Kodak 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

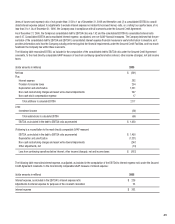

0

Adjustments to interest expense relate to items that are not debt for borrowed money, including interest relating to capital leases and interest relating

to tax matters.

In addition, subject to various conditions and exceptions in the Secured Credit Agreement, in the event the Company sells assets for net proceeds

totaling $75 million or more in any year, except for proceeds used within 12 months for reinvestments in the business of up to $300 million, proceeds

from sales of assets used in the Company’s non-digital products and services businesses to prepay or repay debt or pay cash restructuring charges

within 12 months from the date of sale of the assets, or proceeds from the sale of inventory in the ordinary course of business, the amount in excess

of $75 million must be applied to prepay loans under the Secured Credit Agreement.

The Company pays a commitment fee at an annual rate of 50 basis points on the undrawn balance of the 5-Year Revolving Credit Facility at the

Company’s current credit rating of Ba3 and B+ from Moody’s Investor Services, Inc. (Moody’s) and Standard & Poor’s Rating Services (S&P), respec-

tively. For the year ended December 31, 2006, this fee was $5 million and is reported as interest expense in the Company’s Consolidated Statement of

Operations.

In addition to the 5-Year Revolving Credit Facility, the Company has other committed and uncommitted lines of credit at December 31, 2006 totaling

$110 million and $616 million, respectively. These lines primarily support borrowing needs of the Company’s subsidiaries, which include term loans,

overdraft coverage, letters of credit and revolving credit lines. Interest rates and other terms of borrowing under these lines of credit vary from country

to country, depending on local market conditions. Total outstanding borrowings against these other committed and uncommitted lines of credit at

December 31, 2006 were $18 million and $29 million, respectively. These outstanding borrowings are reflected in the short-term borrowings in the

accompanying Consolidated Statement of Financial Position at December 31, 2006.

At December 31, 2006, the Company had outstanding letters of credit totaling $144 million and surety bonds in the amount of $100 million primarily

to ensure the payment of possible casualty and workers’ compensation claims, environmental liabilities, and to support various customs and trade

activities.

Debt Shelf Registration and Convertible Securities

On September 5, 2003, the Company filed a shelf registration statement on Form S-3 (the primary debt shelf registration) for the issuance of up to

$2.0 billion of new debt securities. Pursuant to Rule 429 under the Securities Act of 1933, $650 million of remaining unsold debt securities under a

prior shelf registration statement were included in the primary debt shelf registration, thus giving the Company the ability to issue up to $2.65 billion

in public debt. After issuance of $500 million in notes in October 2003, the remaining availability under the primary debt shelf registration was $2.15

billion.

The Company has $575 million of Convertible Senior Notes due 2033 (the Convertible Securities) on which interest accrues at the rate of 3.375%

per annum and is payable semiannually. The Convertible Securities are unsecured and rank equally with all of the Company’s other unsecured and

unsubordinated indebtedness. The Convertible Securities may be converted, at the option of the holders, to shares of the Company’s common stock if

the Company’s Senior Unsecured credit rating assigned to the Convertible Securities by either Moody’s or S&P is lower than Ba2 or BB, respectively.

At the Company’s current Senior Unsecured credit rating, the Convertible Securities may be converted by their holders.

The Company’s $2.7 billion Secured Credit Facilities, along with other committed and uncommitted credit lines, and cash balances, provide the Com-

pany with adequate liquidity to meet its working capital and investing needs.

Credit Quality

Moody’s and S&P’s ratings for the Company, including their outlooks, as of the filing date of this Form 10-K are as follows:

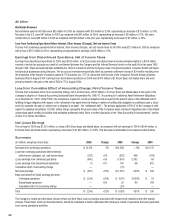

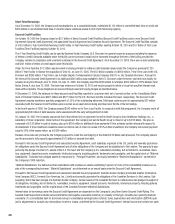

Senior Secured Rating Corporate Rating Senior Unsecured Rating Outlook

Moody’s Ba3 B1 B2 Negative

S&P B+ B+ B Negative

Moody’s ratings reflect their views regarding the Company’s: (i) execution challenges to achieve digital profitability as its business shifts into highly

competitive digital imaging markets, (ii) ongoing exposure to the accelerating secular decline of its consumer film business and potential decline of its

entertainment imaging film business, and (iii) variability in the utilization of its traditional manufacturing assets and potential for incremental restruc-

turing costs.

Moody’s Ba3 rating assigned to the Secured Credit Facilities reflects the above factors as well as the security collateral and the secured cross guaran-

tee afforded to the Secured Credit Facilities.

The negative rating outlook reflects Moody’s concern regarding the Company’s challenges to transition to a digital product and services business,

including requirements to fund investment and restructuring costs, and uncertain prospects for achieving solid digital business profitability.