Kodak 2006 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

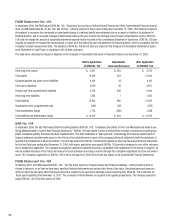

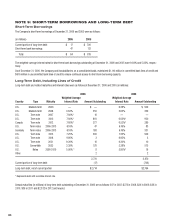

In addition to the 5-Year Revolving Credit Facility, the Company has other committed and uncommitted lines of credit at December 31, 2006 totaling

$110 million and $616 million, respectively. These lines primarily support borrowing needs of the Company’s subsidiaries, which include term loans,

overdraft coverage, letters of credit and revolving credit lines. Interest rates and other terms of borrowing under these lines of credit vary from country

to country, depending on local market conditions. Total outstanding borrowings against these other committed and uncommitted lines of credit at

December 31, 2006 were $18 million and $29 million, respectively. These outstanding borrowings are reflected in the short-term borrowings in the

accompanying Consolidated Statement of Financial Position at December 31, 2006.

At December 31, 2006, the Company had outstanding letters of credit totaling $144 million and surety bonds in the amount of $100 million primarily

to ensure the payment of possible casualty and workers’ compensation claims, environmental liabilities, and to support various customs and trade

activities.

Debt Shelf Registration and Convertible Securities

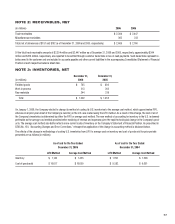

On September 5, 2003, the Company filed a shelf registration statement on Form S-3 (the primary debt shelf registration) for the issuance of up to

$2.0 billion of new debt securities. Pursuant to Rule 429 under the Securities Act of 1933, $650 million of remaining unsold debt securities under a

prior shelf registration statement were included in the primary debt shelf registration, thus giving the Company the ability to issue up to $2.65 billion in

public debt. After issuance of $500 million in notes in October 2003, the remaining availability under the primary debt shelf registration was at $2.15

billion.

On October 10, 2003, the Company completed the offering and sale of $500 million aggregate principal amount of Senior Notes due 2013 (the Notes),

which was made pursuant to the Company’s new debt shelf registration. The remaining unused balance under the Company’s new debt shelf is

$2.15 billion. Concurrent with the offering and sale of the Notes, on October 10, 2003, the Company completed the private placement of $575 million

aggregate principal amount of Convertible Senior Notes due 2033 (the Convertible Securities) to qualified institutional buyers pursuant to Rule 144A

under the Securities Act of 1933. Interest on the Convertible Securities will accrue at the rate of 3.375% per annum and is payable semiannually. The

Convertible Securities are unsecured and rank equally with all of the Company’s other unsecured and unsubordinated indebtedness. As a condition of

the private placement, on January 6, 2004 the Company filed a shelf registration statement under the Securities Act of 1933 relating to the resale of

the Convertible Securities and the common stock to be issued upon conversion of the Convertible Securities pursuant to a registration rights agree-

ment, and made this shelf registration statement effective on February 6, 2004.

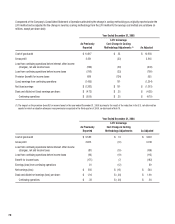

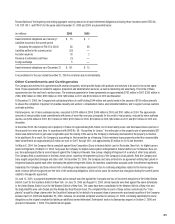

The Convertible Securities contain a number of conversion features that include substantive contingencies. The Convertible Securities are convertible

by the holders at an initial conversion rate of 32.2373 shares of the Company’s common stock for each $1,000 principal amount of the Convertible Se-

curities, which is equal to an initial conversion price of $31.02 per share. The initial conversion rate of 32.2373 is subject to adjustment for: (1) stock

dividends, (2) subdivisions or combinations of the Company’s common stock, (3) issuance to all holders of the Company’s common stock of certain

rights or warrants to purchase shares of the Company’s common stock at less than the market price, (4) distributions to all holders of the Company’s

common stock of shares of the Company’s capital stock or the Company’s assets or evidences of indebtedness, (5) cash dividends in excess of the

Company’s current cash dividends, or (6) certain payments made by the Company in connection with tender offers and exchange offers.

The holders may convert their Convertible Securities, in whole or in part, into shares of the Company’s common stock under any of the following

circumstances: (1) during any calendar quarter, if the price of the Company’s common stock is greater than or equal to 120% of the applicable conver-

sion price for at least 20 trading days during a 30 consecutive trading day period ending on the last trading day of the previous calendar quarter; (2)

during any five consecutive trading day period following any 10 consecutive trading day period in which the trading price of the Convertible Securities

for each day of such period is less than 105% of the conversion value, and the conversion value for each day of such period was less than 95% of the

principal amount of the Convertible Securities (the Parity Clause); (3) if the Company has called the Convertible Securities for redemption; (4) upon the

occurrence of specified corporate transactions such as a consolidation, merger or binding share exchange pursuant to which the Company’s common

stock would be converted into cash, property or securities; and (5) if the Senior Unsecured credit rating assigned to the Convertible Securities by ei-

ther Moody’s or S&P is lower than Ba2 or BB, respectively, or if the Convertible Securities are no longer rated by at least one of these services or their

successors (the Credit Rating Clause). At the Company’s current credit rating, the Convertible Securities may be converted by their holders.

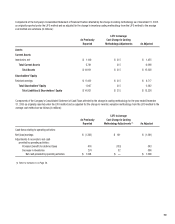

The Company may redeem some or all of the Convertible Securities at any time on or after October 15, 2010 at a purchase price equal to 100% of the

principal amount of the Convertible Securities plus any accrued and unpaid interest. Upon a call for redemption by the Company, a conversion trigger

is met whereby the holder of each $1,000 Convertible Senior Note may convert such note to shares of the Company’s common stock.

The holders have the right to require the Company to purchase their Convertible Securities for cash at a purchase price equal to 100% of the principal

amount of the Convertible Securities plus any accrued and unpaid interest on October 15, 2010, October 15, 2013, October 15, 2018, October 15,

2023 and October 15, 2028, or upon a fundamental change as described in the offering memorandum filed under Rule 144A in conjunction with the

private placement of the Convertible Securities. As of December 31, 2005, the Company has reserved 18,536,447 shares in treasury stock to cover

potential future conversions of these Convertible Securities into common stock.