Kodak 2006 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The Company uses cash flow hedges to manage foreign currency exchange risk and commodity price risk related to forecasted transactions. The

Company also uses foreign currency forward contracts to offset currency-related changes in foreign currency denominated assets and liabilities; these

foreign currency forward contracts are not designated as accounting hedges and all changes in fair value are recognized in net (loss) earnings in the

period of change.

The fair values of foreign currency forward contracts designated as cash flow hedges of forecasted foreign currency denominated intercompany sales

are reported in other current assets and/or current liabilities, and the effective portion of the gain or loss on the derivatives is recorded in accumulated

other comprehensive (loss) income. When the related inventory is sold to third parties, the hedge gains or losses as of the date of the intercompany

sale are transferred from accumulated other comprehensive (loss) income to cost of goods sold.

The fair values of silver forward contracts designated as hedges of forecasted worldwide silver purchases are reported in other current assets and/or

current liabilities, and the effective portion of the gain or loss on the derivative is recorded in accumulated other comprehensive (loss) income. When

the related silver-containing products are sold to third parties, the hedge gains or losses as of the date of the purchase of raw silver are transferred

from accumulated other comprehensive (loss) income to cost of goods sold. These gains (losses) transferred to cost of goods sold are generally offset

by increased (decreased) costs of silver purchased in the open market.

Environmental Expenditures

Environmental expenditures that relate to current operations are expensed or capitalized, as appropriate. Expenditures that relate to an existing

condition caused by past operations and that do not provide future benefits are expensed as incurred. Costs that are capital in nature and that provide

future benefits are capitalized. Liabilities are recorded when environmental assessments are made or the requirement for remedial efforts is probable,

and the costs can be reasonably estimated. The timing of accruing for these remediation liabilities is generally no later than the completion of feasibil-

ity studies.

The Company has an ongoing monitoring and identification process to assess how the activities, with respect to the known exposures, are progressing

against the accrued cost estimates, as well as to identify other potential remediation sites that are presently unknown.

Income Taxes

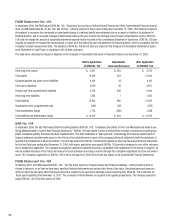

In July 2006, the Financial Accounting Standards Board (FASB) issued FASB Interpretation No. 48, “Accounting for Uncertainty in Income Taxes” (FIN

48). FIN 48 clarifies the accounting and reporting for income taxes recognized in accordance with SFAS No. 109. This Interpretation prescribes a

comprehensive model for the financial statement recognition, measurement, presentation and disclosure of uncertain tax positions taken, or expected

to be taken, in income tax returns. The Company will adopt FIN 48 as of January 1, 2007, as required. The cumulative effect of adopting FIN 48 will

be recorded as an adjustment to retained earnings. The Company does not expect that the adoption of FIN 48 will have a significant impact on the

Company’s financial position and results of operations.

The Company accounts for income taxes in accordance with SFAS No. 109. The asset and liability approach underlying SFAS No. 109 requires the

recognition of deferred tax liabilities and assets for the expected future tax consequences of temporary differences between the carrying amounts and

tax basis of the Company’s assets and liabilities. Management provides valuation allowances against the net deferred tax asset for amounts that are

not considered more likely than not to be realized.

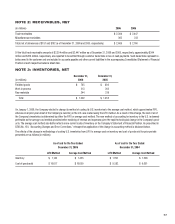

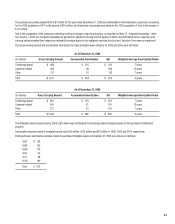

The valuation allowance as of December 31, 2006 of $1,849 million is attributable to $324 million of foreign net deferred tax assets, including certain

net operating loss and capital loss carryforwards and $1,525 million of U.S. net deferred tax assets, including certain tax credits, which are not

considered more likely than not to be realized.