remainder paid

in a lump sum on or after January 1, 2008. However, if Mr. Faraci is terminated after January 1, 2008, he will receive his enhanced pension benefi t in

a lump sum following the six-month anniversary of his termination.

Daniel T. Meek

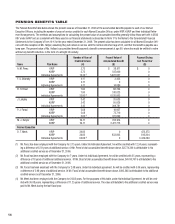

In addition to benefi ts described above, Mr. Meek is entitled to a supplemental unfunded retirement benefi t under the terms of his 1998 offer letter

which was further supplemented under his 2006 retention agreement. Under his 1998 arrangement, provided Mr. Meek remained employed with the

Company for fi ve years, Mr. Meek will be treated as having completed eight years of additional service with the Company for purposes of calculating

benefi ts under KRIP, KURIP and KERIP. Pursuant to his 2006 retention agreement, Mr. Meek was entitled to benefi ts calculated by adding three years

to his age and crediting three additional years of service.

In order to receive this supplemental benefi t, Mr. Meek was to remain employed with the Company until March 31, 2008. Pursuant to Mr. Meek’s

May 2, 2006 letter agreement, in connection with his termination of employment effective June 30, 2006, Mr. Meek became eligible to receive his

enhanced retirement benefi t in a lump sum equal to $3,439,389.

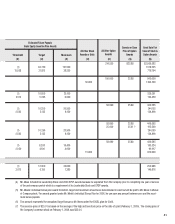

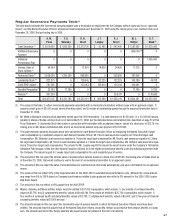

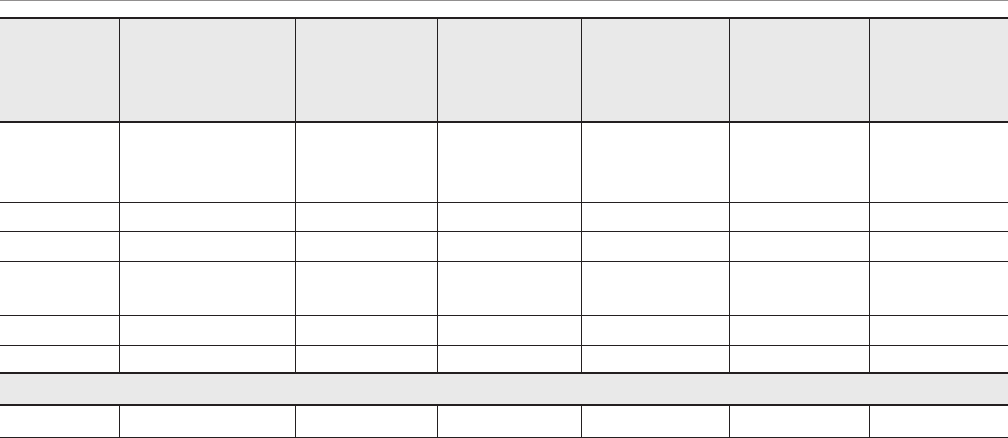

NON-QUALIFIED DEFERRED COMPENSATION TABLE

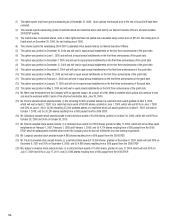

Executive Registrant Aggregate Aggregate

Contributions in Contributions in Earnings in Aggregate Balance at Last

Last Fiscal Last Fiscal Last Fiscal Withdrawals/ Fiscal

Name Account Type Year End (1) Year End Year End (1) Distributions Year End

A. M. Perez Salary Deferral $ 96,169 $ 0 $ 7,493 $ 0 $ 146,963

EDCP Plan 0 0 76,885 0 1,008,108

Deferred Stock Units 1,034,478 (2) 0 15,237

(3) 0 1,631,861

F. S. Sklarsky N/A N/A N/A N/A N/A N/A

R. H. Brust Deferred Stock Units 0 0 12,697 (3) 0 670,594

J. T. Langley Indiv. Bonus Deferral 293,570 0 37,974 0 537,117

EDCP Plan 502,053 0 62,481 0 956,077

P. J. Faraci N/A N/A N/A N/A N/A N/A

M. J. Hellyar EDCP Plan 0 0 13,313 0 174,560

Former Executive

D. T. Meek EDCP Plan 0 0 94,463 0 1,238,576

(1) The amounts reported in these columns include compensation that has already been reported in the Summary Compensation Table. For Mr.

Perez, this amount includes a salary deferral of $96,169 and above-market interest of $22,576. For Mr. Langley, the amount includes above-mar-

ket interest of $26,928. For Ms. Hellyar, this amount includes above-market interest of $3,553. For Mr. Meek, this amount includes above-mar-

ket interest of $25,214.

(2) This amount represents the value of 25,000 restricted stock units that vested during 2006, the aggregate value of net dividends paid on Mr.

Perez’s unvested restricted stock units and the 2004-2005 Leadership Stock Award, including dividends (on an after-tax basis).

(3) This amount represents the aggregate value of net dividends on vested restricted stock units.

Executive Deferred Compensation Plan

The Company maintains the Eastman Kodak Company 1982 Executive Deferred Compensation Plan (EDCP) for its executives. Near the end of each

year, the Company’s executives may elect to defer any portion of their base salary in excess of $50,000 for the following year and a portion of any

EXCEL award earned for the following year. The plan has only two investment options: an interest-bearing account that pays interest at the prime rate

and a Kodak phantom stock account. Participants may only invest amounts in the Kodak phantom stock account if they are, or were, subject to our

stock ownership guidelines. Dividend equivalents on amounts invested in an executive’s phantom stock account are credited to an executive’s account

in the form of additional stock units at the same rate as dividends are paid on shares of Company common stock. The plan’s benefi ts are neither

funded nor secured.