Kodak 2006 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

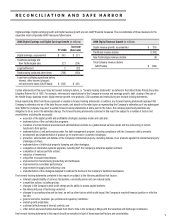

Digital earnings, Digital earnings growth and Digital revenue growth are non-GAAP financial measures. The reconciliations of those measures to the

respective most comparable GAAP measures follow below:

2006 Digital Revenue Growth (in millions)

Digital revenue growth, as presented $ 316

Traditional revenue decline (1,302)

New Technologies revenue decline (8)

Total Company revenue decline

(GAAP basis) $ (994)

Certain statements in this report may be forward-looking in nature, or “forward-looking statements” as defined in the United States Private Securities

Litigation Reform Act of 1995. For example, references to expectations for the Company’s revenue and earnings growth, debt, closing of the sale of

the Health Group, business model, digital revenue growth, new products, SGA expenses and restructuring are forward-looking statements.

Actual results may differ from those expressed or implied in forward-looking statements. In addition, any forward-looking statements represent the

Company’s estimates only as of the date they are made, and should not be relied upon as representing the Company’s estimates as of any subsequent

date. While the Company may elect to update forward-looking statements at some point in the future, the Company specifically disclaims any

obligation to do so, even if its estimates change. The forward-looking statements contained in this report are subject to a number of factors and

uncertainties, including the successful:

• execution of the digital growth and profitability strategies, business model and cash plan;

• implementation of the cost reduction programs;

• transition of certain financial processes and administrative functions to a global shared services model and the outsourcing of certain

functions to third parties;

• implementation of, and performance under, the debt management program, including compliance with the Company's debt covenants;

• development and implementation of product go-to-market and e-commerce strategies;

• protection, enforcement and defense of the Company's intellectual property, including defense of our products against the intellectual property

challenges of others;

• implementation of intellectual property licensing and other strategies;

• completion of information systems upgrades, including SAP, the Company's enterprise system software;

• completion of various portfolio actions;

• reduction of inventories;

• integration of acquired businesses;

• improvement in manufacturing productivity and techniques;

• improvement in receivables performance;

• improvement in supply chain efficiency; and

• implementation of the strategies designed to address the decline in the Company's traditional businesses.

The forward-looking statements contained in this report are subject to the following additional risk factors:

• inherent unpredictability of currency fluctuations, commodity prices and raw material costs;

• competitive actions, including pricing;

• changes in the Company's debt credit ratings and its ability to access capital markets;

• the nature and pace of technology evolution;

• changes to accounting rules and tax laws, as well as other factors which could impact the Company's reported financial position or effective

tax rate;

• general economic, business, geo-political and regulatory conditions;

• market growth predictions;

• continued effectiveness of internal controls; and

• other factors and uncertainties disclosed from time to time in the Company's filings with the Securities and Exchange Commission.

Any forward-looking statements in this report should be evaluated in light of these important factors and uncertainties.

2006 Digital Earnings and Digital Earnings Growth (in millions)

Increase/

FY 2006 (Decrease)

Digital earnings, as presented $ 343 $ 271

Traditional earnings and

New Technologies loss 221 (214)

Legal settlement 2 (23)

Restructuring costs and other items (768) (350)

Loss from continuing operations before

interest, other income (charges),

net and income taxes (GAAP basis) $ (202) $ 430