Kodak 2006 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

0

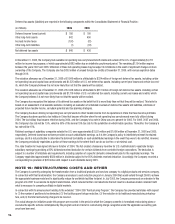

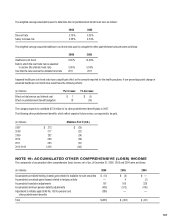

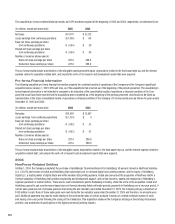

Other postretirement benefit cost for the Company’s U.S., United Kingdom, and Canada plans included:

(in millions) 2006 2005 2004

Components of net postretirement benefit cost

Service cost $ 11 $ 14 $ 15

Interest cost 166 170 189

Amortization of:

Prior service cost (46) (52) (59)

Actuarial loss 50 68 85

Other postretirement benefit cost before curtailment and

settlement gains 181 200 230

Curtailment gains (17) (28) (63)

Settlement gains — — (64)

Net other postretirement benefit cost from continuing operations $ 164 $ 172 $ 103

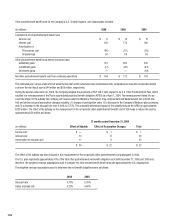

The estimated prior service credit and net actuarial loss that will be amortized from accumulated other comprehensive loss into net periodic benefit

cost over the next fiscal year is $44 million and $59 million, respectively.

During the quarter ended June 30, 2004, the Company adopted the provisions of FSP 106-2 with respect to its U.S. Other Postretirement Plan, which

resulted in a remeasurement of the Plan’s accumulated projected benefit obligation (APBO) as of April 1, 2004. This remeasurement takes into ac-

count the impact of the subsidy the Company will receive under the Medicare Prescription Drug, Improvement and Modernization Act of 2003 (the

Act) and certain actuarial assumption changes including: (1) changes in participation rates, (2) a decrease in the Company’s Medicare plan premiums,

and (3) a decrease in the discount rate from 6.00% to 5.75%. The actuarially determined impact of the subsidy reduced the APBO by approximately

$228 million. The effect of the subsidy on the measurement of the net periodic other postretirement benefit cost in 2004 was to reduce the cost by

approximately $52 million as follows:

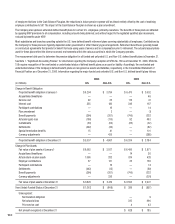

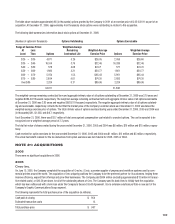

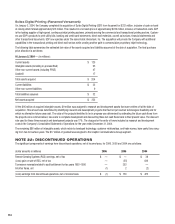

12 months ended December 31, 2004

(in millions) Effect of Subsidy Effect of Assumption Changes Total

Service cost $ — $ 1 $ 1

Interest cost 13 13 26

Amortization of actuarial gain 17 8 25

$ 30 $ 22 $ 52

The effect of the subsidy has been included in the measurement of the net periodic other postretirement cost subsequent to 2004.

The U.S. plan represents approximately 97% of the total other postretirement net benefit obligation as of both December 31, 2006 and 2005 and,

therefore, the weighted-average assumptions used to compute the other postretirement benefit amounts approximate the U.S. assumptions.

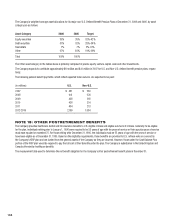

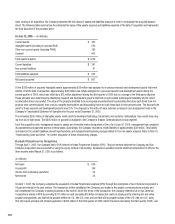

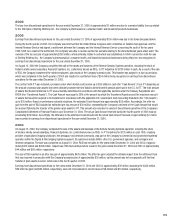

The weighted-average assumptions used to determine the net benefit obligations were as follows:

2006 2005

Discount rate 5.73% 5.50%

Salary increase rate 4.22% 4.60%