Kodak 2006 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

00

of employee elections to the Cash Balance Plus plan, the reductions in future pension expense will be almost entirely offset by the cost of matching

employee contributions to SIP. The impact of the Cash Balance Plus plan is shown as a plan amendment.

The Company also sponsors unfunded defined benefit plans for certain U.S. employees, primarily executives. The benefits of these plans are obtained

by applying KRIP provisions to all compensation, including amounts being deferred, and without regard to the legislated qualified plan maximums,

reduced by benefits under KRIP.

Most subsidiaries and branches operating outside the U.S. have defined benefit retirement plans covering substantially all employees. Contributions by

the Company for these plans are typically deposited under government or other fiduciary-type arrangements. Retirement benefits are generally based

on contractual agreements that provide for benefit formulas using years of service and/or compensation prior to retirement. The actuarial assumptions

used for these plans reflect the diverse economic environments within the various countries in which the Company operates.

The measurement date used to determine the pension obligation for all funded and unfunded U.S. and Non-U.S. defined benefit plans is December 31.

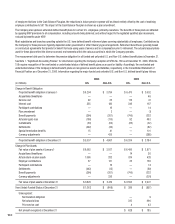

See Note 1, “Significant Accounting Policies” for information regarding the Company’s adoption of SFAS No. 158 as of December 31, 2006. SFAS No.

158 requires recognition of the overfunded or underfunded status of defined benefit plans as an asset or liability. Accordingly, the overfunded and

underfunded status of the Company’s defined benefit plans are recognized as assets and liabilities, respectively, in the Consolidated Statement of

Financial Position as of December 31, 2006. Information regarding the major funded and unfunded U.S. and Non-U.S. defined benefit plans follows:

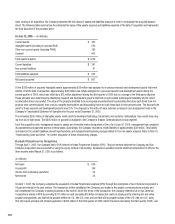

2006 2005

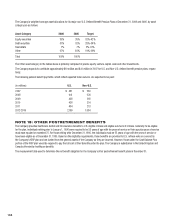

(in millions) U.S. Non-U.S. U.S. Non-U.S.

Change in Benefit Obligation

Projected benefit obligation at January 1 $ 6,204 $ 3,784 $ 6,475 $ 3,652

Acquisitions/divestitures — — — 46

Service cost 92 35 116 41

Interest cost 325 180 346 167

Participant contributions — 16 — 14

Plan amendment — 2 — (1)

Benefit payments (394) (261) (740) (227)

Actuarial (gain) loss (190) (115) 92 463

Curtailments (53) (30) (85) (22)

Settlements (442) (20) — (62)

Special termination benefits 15 41 — 101

Currency adjustments — 435 — (388)

Projected benefit obligation at December 31 $ 5,557 $ 4,067 $ 6,204 $ 3,784

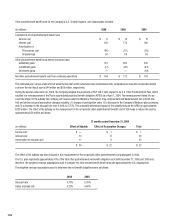

Change in Plan Assets

Fair value of plan assets at January 1 $ 6,593 $ 2,927 $ 6,480 $ 2,871

Acquisitions/divestitures — — 14 36

Actual return on plan assets 1,006 283 814 428

Employer contributions 57 131 25 156

Participant contributions — 16 — 14

Settlements (442) (13) — (60)

Benefit payments (394) (261) (740) (227)

Currency adjustments — 336 — (291)

Fair value of plan assets at December 31 $ 6,820 $ 3,419 $ 6,593 $ 2,927

Over (Under) Funded Status at December 31 $ 1,263 $ (648) $ 389 $ (857)

Unrecognized:

Net transition obligation — 9

Net actuarial loss 235 990

Prior service cost 4 43

Net amount recognized at December 31 $ 628 $ 185