Kodak 2006 Annual Report Download - page 195

Download and view the complete annual report

Please find page 195 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Mr. Perez’s Benefi ts and Perquisites

According to the terms of Mr. Perez’s hiring agreement, Mr. Perez is eligible to participate in the Company’s cash balance benefi t under the Kodak

Retirement Income Plan. In addition, Mr. Perez is eligible for an enhanced retirement benefi t, which is described on page 60 of this Proxy Statement.

Mr. Perez is also provided fi nancial planning, an executive physical, home security systems and services and personal umbrella insurance benefi ts. The

Company requires Mr. Perez to use Company transportation for security reasons.

Mr. Perez’s Severance Benefi ts Associated with a Change-in-Control

Mr. Perez is eligible to receive change-in-control benefi ts under the Company’s Executive Protection Plan. Our Executive Protection Plan provides Mr.

Perez severance benefi ts and one-year continuation of medical, dental and life insurance benefi ts if his employment is terminated without “cause” or

for “good reason” during the two-year period following a change-in-control. Mr. Perez is entitled to benefi ts under the plan if he terminates employ-

ment for any reason during the 30-day period commencing 23 months after a change-in-control. Details of these benefi ts are found in the Change-in-

Control Severance Payments Table on page 72 of this Proxy Statement.

Mr. Perez’s Stock Ownership Requirements

Mr. Perez has met the guideline for Kodak stock ownership. Please see page 42 of this Proxy Statement.

OTHER COMPENSATION ELEMENTS

Retirement Plan Program

In addition to our tax-qualifi ed defi ned benefi t plan (KRIP) and tax-qualifi ed defi ned contribution plan (Savings & Investment Plan), which cover virtu-

ally all U.S. employees, the Company provides supplemental retirement benefi ts to our Named Executive Offi cers under the Kodak Unfunded Retire-

ment Income Plan (KURIP) and the Kodak Excess Retirement Income Plan (KERIP). Both plans are unfunded, unsecured obligations of the Company.

KERIP is an unfunded excess benefi t plan that is designed to provide our executives with pension benefi ts that make up for the limitations under the

Internal Revenue Code on allocations and benefi ts that may be paid under the Company’s tax-qualifi ed defi ned benefi t plan. The KURIP plan is also an

unfunded plan that is also designed to provide supplemental retirement benefi ts for our Named Executive Offi cers and other executives. The benefi t

payable under KURIP is designed to provide our Named Executive Offi cers with benefi ts that would not be available under the Company’s qualifi ed

retirement plans as a result of tax code limitations under Section 401(a)(17) of the Internal Revenue Code and/or because deferred compensation

is ignored for purposes of calculating benefi ts under our tax-qualifi ed defi ned contribution and defi ned benefi t plans. None of our Named Executive

Offi cers has an accumulated benefi t under the KERIP supplemental pension plan. The accumulated benefi t provided to our Named Executive Offi cers

under the KURIP supplemental pension plan is shown in the Pension Benefi ts Table on page 58 of this Proxy Statement. For further information regard-

ing how benefi ts are calculated under each plan, see the discussion below the Pension Benefi ts Table on page 58 of this Proxy Statement.

The Company believes that our pension plan and non-qualifi ed supplemental pension plans enhance our executive compensation package. The primary

objective of our pension plans is to attract and retain our employees.

Supplemental Individual Retirement Arrangements

We have also entered into individual agreements with our Named Executive Offi cers to provide additional retirement benefi ts beyond those available

under our tax-qualifi ed pension plan and supplemental retirement plans described above. For some of our Named Executive Offi cers, these agree-

ments provide for additional years of service in calculating their benefi ts under KRIP and KURIP. These individual arrangements were necessary to

attract and retain certain Named Executive Offi cers who would have a lesser Kodak pension due to their short service with the Company. The benefi ts

provided to our Named Executive Offi cers under any individual retirement agreement are described following the Pension Benefi ts Table on page 58 of

this Proxy Statement.

Deferred Compensation Plan

The Company maintains a deferred compensation plan for its executives, known as the Eastman Kodak Company 1982 Executive Deferred Compensa-

tion Plan. The plan permits the Company’s executives to defer a portion of their base salary and annual bonus awards. Each fall, the Company’s execu-

tives may elect to defer base salary for the following year and up to a portion of any bonus earned under EXCEL the following year. The plan is intended

to promote retention by providing our Named Executive Offi cers with a long-term savings opportunity on a tax-preferred basis. The plan’s benefi ts are

neither funded nor secured.

The plan only has two investment options, an interest-bearing account that pays interest at the prime rate and a Kodak phantom stock account. Any

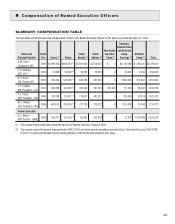

amounts earned by a Named Executive Offi cer as a result of “above-market” rates under the interest-bearing account in 2006 are shown in the Sum-

mary Compensation Table on page 43 of this Proxy Statement. The accumulated amount of deferred compensation of our Named Executive Offi cers

under the plan is shown in the Non-Qualifi ed Deferred Compensation Table on page 61 of this Proxy Statement.