Kodak 2006 Annual Report Download - page 194

Download and view the complete annual report

Please find page 194 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Initial Hire Grants and Ad Hoc Awards

In addition to annual equity awards, our Named Executive Officers may receive stock options and time-based restricted stock grants in connection

with the commencement of their employment, as a result of a promotion or for retention purposes. The Committee, in consultation with its indepen-

dent consultant, determines the size of these awards based on market data. The objectives of these grants are to encourage hiring, retention and

stock ownership and to align an executive’s interest with those of our shareholders. In certain instances, new hire grants were designed to replace

equity compensation forfeited by an executive when terminating their prior employment to accept employment with Kodak. On occasion, the Commit-

tee also grants one-time, ad hoc option awards to reward an executive for superior individual performance. Any non-annual equity awards granted to

Named Executive Officers in 2006 are shown in the Grants of Plan-Based Awards Table on page 50 of this Proxy Statement.

In 2006, the grant date for these awards was the effective date of employment or, in connection with a promotion, the date the Committee approved

the grant. As a result of the Board’s adoption of the new Equity Award Policy, effective as of January 1, 2007, the grant date of any options awarded

to a newly hired executive will be the date of the next regularly scheduled Committee meeting after the first date of his or her employment. The grant

date for any ad hoc option awards to our executives will continue to be the date the Committee approved the award, if the award was approved in a

meeting. If the award is approved by unanimous written consent of the Committee, the grant date of the award will be the date of the next regularly

scheduled Committee meeting following the date of the Committee’s written consent.

CEO EVALUATION AND COMPENSATION

Evaluation of CEO

Early this year, the Board implemented a number of enhancements to its CEO evaluation process. Under this revised process, the Presiding Director of

the Board, the Chair of the Compensation Committee and the Chief Human Resources Officer lead the annual process of assessing the performance

of the Chief Executive Officer. In February each year, a written self-assessment of performance versus the business plan of record is completed by the

CEO. The written assessment is sent to the full Board for review. Later in the same month, the Chief Human Resources Officer interviews each mem-

ber of the Board to collect feedback against an established set of criteria, including reaction to the CEO self-assessment and the Company’s leadership

imperatives. All input is summarized and reviewed by the Presiding Director and the Chair of the Compensation Committee, who are responsible for

delivering feedback to the CEO. The Committee takes the evaluation results into consideration in determining the appropriateness of the individual

performance award level of the CEO.

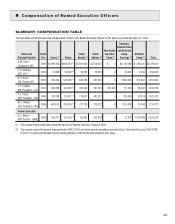

CEO Compensation

Each year, the Committee requests its external consultant to assess the market competitiveness of the total compensation paid to Mr. Perez compared

to that of national survey data reflecting peer CEO compensation. In July 2006, the analysis of the national survey data showed that Mr. Perez was

paid below the median. The external consultant recommended increases in long-term incentive target grant amounts to close the market-competitive

gap for Mr. Perez. These recommendations were developed with the Chair of the Compensation Committee and Company management. In addition,

the external consultant reviewed the costs of the long-term incentive recommendation and concluded that they were reasonable from a share utiliza-

tion and cost perspective. The Committee reviewed the recommendations in October 2006 and approved them in December 2006. Please see page 36

of this Proxy Statement for further explanation of the long-term incentive gap closure.

Mr. Perez’s Base Salary

Mr. Perez annual base salary is $1,100,000. In February 2007, the Committee took into consideration the long-term equity increase associated with

the market-competitive gap closure and decided that Mr. Perez’s base salary will not be increased in 2007. Mr. Perez’s base salary has not changed

since May 10, 2005, when the Committee approved the increase associated with his promotion to CEO.

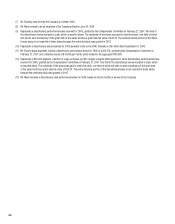

Mr. Perez’s 2006 EXCEL Award

Mr. Perez did not receive a bonus under the EXCEL plan in 2006. However, based on the Company’s achievements and in consideration of the same

factors used to determine the EXCEL corporate award pool, the Committee granted Mr. Perez a discretionary bonus of $1,381,050, which is based

on the corporate award pool of 81% of target. Please see pages 34-35 of this Proxy Statement for details on the 2006 EXCEL results and the NEO

discretionary bonuses. Mr. Perez received 50% of this bonus in cash, and 50% was paid in restricted stock which ratably vests over three years. The

grant date of the restricted shares was February 27, 2007.

Mr. Perez’s 2006 Equity Awards

The Company’s performance for the 2005-2006 Leadership Stock cycle did not reach the threshold performance target. Consequently, Mr. Perez

did not earn any shares under this plan. For the 2006 EPSP, Mr. Perez earned 30,281 shares with a one-year vesting period, which is equal to 95%

of target. The Committee approved a 2006 stock option grant of 314,530 options, which have a seven-year term and vest ratably over a three-year

period. The Committee also approved a 2007 Leadership Stock allocation of 100,650 performance units for the 2007 performance cycle. The total

value of the 2006 stock option grant and the 2007 Leadership Stock allocation equal the value of the market-competitive gap closure approved by the

Committee.