Kodak 2006 Annual Report Download - page 223

Download and view the complete annual report

Please find page 223 of the 2006 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

(10) If Ms. Hellyar is terminated prior to June 1, 2007 as a result of disability or by the Company for any reason other than cause without offering com-

parable employment, she will be eligible to receive a payment of $680,000. If her employment terminates under similar circumstances between

June 1, 2007 and June 1, 2008, she will receive a payment of $320,000.

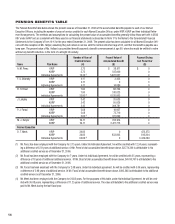

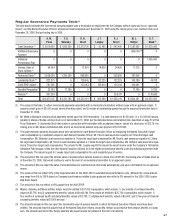

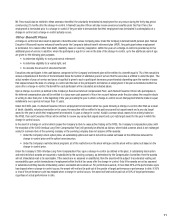

Severance Benefi ts Based on Termination Due to Disability Table(1)

The table below estimates the incremental amounts payable upon a termination of employment due to disability, as if the Named Executive Offi cers’

employment was terminated as of December 31, 2006, using the closing price of our common stock as of December 29, 2006, the last trading day in

2006.

A. M. F. S. R. H. J. T. P. J. M. J.

Perez Sklarsky Brust Langley Faraci Hellyar

Cash Severance (2) $ 0 $ 1,050,000 $ 0 $ 0 $ 0 $ 1,587,600

Additional Severance 0 0 0 0 0 680,000 (9)

Payment

Intrinsic Value of Stock Options (3) 94,504 0 12,601 14,659 34,409 11,725

Restricted Stock (4) 2,838,000 1,290,000 696,600 0 258,000 387,000

Leadership Stock (5) 822,375 0 129,645 132,225 132,225 105,780

2006 EPSP Award (6) 781,256 0 123,163 125,614 125,614 100,491

Benefi ts/Perquisites (7) 14,000 11,785 0 0 0 11,785

Pension (8) 301,209 0 0 0 0 0

Total $ 4,851,344 $ 2,351,785 $ 962,009 $ 272,498 $ 550,248 $ 2,884,381

(1) The values in this table: 1) refl ect incremental payments associated with a termination due to disability; 2) assume a stock price of $25.80

(except if otherwise noted); and 3) include all outstanding grants through the assumed termination date of December 31, 2006.

(2) The cash severance amounts disclosed above were calculated for each Named Executive Offi cer by multiplying the Named Executive’s target

cash compensation by a multiplier unique for each Named Executive Offi cer. Mr. Sklarksy’s cash severance equation is 1 times his target cash

compensation. Ms. Hellyar’s cash severance equation is 2 times her target cash compensation.

(3) The amounts in this row report the intrinsic value of unvested stock options, based on a stock price of $25.80, the closing price of Kodak stock

as of December 29, 2006, that would vest immediately in the event of termination due to disability.

(4) The amounts in this row report the value of unvested shares of restricted stock that would automatically vest upon a termination due to disability.

For Mr. Perez, the amount disclosed also includes value of the unvested shares of restricted stock that vest on a pro rata basis pursuant to the

terms of Mr. Perez’s signing bonus, included in his offer letter, discussed on page 47 of this Proxy Statement.

(5) The amounts in this row refl ect 50% of the target allocation for the 2006-2007 Leadership Stock performance cycle, although the actual amount

may range from 0% to 200% based on Company’s performance relative to plan goals and also refl ects a 0% earnout for the 2005-2006 Leader-

ship Stock Award.

(6) The amounts in this row refl ect a 95% payout from the 2006 EPSP.

(7) Mr. Sklarsky and Ms. Hellyar would be entitled to $11,785 in perquisites, which include: 1) four months of continued benefi ts, valued at $2,785;

and 2) outplacement benefi ts, valued at $9,000. Mr. Perez would be entitled to $14,000 in perquisites, which includes two years of fi nancial

counseling benefi ts, valued at $7,000 per year.

(8) The amounts included in this row report the incremental value of pension benefi ts to which Mr. Perez would have been entitled assuming he

would receive his pension benefi t in the form of a lump sum.

(9) If Ms. Hellyar is terminated prior to June 1, 2007 as a result of disability or by the Company for any reason other than cause without offering com-

parable employment, she will be eligible to receive a payment of $680,000. If her employment terminates under similar circumstances between

June 1, 2007 and June 1, 2008, she will receive a payment of $320,000.