Kodak 2006 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

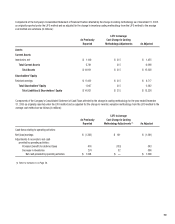

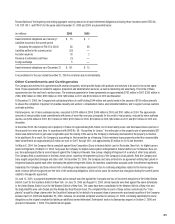

Reconciliations of the beginning and ending aggregate carrying amount of all asset retirement obligations (including those recorded under SFAS No.

143, FSP 143-1, and FIN 47) for the years ended December 31, 2006 and 2005 are presented below:

(in millions) 2006 2005

Asset retirement obligations as of January 1 $ 75 $ 7

Liabilities incurred in the current period

(including the adoption of FIN 47 in 2005) 38 66

Liabilities settled in the current period (30) —

Accretion expense 18 2

Revisions in estimated cash flows (5) —

Foreign exchange 5 —

Asset retirement obligations as of December 31 $ 101 $ 75

A reconciliation for the year ended December 31, 2004 is not shown due to immateriality.

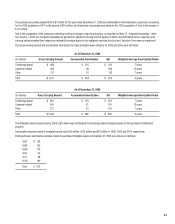

Other Commitments and Contingencies

The Company has entered into agreements with several companies, which provide Kodak with products and services to be used in its normal opera-

tions. These agreements are related to supplies, production and administrative services, as well as marketing and advertising. The terms of these

agreements cover the next two to sixteen years. The minimum payments for these agreements are approximately $792 million in 2007, $393 million in

2008, $169 million in 2009, $103 million in 2010, $68 million in 2011 and $139 million in 2012 and thereafter.

At December 31, 2006, the Company had outstanding letters of credit totaling $144 million and surety bonds in the amount of $100 million primarily

to ensure the completion of payment of possible casualty and workers’ compensation claims, environmental liabilities, and to support various customs

and trade activities.

Rental expense, net of minor sublease income, amounted to $170 million in 2006, $149 million in 2005 and $161 million in 2004. The approximate

amounts of noncancelable lease commitments with terms of more than one year, principally for the rental of real property, reduced by minor sublease

income, are $159 million in 2007, $131 million in 2008, $103 million in 2009, $79 million in 2010, $63 million in 2011 and $101 million in 2012 and

thereafter.

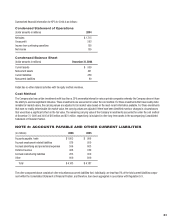

In December 2003, the Company sold a property in France for approximately $65 million, net of direct selling costs, and then leased back a portion of

this property for a nine-year term. In accordance with SFAS No. 98, “Accounting for Leases,” the entire gain on the property sale of approximately $57

million was deferred and no gain was recognizable upon the closing of the sale as the Company’s continuing involvement in the property is deemed

to be significant. As a result, the Company is accounting for the transaction as a financing. Future minimum lease payments under this noncancelable

lease commitment are approximately $5 million per year for 2007 through 2011, and approximately $5 million for 2012 and thereafter.

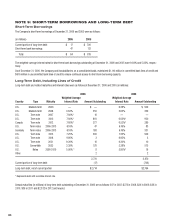

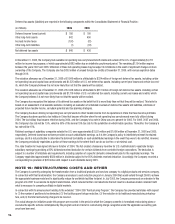

On March 8, 2004, the Company filed a complaint against Sony Corporation (Sony) in federal district court in Rochester, New York, for digital camera

patent infringement. On March 31, 2004, Sony sued the Company for digital camera patent infringement in federal district court in Newark, New Jer-

sey. Sony subsequently filed a second lawsuit against the Company in Newark, New Jersey, alleging infringement of a variety of other Sony patents.

The Company filed a counterclaim in the New Jersey action, asserting infringement by Sony of the Company’s kiosk patents. Both the Company and

Sony sought unspecified damages and other relief. On December 29, 2006, the Company and Sony entered into an agreement settling their patent in-

fringement lawsuits against each other, dismissing the patent infringement claims. No monetary consideration was paid under the settlement agreement.

Separately, the Company and Sony entered into a technology cross license agreement. Due to continuing obligations related to the license agree-

ment, revenue will be recognized over the term of the continuing obligations, which is two years. No revenue was recognized during the current period

related to this specific agreement.

On June 13, 2005, a purported shareholder class action lawsuit was filed against the Company and two of its current executives in the United States

District Court for the Southern District of New York. On June 20, 2005 and August 10, 2005, similar lawsuits were filed against the same defendants

in the United States District Court for the Western District of New York. The cases have been consolidated in the Western District of New York and

the lead plaintiffs were John Dudek and the Alaska Electrical Pension Fund. The complaints filed in each of these actions (collectively, the “Com-

plaints”) sought to allege claims under the Securities Exchange Act on behalf of a proposed class of persons who purchased securities of the Company

between April 23, 2003 and September 25, 2003, inclusive. An amended complaint was filed on January 20, 2006, containing essentially the same

allegations as the original complaint but adding an additional named defendant. Defendants’ motion to dismiss was argued on October 3, 2006 and

granted on November 1, 2006. The plaintiff did not appeal.